Gold and Silver Update

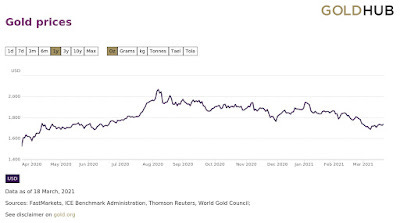

Gold has been in a down trend since hitting a high back in August 2020 at $2,038 per ounce and has mostly been trading sideways in a range between $1,750 and $1,850 per ounce over the past six months (see long term chart below). Recent volatility in the bond market with long term interest rates spiking has caused more downward pressure on gold, hitting a low of $1,685 on March 8, from which it has bounced back up to around $1,739. Many investors believe gold has been consolidating since August and will eventually begin a steady move up, driven by massive fiscal and monetary stimulus in the US which is expected to cause inflation (and possibly a rotation from stocks and bonds into commodities). As I have written about before, a Financial Fortress comprised of a diversified portfolio should include an allocation to precious metals, including gold and silver.

As I discussed in my book Investing in Gold and Silver, there are many ways to invest in gold and silver. The most popular way is to simply buy coins and bars and securely store them. Lately this has become a challenge, especially for silver, with the #silversqueeze movement which has been encouraging individual investors to buy as much physical silver as possible to expose perceived manipulation of the "paper" silver market (futures contracts being sold with no physical backing). You can find silver coins, but they have a hefty premium to the spot price of silver - a quick survey of EBay had many monster boxes available in the $17K range (each monster box includes 500 one ounce US liberty silver coins, implying a physical price of $34 per ounce while the spot price is about $26 - a 30% premium to spot). Having physical possession of gold and silver is comforting to some investors and for many it is the only way they want to hold precious metals. Storage and security can become a problem depending on how large your holdings are, however.

Alternatively, you can invest directly in common stock of gold miners such as Barrick Gold (GOLD) or Wheaton Precious Metals (WHT). If you are looking for diversification across several of the larger miners, you may be interested in investing in ETF's such as the Van Eck Gold Miner's Index Fund (GDX) or if you want exposure to the smaller "junior" miners, you can invest in the Van Eck Junior Gold Miner's Index Fund (GDXJ). There is also "paper" ownership of physical gold and silver through one of the ETF's like Sprott Physical Silver Trust (PSLV) or the SPDR Gold Shares ETF (GLD). These ETF's buy and hold physical gold and silver in vaults - the value of the ETF shares reflects the value of the stored gold and silver, less storage and administrative costs.

I recently learned of a new way to invest in metals that I hadn't heard about before. There are some companies that are formed to invest in metals royalties. These companies own the rights to the claims and get paid a set amount or percentage for gold, silver and other metals that are extracted from the claim. They have none of the cost risk that miners often face and so are a leveraged way to invest in metals since they are very sensitive to an increase in price of the underlying metals and of course, production levels (more gold at higher prices equals higher royalty payments). One such company is Metalla Royalty and Streaming, Ltd. (MTA), which engages in the acquisition and management of precious metal royalties, streams, and similar production-based interests. It focuses on precious metals such as gold and silver. The company was founded on May 11, 1983 and is headquartered in Vancouver, Canada. While this stock has performed poorly so far this year (down 28%), when gold prices turn around it could see some significant upside due to the leverage discussed previously and may be worth a look in a diversified portfolio as part of precious metals allocation.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.