Some market observers are calling for a housing crash, saying that this is lagging what we have experienced in the stock and bond (and indeed all other) markets recently. The reason for this is the Fed pulling back on liquidity in the financial system by raising interest rates and stopping “Quantitative Easing.” For a visual of this, you have to look no further than the recent decline in money supply growth after exponential growth during 2020. The Fed has literally slammed on the brakes to control inflation and in the process they are wrecking the value of your assets and pretty soon, the economy too:

You’ll notice that historically, negative money supply growth doesn’t last very long. This is because it often leads to financial turmoil and recessions, which forces a reactive policy reversal by the Fed. In our debt-based monetary system, you need to have constant growth in money/debt in order to support the system, otherwise it collapses. This is why I am an advocate for sound money as I have written previously. Our centrally-planned system no longer has any normal market signals and the small group of unelected officials who are at the controls don’t seem to know what they are doing. We have gotten a taste of this since the beginning of the year - most folks have taken a huge hit in their retirement and investment accounts. Is housing next?

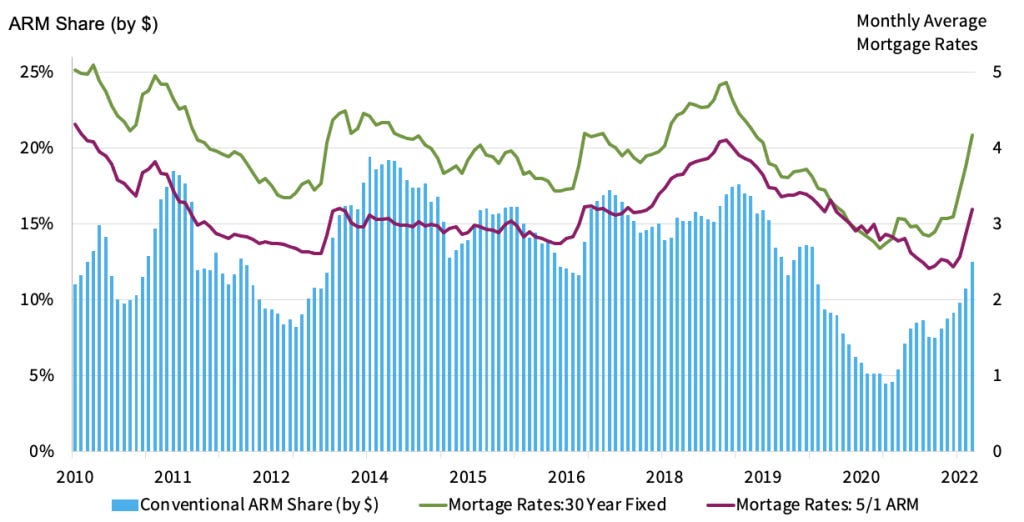

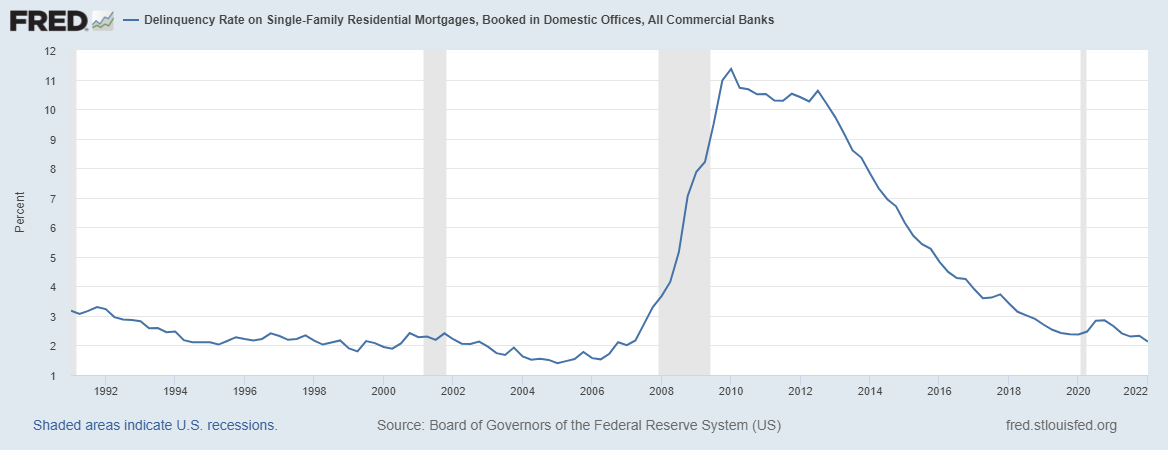

There are certainly many signs that we are heading into a housing slowdown, as I’ll walk through in this piece. Absent a really serious recession in which there are major job losses and a significant spike in foreclosures, what we could see in the coming 6-12 months is more of a correction in prices from unsustainable levels, rather than a crash akin to the 2008 Great Financial Crisis. There are several factors that play into my thinking. For one thing, lenders are much more careful about making loans these days compared to the 2008 “liar loans.” Buyers have a lot more “skin in the game” nowadays, where 20% down payments for a 30 year mortgage are more typical. I remember when I sold my house in 2006, the buyer had a 100% loan to value, interest only, zero down loan from a lender that shortly after the loan funded, stopped lending altogether and shortly after that went out of business during the GFC. That was scary! Adjustable rate mortgage share, while growing, is still pretty low by historical standards and can help with the recent decline in affordability for some buyers, although I still prefer a fixed rate mortgage if you can get it (see CoreLogic chart below).

Here’s the Case-Schiller US National Home Price Index through May; my suspicion based on what I’m seeing in the market now (especially price cuts by sellers) is that prices may have peaked in May and have already started to correct:

Meanwhile, housing affordability has plummeted, but as prices adjust this should reverse:

Recent parabolic moves in prices, coupled with rising mortgage rates have been a double whammy on affordability. Here’s a chart on mortgage rates:

Although rates have dropped a bit from their recent peak (5.81% as of 6/23) to 5.3% as of 7/28, a really quick move in just about a month, they are still much higher than the lows we saw < 3% last year. The quick move down in rates recently seems to be the market’s interpretation that we are heading into a recession and the end of Fed interest rate tightening is in sight. This caused a rally in long-dated Treasury bonds recently, which mortgage rates are tied to. Here’s some recent date from the National Association of Realtors for June:

June pending home sales were down from the latest release of the National Association Realtors:

-8.6%

Latest News

As escalating mortgage rates and housing prices impacted potential buyers, pending sales fell in all four major regions in June 2022, with the West experiencing the largest monthly decline.

Existing home sales were also down according to the National Association of Realtors:

-5.4%

Latest News

Existing-home sales fell in June 2022, with declines in three out of four major U.S. regions month-over-month and down in all regions year-over-year.

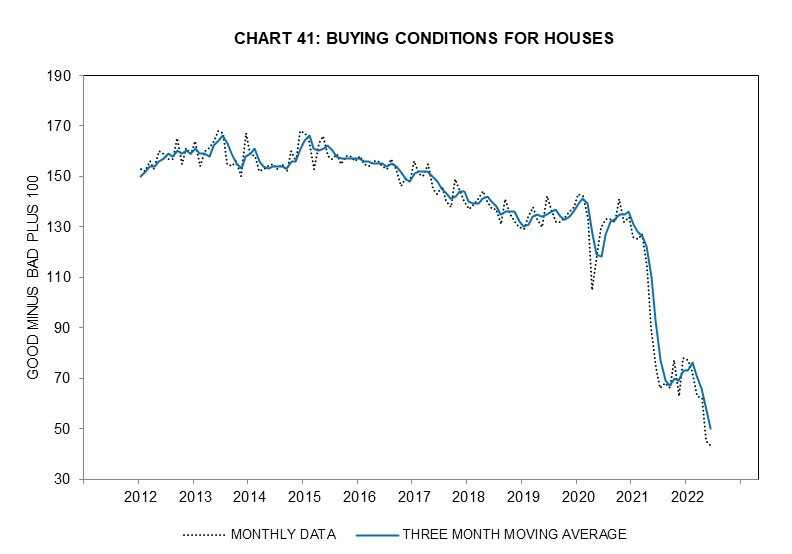

Also, from the most recent University of Michigan consumer sentiment survey, housing sentiment is the lowest its been since the survey started:

Meanwhile, Redfin reports the housing market is getting more competitive for sellers, with fewer homes sold above list price:

In June 2022, 55.4% of homes in the U.S. sold below list price, down 0.93 points year over year. There were only 17.4% of homes that had price drops, up from 9.0% of homes in June last year. There was a 102.3% sale-to-list price, down 0.26 points year over year.

I have definitely seen this in our local housing market where price cuts are happening more frequently and more homes are being listed. The shift from a sellers’ market to a buyers’ market seems to have happened overnight.

Homes for sale have been steadily climbing from the lows of January 2022, but inventory is still quite low compared to the pre-Covid period and that constrained supply should help support the market:

In June 2022, there were 1,671,553 homes for sale in the United States, up 3.1% year over year. The number of newly listed homes was 794,112 and down 2.9% year over year. The median days on the market was 18 days, up 3 year over year. The average months of supply is 2 months, up 0 year over year.

Mortgage Delinquency rate is still pretty low, although extraordinary measures during COVID period to pause delinquencies and foreclosures are in the rear view mirror now:

Whether you are a buyer or a seller in the current real estate market, the most important thing is to not lose sight of the long term view and what your goals are.

An investor makes their money on the purchase, so naturally you want to buy at a “good price,” preferably when there’s panic selling and everyone is negative on the market. Buying when there’s a market correction makes a lot of sense and also having the ability to hold for a long period - maybe 5 or 10 years will ensure you will make a profit as long as there’s inflation (the Fed will make sure of this) and you have a nice fixed rate mortgage. As an investor, I would probably be on the sidelines right now and watch what happens in the next 6-12 months before buying, unless you find a screaming deal that is cash flow positive in a strong rental market. Having said that, the abysmal homebuyer sentiment could be a contrarian indicator and that coupled with a “Fed pivot” in the near future to lower interest rates could potentially light a fire under housing (and all other risk assets for that matter).

For a homebuyer, what matters most is whether you have an affordable, fixed monthly payment and the home is located where you and your family will be happy for several years. That way a small or even large correction in the price of your home in the short term is no big deal because by the time you sell, you should be fine if it’s 5 or 10 years out. Rents may be cheaper than owning in some markets, so that’s important to pay attention to, but inflation will cause rents to continue to march up, while buying (with a fixed rate mortgage) will help you fix your housing cost which makes it a lot easier on the household budget. This is especially important if there continues to be persistently high inflation at elevated levels in the coming years.

So in summary, whether it’s time to buy or sell really depends on your situation and market timing (similar to the stock market) is really not what should be driving your decisions, especially for your home.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.