Inspirational Tweet:

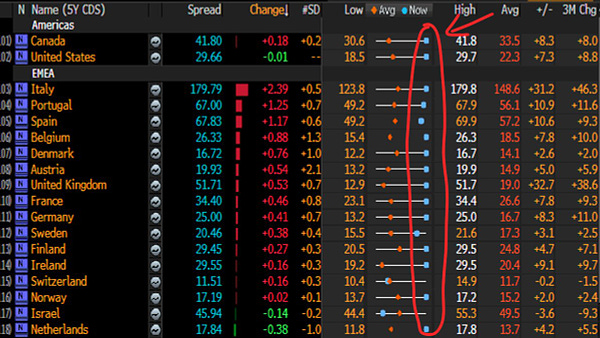

What a week, indeed. As the Lenin quote goes, “there are weeks in which decades happen” and this was just such a week. In addition to the British Central Bank bond market intervention, there were interventions in the currency markets by Japan at historical levels to defend their rapidly weakening currency and China is reportedly getting ready to do the same. Also in the news, Credit Suisse and Deutsche Bank are potentially having a “Lehman Moment” as the price of their credit default swaps soar and their stock price tanks. Meanwhile the Credit Suisse CEO says it’s at a “critical moment,” but the firm has a “strong capital base and liquidity position.” This tweet sums it up nicely:

Or this one:

Let’s not forget the sabotage of the Nordstream pipelines, arguably one of the most significant geopolitical events since the invasion of Ukraine. This meme was a funny / not funny take on it:

Meanwhile on Bitcoin Twitter, people are discussing the relative pros and cons of cooking with cast iron, stainless steel or powder coated pans. Clearly the Bitcoiners are not too worried about the global market chaos.

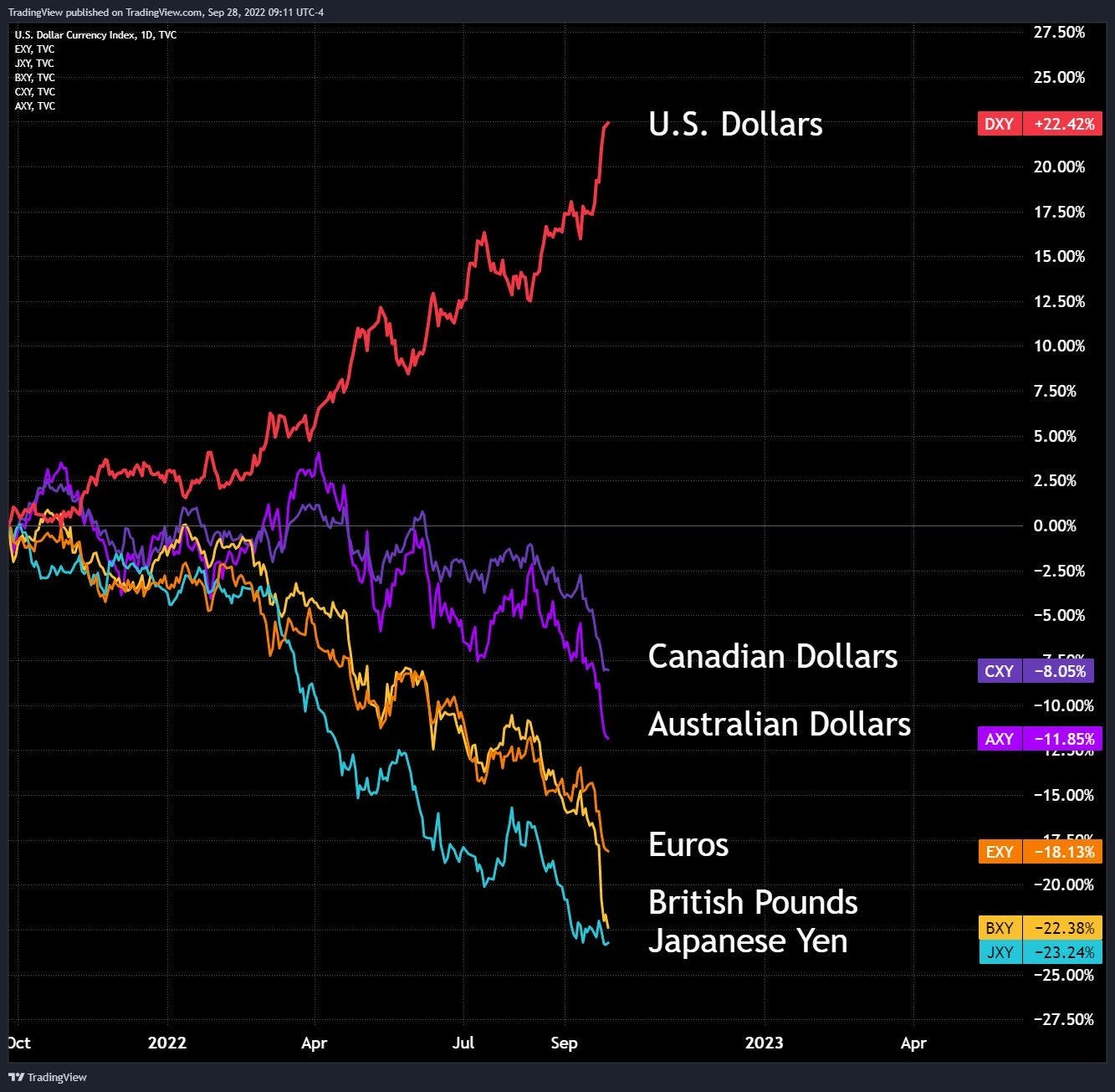

The core of all this seems to be the incredible dollar strength (fortified by the Federal Reserve’s hawkish monetary policy which includes raising rates and quantitative tightening to reign in inflation), since the dollar is used all over the world for commerce including lending - a strong dollar makes it very difficult for a country to repay their loans in local currency that is depreciating against the dollar and yet the demand for dollars continues unabated:

The dollar continues to have strong demand because it’s still the world’s reserve currency and used for settling all sorts of transactions and it’s the ultimate “safe haven” for investors as they sell everything else including local currencies, stocks, bonds, gold, real estate, etc - the “dollar milkshake theory” put forth by Brent Johnson of Santiago Capital. Eventually, the dollar will weaken when the Fed pivots back to money printing, but for now it’s the cleanest dirty shirt in the laundry basket.

As a reminder, these are Bitcoin’s key fundamentals:

Absolutely scarce (21M maximum coins)

Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

The Bitcoin network operates independently of all legacy financial systems; it is the first digital global payments infrastructure

No counter party risk when self-custodied

Trustless; Bitcoin is not controlled by any person or group

A hedge against fiat currency debasement / collapse in the same way that gold is, but doesn’t have gold’s drawbacks of difficulty to validate, store, transfer and secure - especially in large amounts

When you own almost anything other than Bitcoin (except gold / silver coins in your possession or perhaps real estate), you are holding someone else’s liability. This is especially true of bonds, and most importantly sovereign bonds, which are all looking like they will be offering “return free risk” as outlined in the tweet below from James Lavish:

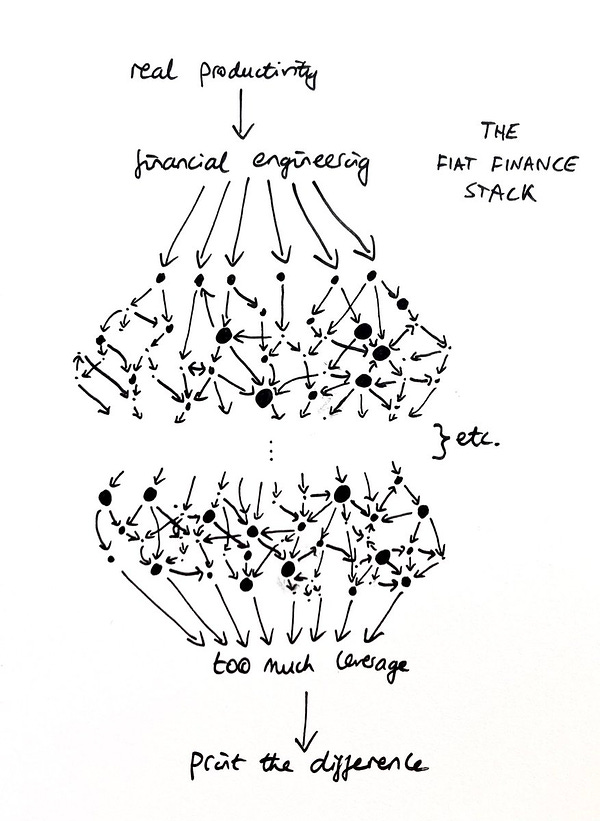

This is also a nice summary of how the fiat system is built:

As I discussed in last weeks Post (in case you missed it, here it is below), defense is really important right now and the only things I trust are Bitcoin, cash, gold/silver, and real estate - although I would consider myself a holder of real estate and looking to accumulate gold/silver and Bitcoin slowly at these levels.

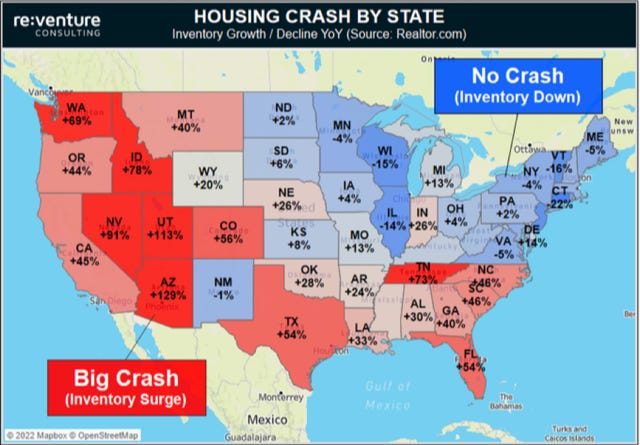

Below is a pretty good graphic of what’s happening in the US real estate market and predicts crash risk. Might not be the time to buy right now, but wait a year and see what happens by then, especially in the formerly “hot” markets in red.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.