We seem to be moving into a time where basic needs (like energy, food, shelter and associated raw materials - i.e., commodities) are going to be in short supply, as we grapple with the new realities of the post-COVID world. Social unrest, political upheaval, war, supply chain issues, deglobalization, sovereign debt crises and many other concerns will be abundant in the coming years, leading to persistently higher levels of inflation. Interest rates will also continue to be higher, unless suppressed by central banks through quantitative easing, which will only worsen inflation. This may be their only rational choice for reducing the massive amount of debt that has accumulated over the past several decades, rather than outright default or jubilee. This environment is very supportive for hard money like gold, silver and Bitcoin (i.e. money that is not someone else’s liability). While I also like gold and silver as discussed below, in case you missed it, here’s a recent post on why I believe Bitcoin is hope:

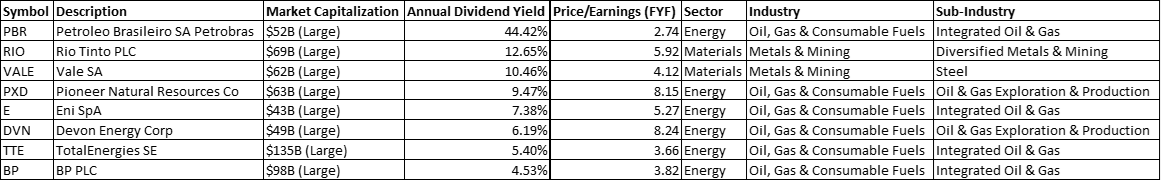

I think the macro environment will support a strong and sustained long term rally in commodity producers as demand for “real things” takes center stage. This includes stocks like gold and silver miners, energy producers (oil, gas, coal, etc.), agricultural commodity producers, basic metals mining companies, and the like. Of course stock selection is important and I like to screen for high quality large cap stocks with low price / earnings ratios and high dividend yields. The nice thing about these stocks is that they are relatively cheap (compared to other sectors) and pay you a dividend while you wait for capital appreciation. Lyn Alden, an excellent macro analyst, has some great commodity producer picks in her model portfolio that she publishes in her free monthly newsletter here. Her newsletter is a must read for me each month.

With very few exceptions, commodity producers have not invested over the past ten years or so in building additional production capacity. This is due to low commodity prices, significant regulatory hurdles and investors wanting better returns (i.e., capital discipline, dividends, stock buybacks). As a result, due to the time and capital needed to expand production, the ability to increase supply quickly will be limited. At the same time, demand will increase as the growing global economy requires raw materials.

For example, oil prices have fallen significantly from their recent peak in early June. Prices have been suppressed due to US releasing the Strategic Petroleum Reserve, limited demand from China due to ongoing Covid lockdowns and global recession fears, while at the same time supply continues to be limited by OPEC production cuts, Ukraine / Russia conflict, green/climate initiatives and various government threats that discourage companies from investing in new productive capacity (including windfall profits taxes, export bans, pipeline / drilling bans, and other uncertainties). Because the factors limiting supply are more long term / structural and the factors limiting demand are temporary, some analysts see a huge snap back in oil prices in the coming months as the temporary demand limiters fade away. Oil is a key input cost affecting all the other commodities including agricultural commodities, metals, materials, etc. so a rising price of oil will also cause rising prices in other commodities, even absent a significant spike in demand for those commodities (i.e., cost increases are passed through to customers).

The situation with copper is not much better. While prices have declined significantly since early June due to fears of a global recession impacting demand, longer term there are some serious supply and demand imbalances.

It takes many years to open a new copper mine and existing mines are being depleted at a rapid pace, while long-term demand continues to grow as a result of demand for electric vehicles and associated electrification projects. All of this will be further driven by targeted government spending like the Inflation Reduction Act and other state and local “green” initiatives that want to accelerate adoption of electric vehicles and “green energy” projects like solar, windmills, etc. All of this will demand a significant amount of copper - see below an interesting infographic from Visual Capitalist on copper used in electric vehicles, which also notes the increased demand in many other commodities in addition to copper:

Looking at demand for gold and silver, their monetary value lies in the ongoing collapse of fiat currencies as an alternative store of value, while silver also has industrial applications especially in high tech equipment including electric vehicles. The market has yet to fully price in the monetary value of gold and silver, but I believe in time it will and mining stocks, which tend to act as leveraged plays on the metals will perform well, especially considering how beaten down they have been this year. Gold and silver mining stocks are downright cheap and I’m not the only one who’s saying this. It’s been rough sailing for the gold and silver miners for the last six months as shown in the charts below. While they could go lower, at these levels the risk/reward tradeoff is starting to look attractive.

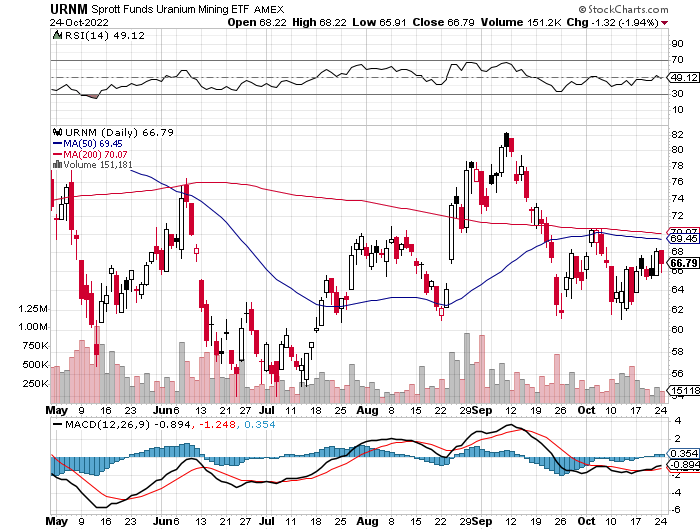

Other interesting commodities include uranium, which could see a huge longer term uptick in demand due to growing support for nuclear power as a climate-friendly alternative to fossil fuels to produce electricity. Many countries are planning to build new nuclear power plants or in the case of Japan, restarting closed plants. Newer generations of nuclear power plants are much more efficient and safer than old generations and the push to use nuclear will have a huge impact on demand for uranium. One good way to play this is the URNM ETF which has direct holdings of physical uranium as well as shares in uranium miners.

Using my criteria described earlier, I built a watchlist of commodity stocks that I will look to scale into over the next several months and hold for long term appreciation and dividend yield. As I move back into stocks, my focus will be on commodity producers, as I see these stocks doing best in the next several years for the reasons outlined earlier, versus simply investing in S&P 500 (SPY) or NASDAQ (QQQ), which could underperform compared to recent history in an environment of elevated inflation and interest rates. Past periods of higher inflation like the 1940’s and the 1970’s weren’t too kind to stocks or bonds, but commodities did quite well and today’s situation, while not identical, seems to have a lot of similarities to those historical periods. Below is a quick screen with some examples of large cap, low price-earnings, high dividend yielding commodity stocks that are on my watchlist:

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. Every week I recap the prior week’s market activity, look ahead to the coming week’s market events, go over recent Bitcoin news and provide commentary and also include content related to my weekly substack post (minus the charts, of course).