Diversification in Times of Volatility

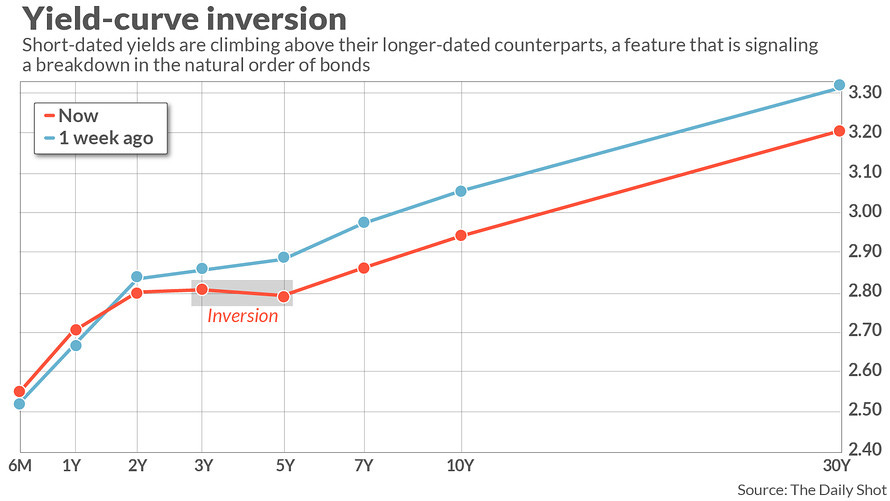

Volatility returned to the markets this week with more "Tariff Talk" and fears of an oncoming recession signaled by an inversion in the yield curve (see below chart), turning investors to bonds again for safety and resulting in yet another sell-off in the stock market.

Again the best strategy is a broadly diversified portfolio with no more than 20% in any one asset class (bonds, stocks, real estate, precious metals and cash). In fact, Goldman Sachs recently suggested that cash may outperform all other asset classes in the near term, suggesting a higher allocation may be appropriate for the time being and this is reinforced by the higher short term rates relative to longer term rates as noted in the chart.

I prefer not to worry about what's happening from day to day in the markets - trading is very difficult to do, even for those who are professionals, so a broadly diversified portfolio is the way to go.

Use leverage carefully in this environment, especially new real estate investments, margin loans on stock portfolios, etc. If you can invest to earn a cash on cash return at a higher rate than you can borrow at and the income stream is fairly safe, I would do that in this environment, rather than borrowing against stocks or buying more real estate at this stage of the cycle. Residential real estate may be at its peak in many local markets, with interest rates set to continue to rise into next year.

Avoiding the temptation to put a lot of your money in any particular investment at any time and especially now ("buying the dip" in stocks, for example) is very important. Get diversified and stay diversified!

I believe we are in a perpetual cycle of booms and busts that are driven by continuous credit expansion. Each one is successively worse than the one before. I fear that the next boom and bust will be far worse than the "Great Recession" that we just experienced and indeed many still experience due to high (real) unemployment and destruction of wealth that persist to this day, 12 years later. This is why I favor a diversified approach that includes a balanced allocation to hard assets (gold, silver, oil/gas real estate) and financial assets (stocks, bonds, mutual funds) to protect and grow wealth, particularly when we are facing the threat of inflation - a consequence of global central back "easy money" policies.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.