Four Reasons to Continue to Invest in Gold and Silver

Although there has been some recent price weakness, gold and silver continue to shine for investors, as shown in the charts below:

Here are four reasons why it's still smart to have at least some of your assets invested in gold and silver:

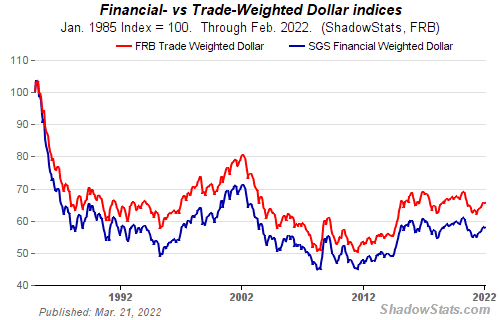

1) The Dollar - Dollar continues to decline in value as a result of continued easy money policy/money printing by the Federal Reserve. This trend seems unlikely to reverse any time soon based on recent Fed policy statements. Noteworthy: the dollar has lost about half of its purchasing power since 1986.

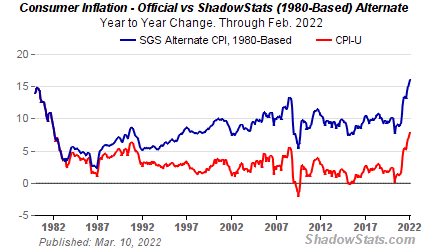

2) Inflation - Actual rate of inflation is likely higher than reported rate and official statistics show continued weakness in employment growth, as noted below from the September unemployment report:

Total nonfarm payroll employment increased by 114,000 in September. In

2012, employment growth has averaged 146,000 per month, compared with

an average monthly gain of 153,000 in 2011.

Critical items such as food and fuel are excluded from the official measure due to volatility but these continue to increase, having a greater impact on the middle class and poor.

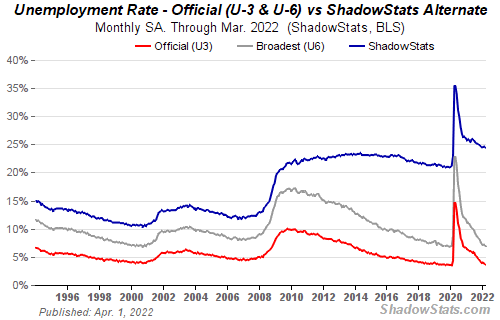

3) Unemployment - A hotly debated topic lately, the official rate recently reported is 7.8% but alternate data which includes those "discouraged" individuals who are no longer seeking work has continued to rise and is approaching 25%. Noteworthy: The U.S. has only recovered 4.2 million of the 8.8 million jobs lost during the Great Recession!

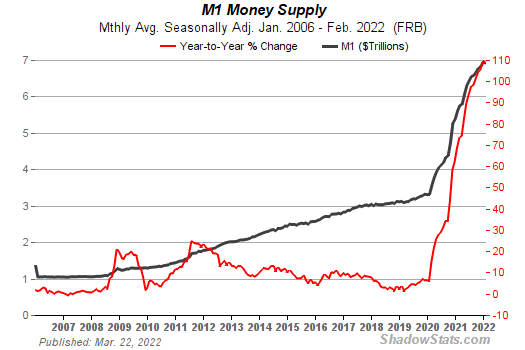

4) Money Supply - If you look at M-1 (includes cash/coins in circulation and checking accounts), although the rate of growth has slowed, the total amount of money in circulation has grown almost $1 trillion since 2008, almost double! This is significant and does not bode well for inflation or value of the dollar.

Recession is when a neighbor loses his job. Depression is when you lose yours. Ronald Reagan

Related articles

Major 'Risk On' Rotation As Junior Miners Outperform Gold and Silver Bullion

Gold Set to Break $1,800 Barrier On Endless QE Inflation Fears