The BLS consumer price index report was released last week for the month of May (all monthly numbers are annualized), and again this month there were some eye popping line items including food at home +11.9%, energy +34.6% (gas +48.7%), used cars and trucks +16.1% and new vehicles +12.6%; oddly, shelter is only +5.5%, which seems low given we are still seeing rent and home price appreciation in the 15% to 20% range, at least where I live in Southern California. The overall increase was 8.6%, higher than last month and higher than expected. My regular readers will know I don't have a lot of faith in the official statistics, since the method of calculation has changed significantly over the years and I often refer to the alternative measure published by Shadowstats (see chart below), which would indicate inflation is likely approaching 17%. That certainly seems a lot more reasonable to people who actually buy gas or shop for groceries.

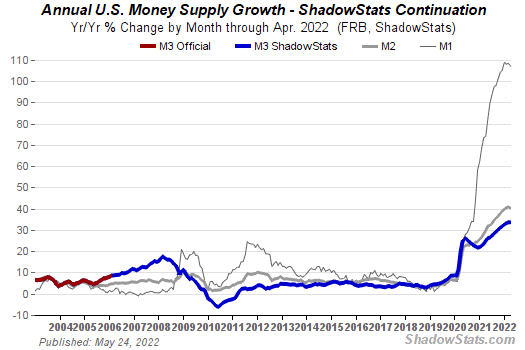

Meanwhile, politicians are blaming everyone for the inflation we are seeing (Trump, Putin, greedy corporations, etc.), when the real reason is simply too much money flooding the system. The BLS stopped tracking the broadest measure of money supply (M3) many years ago, but Shadowstats has estimated a continuation of that in the chart below. The M1 money supply growth is particularly striking in its parabolic move up, but the trend of all three measures is clearly up and to the right. That means more dollars in the system and while some of that was trapped in bank reserves, a lot of it ended up in people’s bank accounts in the form of stimulus payments, which of course chased goods and services in the real economy and therefore drives inflation.

Another troubling statistic is the growth in consumer debt, which further pushes up inflation as people use borrowed money to continue buying goods and services that they may not be able to afford with cash:

It’s pretty clear that we can’t have growth in our economy without more and more debt and this is deeply troubling.

With respect to inflation, Milton Friedman once said:

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. ... A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.

While I agree with the first part, the second part is problematic in that the entire monetary system is designed around having some level of inflation. The problem with even a small amount of inflation (for example the Fed’s 2% target) is that if you simply work hard and save your money, put it in the bank, and earn interest, it is a certainty that you will lose purchasing power and in times with high levels of inflation, your savings will erode even faster. If the real inflation rate is double the amount officially reported, you are in serious trouble.

As you can see above, the dollar has consistently lost purchasing power over time and since 1985 has lost about 40% of its value if you look at the SGS data point. Having any level of inflation at all is theft from people who work hard and save their money. Facing eroding savings, the average person has little choice but to speculate in stocks, cryptocurrencies, real estate and other investments, in some cases using debt or other forms of leverage in order to “beat inflation.” For folks with 401(k)’s, which other than their primary residence is probably the majority of their assets that they are counting on for retirement, they are basically forced to invest in the stock market if they want to beat inflation (or they can have bonds or cash which are guaranteed to lose money). 401(k) owners are at the mercy of Wall Street and unless they are professional traders, spend a lot of time studying the markets, or outsource portfolio management to experts, they are totally outmatched.

As Ludwig von Mises, a famous Austrian Economist once said:

How long can a central bank continue an inflation? Probably as long as people are convinced that the government, sooner or later, but certainly not too late, will stop printing money and thereby stop decreasing the value of each unit of money. When people no longer believe this, when they realize that the government will go on and on without any intention of stopping, then they begin to understand that prices tomorrow will be higher than they are today. Then they begin buying at any price, causing prices to go up to such heights that the monetary system breaks down.

He also said:

The longer the boom of inflationary bank credit continues, the greater the scope of malinvestments in capital goods, and the greater the need for liquidation of these unsound investments. When the credit expansion stops, reverses, or even significantly slows down, the malinvestments are revealed.

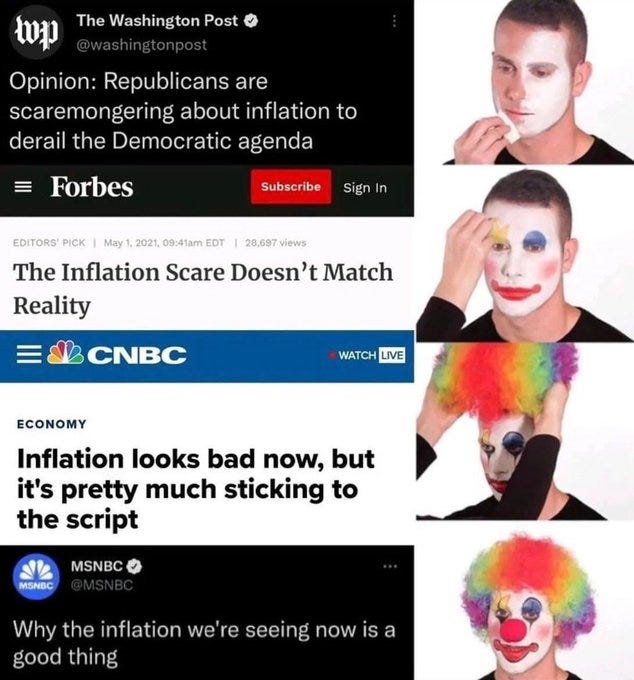

We have certainly seen many malinvestments revealed recently, including meme stocks, money losing IPO companies, crypto frauds, SPAC’s, etc., all initially pumped up due to the Fed’s easy money policies and now collapsing. Today, with the Fed in full reverse, talking tough, raising rates and stopping bond purchases (Quantitative Easing) and even discussing selling bonds in its portfolio (Quantitative Tightening), this has resulted in rapidly declining bond and stock markets. Indeed, we are seeing the end of a very long inflationary credit cycle that goes back to the Great Financial Crisis. The question is, what comes next? Will Central Banks including the Fed continue to raise interest rates and tighten credit to “tame” inflation and ultimately lead to a recession or a depression? Will the Fed keep going until something “breaks,” including the entire economy? That’s what many market observers think will happen. Clearly, inflation has the politicians’ attention and this stands in the way of their reelection prospects. As I tweeted recently, this is their playbook:

Therefore, it seems like the stock and bond markets will continue to get pummeled until there’s reason for the Fed to reverse course and signal a shift back to easy money. Due to the incredible amount of debt outstanding, not only in the US but around the world, interest rates can’t be raised above the inflation rate like they could during the 1970’s without causing total economic destruction. So the path of least resistance is to look busy fighting inflation for a while and then when there’s a little good news on the inflation front, flip back to money printing, the path of least resistance for central planners and politicians (and always has been throughout history). The problem of course is that will cause more inflation and likely reinflate the “everything asset bubble.” Perhaps David Hunter’s predicted epic stock market melt-up will follow. It seems that a pivot is inevitable, but guessing the timing is not easy.

What is the best way to preserve your wealth in these unprecedented times? In my view, it’s holding hard assets including gold, silver and most importantly Bitcoin in self-custody. Self-custody is important because we have recent experience with governments seizing bank accounts of private citizens (donors to Canadian trucker protests). Also, sovereign funds are not safe either, as Russia learned when the west seized their foreign reserves (about $300 Billion) as part of Ukraine conflict sanctions. Regardless of what you think about the Canadian trucker movement or Russia/Ukraine, these are telling government actions. Indeed, there have been times in history when governments have made gold ownership illegal, even in the US (see Executive Order 6102).

Real estate (either your primary residence or an investment property) is also good in inflationary times if you have a modest loan balance relative to value of the property, a low long-term fixed interest rate and an affordable payment. But unlike the banks and other “too big to fail” institutions, if you can’t make your mortgage payment, there is no way out for you but foreclosure, so it pays to be prudent with your monthly cash flow and not get over-extended. As I wrote recently, the real estate market also seems to be in a bubble and it’s probably not a great time to buy investment property. It may make sense to buy a primary residence if you have to for some life event (growing family, new job, etc.). If you do have to buy in this market, I would stay away from adjustable rate loans, since those can be a problem in an inflationary environment when rates reset. In a weird way, long term fixed rate debt like a mortgage becomes an asset in inflationary times, since your mortgage was originated when dollars were worth more and is paid back in dollars that are progressively worth less.

Bonds are a train wreck as an investment now, promising to pay you back less than the rate of inflation in all cases. Better to be a borrower at fixed rates and not a lender during inflationary times. The standard investment play in a recession is to buy bonds, but that no longer seems to be a sure thing with historically low rates and historically high inflation - that worked during the Great Financial Crisis in 2008 but I’m not sure that would still work today.

Stocks seem certain to suffer for some time (until the Fed rate “pivot”), especially tech stocks. I do like commodity producers like oil companies, gold miners and the like for their strong dividends / cash flows and upside potential in an inflationary environment. In today’s world, real assets beat paper assets.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.