Financial Fortress - Hard Assets

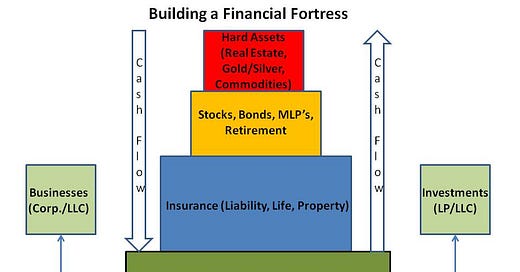

In a September 2012 post, I introduced the concept of the Financial Fortress (see graphic at right). I have published a few posts since then to explain each of the layers of the Financial Fortress, starting at the base and moving to the top.

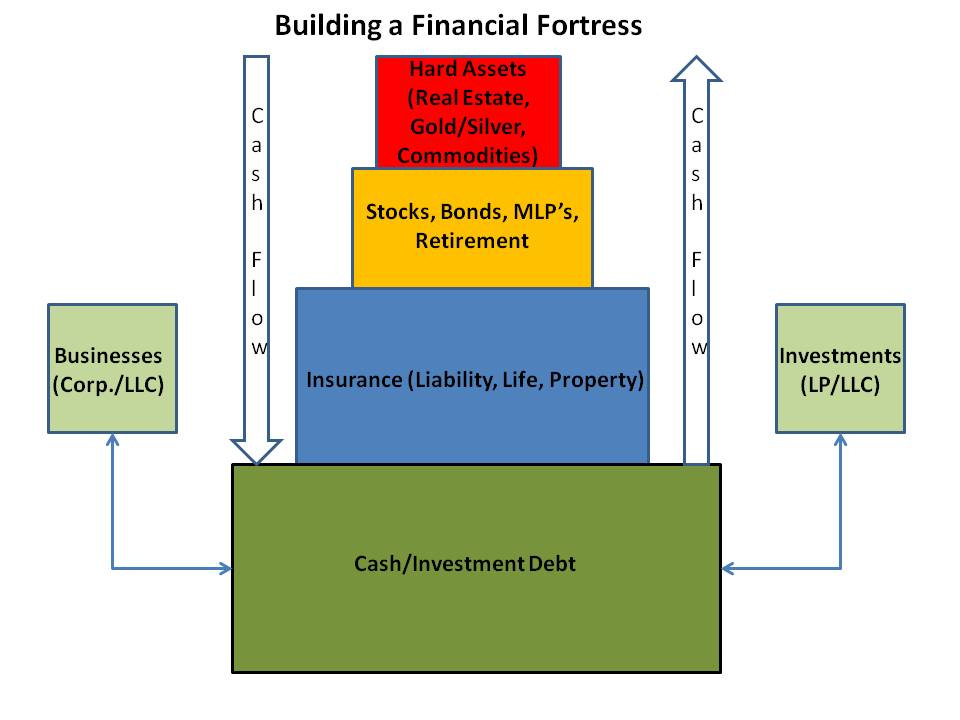

The top of the financial fortress provides protection against inflation and consists of "hard" or "real" assets, including real estate, precious metals such as gold and silver and commodities (such as oil, natural gas, etc.). Many financial advisers are concerned about the effects of the Federal Reserve's current monetary policy, which involves the creation of a flood of new dollars to help create liquidity and stimulate the economy. The end result of this policy will be inflation - it is virtually a certainty. How much inflation and how soon it appears is really the question. The hope is that the Fed can reign the inflation in by raising interest rates and using other tools at its disposal. The chart below shows how much the money supply has grown since the beginning of the Great Recession, increasing by more than $1 Trillion.

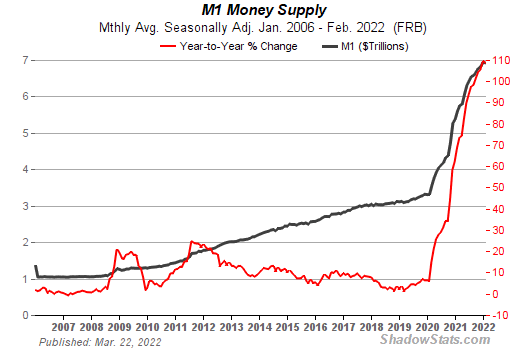

Another important chart to review is the value of the dollar. As you can see in the chart below, the value of the dollar has decreased steadily in real (inflation-adjusted terms) for many years and has lost roughly half its value since 1986:

Hard assets like gold, silver, real estate and commodities appreciate when the dollar weakens and provide a real store of value. See the 10-year charts below for gold and silver, for example:

Gold - 10 Year Price History

Silver - 10 Year Price History

Since the value of silver and gold is expressed in dollars, devaluation of the dollar tends to drive up the value of these and other precious metals.

I recommend buying gold and silver in physical form, bars or coins, and storing them in a bank safe deposit box or vault. You can also buy shares in gold or silver exchange traded funds and also buy stocks of mining companies, but I prefer to hold the physical asset for greater control and certainty.

The best way to invest in oil and gas, I have found, is through publicly traded master limited partnerships (see related blog post on this topic). These provide high current yield and have tax advantages (tax free distributions until your initial investment is recovered).

Real estate requires a bit more work, particularly when identifying suitable investment property (a topic which I have posted on regularly). If you run it like a business and ensure you purchase a property that can provide positive cash flow, there are few better investments than real estate particularly with the leverage you are able to enjoy with a mortgage.

Hopefully, you will be able to build your own financial fortress, if you haven't already started, before the next financial crisis is upon us.

Related articles