Free Trades May Cost More Than You Think

What started with RobinHood and spread, as other online trading platforms appeared, to all of the major trading sites, including TD Ameritrade, ETrade, Vanguard, Charles Schwab, Fidelity and others? Free trades! How cool that you can buy and sell as much stock or as many options as you want with no commissions!

We have already heard about how you still "pay" for your trades in the form of worse pricing (bid / ask spreads) when buying and selling and also slower execution at times, which can cost you quite a bit of money in a much less visible way. In fact, you could be paying more now than you did when you had to pay commissions!

But there is a much more sinister side to the online trading phenomenon. By making it so easy to trade options on your phone and providing so much information at your fingertips, including real time market data, individual stock data, fair value estimates, analyst estimates, earnings trends, news, etc. on a very professional looking app, new and even experienced investors are empowered to think they know what they are doing and that they can make money. Indeed, some have "beginner's luck" and do well, at least at first. The reality is, as it has been said, "online trading is gambling, only you think you can win." This is especially true with trading options, where if you are correct you can get a gain of a multiple of your initial investment and if you're wrong, you can lose it all. This is gambling, plain and simple. Anyone who says they are "investing" when trading stock options is kidding themselves. How far we have come from options simply being used as "insurance" for hedging against an unexpected increase or decrease in the value of a stock you own.

Stock options include "plain vanilla" puts and calls, but the complexity of options offered on RobinHood (as an example) is mind boggling and includes extremely complex structures like Iron Condors, straddles/strangles, call debit spreads, put credit spreads, etc. These are much more risky than the "plain vanilla" options, especially for beginners. With the addition of margin accounts, available to just about anyone, the damage you can do to yourself with these complex options grows exponentially. This problem still exists even after the "infinite leverage" debacle that occurred at RobinHood recently, where someone was able to borrow $1M with a $4,000 deposit. Here's a real life example of how this "double leverage" of the options and margin can clobber you. I know someone who invested $500, grew it to $2,000 with a few successful trades, leveraged it 2.5x with options and margin and ended up losing it all, for a total loss of $5,000. A $500 investment turned into a $5,000 loss! Imagine that!

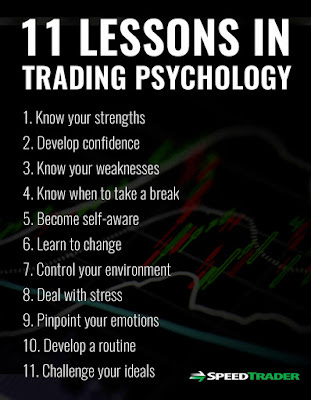

What's worse, many people sell options trading strategy classes and programs, which further inappropriately legitimize options trading as investing. Options traders are taught to ignore the doubters and the negativity and focus on the "program," manage risk and make money. Here's an example called "11 Lessons in Trading Psychology:"

My favorite is number 11, "Challenge your ideals." Someone with a gambling problem is simply not capable of managing risk, and I believe many people may be developing a gambling problem they didn't have by using these online trading app's.

I fear that today's online brokers have already become the bookies of the current generation and we are only just now beginning to see the toll this will take on our society.

If you or someone you love seems to have a gambling problem, check out Gambler's Anonymous.

If you are interested in how RobinHood works, I wrote a whole series about it here (spoiler alert, it didn't work out too well for me):

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.