Dealing with Bitcoin Fear, Uncertainty and Doubt (FUD)

Now, with personal attacks against Bitcoiners!

“First they ignore you, then they laugh at you, then they fight you, then you win.” - Unknown

If you are like me and have devoted a significant portfolio allocation to Bitcoin, it's relatively easy to fall prey to the "FUD" or Fear, Uncertainty and Doubt that is often spread by the media directed at Bitcoin. It comes and goes in waves and usually peaks after a big run-up in the price of Bitcoin. I have to say lately even though Bitcoin is well off of its all time highs, the FUD has been intense - to the point of not only attacking the protocol, but also the Bitcoin community directly. As a long term investor, it's important to do your own research, your own thinking and stick to your strategy - whatever works best for you. I have found that Bitcoin requires a significant amount of research to understand how it works (literally hundreds of hours), but having done that research my conviction continues to grow, I still learn more every day and I continue to advocate for a “nonzero” position.

Here are some of the most common types of Bitcoin FUD:

Governments will "outlaw"

It's a "bubble"

It's a Ponzi scheme

Something better will come along

There's nothing of tangible value (unlike gold or silver)

It will crash 90%

It is used for illicit / criminal activity

It uses too much energy / polluting / not ESG

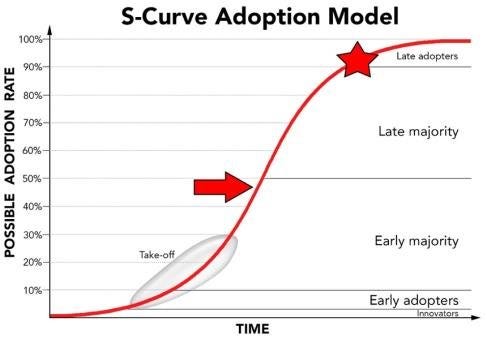

Whenever something is new, it's difficult for most people to see the potential. This could be said of many inventions in the past, such as electricity or the automobile or more recently, the internet. I recall a video clip of Bill Gates on the David Letterman show in 1995 explaining the internet and what it does and Letterman was cracking lots of jokes about it. I believe the current status of Bitcoin is much like the early internet days and you have similar camps of believers and naysayers, both are equally convinced they are "right." I believe we are still in the early adoption stage of Bitcoin.

When you think about Bitcoin, its most obvious use case is as a commodity similar to gold, where it can be used as a store of value. In fact, that's exactly what Bitcoin was engineered to be: programmatically safe, sound money that you can self-custody with no counterparty risk, transfer peer to peer without the need for an intermediary and that cannot be debased (supply hard cap at 21 million coins). Bitcoin is superior to gold in how it can be stored and transferred digitally at very low cost compared to gold. While you can buy large amounts of physical gold, you will incur insurance and storage costs and there’s always counterparty risk (i.e. that the place where your gold is stored is compromised). There’s also the challenge of verifying the authenticity of your gold - i.e., making sure it’s not just tungsten (which weighs about the same) wrapped in gold foil. As the amount of physical gold you own becomes larger and larger, storage, transfer and authentication become even more costly and challenging and at some level impractical, unless you are a central bank.

Bitcoin is already regulated in the United States as a commodity and many investors believe that as long as the government is able to maintain regulatory control over Bitcoin and get their tax revenue from the sale of Bitcoin (approving physical Bitcoin Exchange Traded Funds in the US will be helpful to adoption and also improve tax administration), Bitcoin should have a path forward in the US. Indeed, several states like California, Texas, Wyoming, Florida and Colorado are considered “crypto friendly,” while most states are still evaluating or worse (most notably and recently New York who now wants to ban Bitcoin mining in the state due to ESG concerns). In the end, Bitcoiners will vote with their feet and will support politicians who are pro-Bitcoin. Indeed, many Bitcoiners consider themselves “single issue voters” as it relates to Bitcoin.

Banning Bitcoin would be silly and a few countries that have tried like India and Nigeria have had to walk that back. Indeed, we already know that El Salvador has adopted Bitcoin as legal tender, which makes it nontaxable and it must be accepted for payments in the country. That move has already stimulated a tremendous amount of tourism and investment interest in the country by the Bitcoin community and could be making a difference in the country’s recent positive economic growth. In late breaking news, the Central African Republic just became the second country in the world to adopt Bitcoin as legal tender. Ultimately, banning Bitcoin puts a country at a disadvantage to the rest of the world that is adopting Bitcoin from an economic development standpoint and to the extent those transactions could be taxable, is a lost source of revenue. It's also practically very difficult to do with a decentralized bearer digital asset. It’s an old joke, but Bitcoiners always talk about the boating accident where they lost the keys to their hardware wallet. Also, an outright ban on Bitcoin would clearly be a taking of property and would be extremely unpopular, especially in jurisdictions that have a history of enforcing property rights like the US and other western countries. There is a whole industry and ecosystem growing up around Bitcoin and that means jobs, many of which we can't even conceive of today. That's important for economic growth and governments / politicians are certainly well aware of this.

The more intriguing use case for Bitcoin is the concept of using it as a "base layer" of a new digital decentralized financial network. Many people are familiar with Etherium, another digital currency that supports "smart contracts" using blockchain technology and that allows for all sorts of financial innovation. However, the Etherium protocol, although popular, is still a work in progress technically. In fact, the protocol is set to complete more technical changes this year to enable proof of stake mining. However, the timeline is uncertain and has been delayed several times. Bitcoin is essentially a completed project. There are entrepreneurs who are developing similar smart contract protocols that can work on top of the Bitcoin network, leveraging its large computing base and extremely strong security. An example of this is Stacks.co. Also the Lightning Network and companies like Strike have tremendous potential for facilitating global payments at very low costs, disrupting the likes of Visa, Mastercard, Western Union and others. This next generation of financial technology can bring the best of both worlds together allowing for low cost, rapid and secure "smart" financial transactions without the need for an intermediary and leveraging the Bitcoin protocol for settlement and payment. I think this is probably the most compelling use case for Bitcoin and one that could dwarf the demand driven by investors and corporate treasuries as an alternative asset.

Ray Dalio, an investor I have a lot of respect for, created a stir in the past (and brings it up every once in a while) by suggesting that it's probable that Bitcoin could be outlawed in the US and other countries (indeed, as noted above that has already been happening). While that is indeed a possibility (gold ownership was outlawed in the US for many years), I think this only happens if Bitcoin becomes a threat to the demand for US Treasury debt. The government needs to be able to issue a lot of Treasury debt to fund operations and ongoing stimulus programs and the Federal Reserve doesn't want to be the only one buying all those bonds for obvious reasons (i.e. further monetary inflation through monetization of the debt). However, the government could easily force banks, pension funds and even individual investors in their retirement accounts to buy US government debt if there were to be insufficient demand from other sources including other countries / global investors. As interest rates rise, US debt will slowly become more attractive (even with a negative real yield US debt could be more attractive than say the EU which in many cases has negative stated interest rates). Complete demonetization of the Treasury market only happens in a hyperinflationary scenario in the US, which at this point I wouldn’t rule out in the next 5 or 10 years (part of the reason why you would hold Bitcoin as a hedge versus cash or bonds in your portfolio), but not imminent and certainly other countries are currently in worse shape financially. The Federal Reserve, even if they are late to the game of curbing inflation with only a 25 basis point increase to the Federal Funds Rate so far, have made a big deal of talking up how aggressive they intend to be in fighting inflation and futures markets are reflecting big increases coming. I’m in the camp that they will continue to raise rates until something in the system “breaks” and forces them to go back to easy money. That will absolutely light risk assets on fire, including Bitcoin. It is of course in their best interest to let inflation "run hot" for a while to reduce the massive $30 Trillion US debt burden in real terms, which should do plenty of damage to cash, bonds and growth stocks in the meantime. Stocks, especially those companies with strong cash flows and the ability to raise prices to cover rising input costs, will continue to see a boost in this environment since investors have no other good investment alternatives outside of commodities which also look to do well in an inflationary and fractured geopolitical environment. Indeed, gold and silver have recently started to rally.

Also, as Cathy Wood says, there are very powerful deflationary forces at work in the world today due to technological innovations. Indeed, you really don't have strong inflation without wage inflation and as the unemployment rate drops and number of unfilled jobs stays elevated, you are starting to see some wage pressures. We are also starting to see increased unionization success in companies that historically have not experienced that like at Apple, Amazon and Starbucks. This will surely cause wage pressures to rise which will feed inflation. Also onshoring of supply chains for redundancy and due to geopolitical turmoil will also likely provide long term upward pressure on inflation as well as in industrial renaissance of sorts for the US and other countries that have become accustomed to “Made in China.” What’s not talked about enough, however, is robotics and automation and how companies will gravitate more toward those solutions instead of creating a lot more low-skill jobs in this reshoring of manufacturing. My own observation from the COVID-19 pandemic and recession is that many of the jobs that were lost may never come back since companies have rapidly accelerated adoption of technology to replace labor, which means that in the long run wage inflation may have a tough time taking hold. If we see any signs of deflation, investors will run right back into Treasuries, which was what we saw during the Great Recession and also more recently last year and whenever an economic downturn happens. That would also solve the Treasury demand problem and many investors (as they have been until very recently) might still be willing to accept zero or slightly negative real rates of return in exchange for "safety."

The volatility of Bitcoin is expected to settle down as it gains adoption and over the long haul, should approach a more "normal" rate of appreciation commensurate with inflation, not unlike gold. In the meantime, the network effect will be a major driver of the price of Bitcoin, since greater use as an alternative investment, more use cases and a fixed supply will continue to drive the price up. The nature of the network effect is that there is a massive advantage to the first mover (in this case Bitcoin, which is the first global monetary network) and the only way you are disrupted is if something comes out that is at least 10x better. While that's a possibility, the first-mover advantage is huge as we have seen with the likes of Amazon, Google, Facebook, Netflix, and Apple. If you are going to own Bitcoin, you have to be willing to hold regardless of the price action, whether up or down, with a time horizon of at least 5-10 years I believe. Bitcoin will continue to be volatile in the near term, that much is certain.

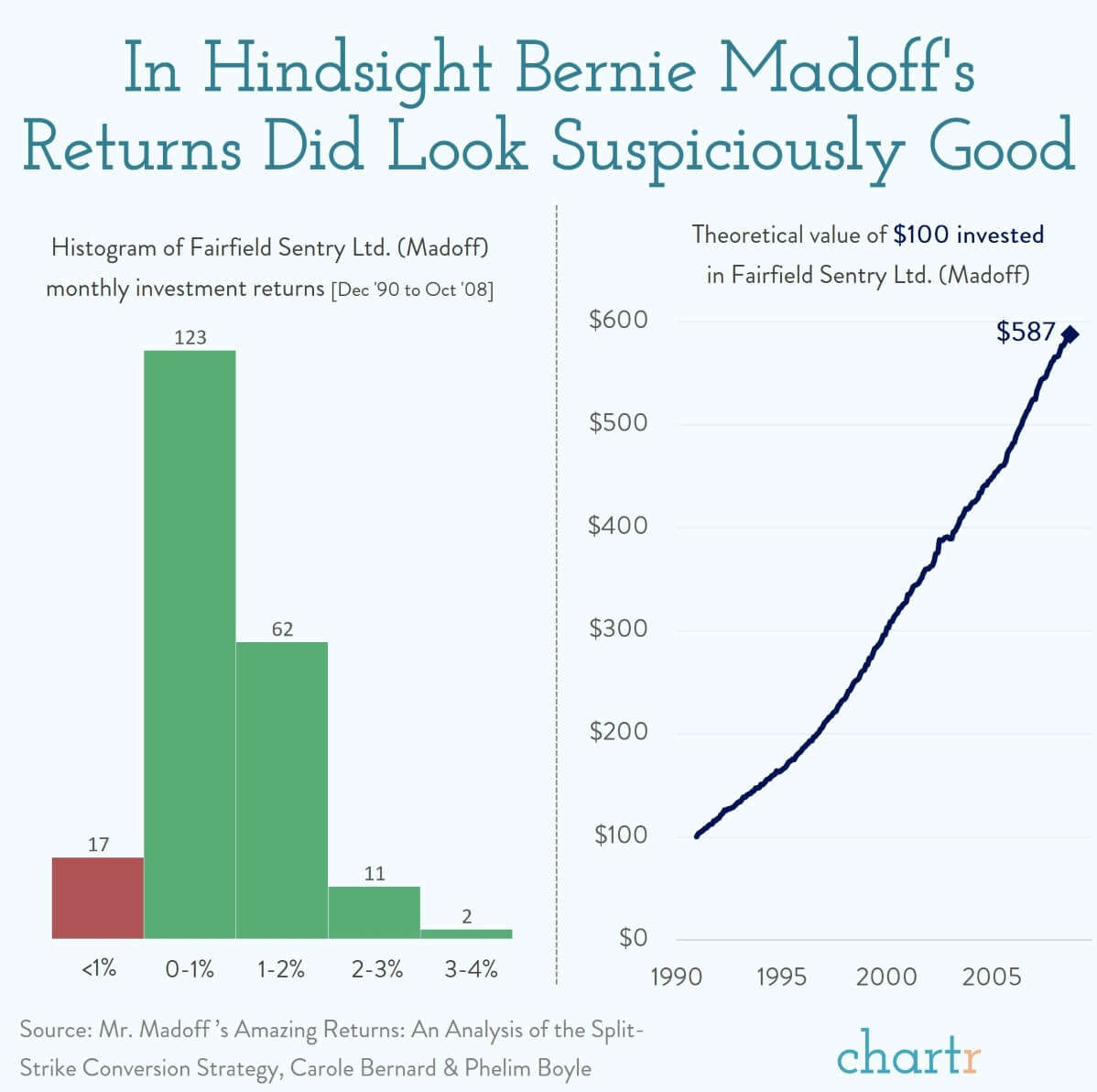

A Ponzi scheme usually has a sponsor who is making money at the top by taking in investments, keeping most of the money for personal use or funding the occasional redemption and paying out a small amount to investors as a "return." Bernie Madoff was running such a scheme - the largest in US history - and was able to do it for years by showing great results to his investors, and it all fell apart when the stock market crashed during the Great Recession. The Ponzi falls apart when new investors stop coming in and the operator is unable to pay interest or redemptions to existing investors. Based on this definition, Bitcoin can't be labelled a Ponzi scheme because as a decentralized platform, there is no central sponsor who is enriching themselves at the expense of new investors (unlike most of the altcoins), there's certainly no faking the price of Bitcoin since it is actively quoted and traded 24 hours a day, 7 days a week and it’s certainly not been a ride straight up. Someone call the Bitcoin CEO! This was Madoff’s performance chart - almost too good to be true:

As far as criminal activity, ironically Bitcoin is probably the worst way for criminals to transact because the blockchain is open and everyone can see it. This actually makes it easier for law enforcement to "follow the money." Historically dollars (especially paper bank notes in suitcases) have accounted for more illegal activity than Bitcoin has.

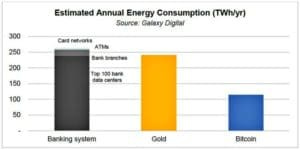

The energy FUD argument is essentially that proof of stake mining for Bitcoin consumes too much energy and therefore adds to the carbon “problem.” Also a slightly different spin in the form of environmental impacts (including noise, industrial waste, etc.) has recently popped-up, most recently in a letter from members of Congress to the US Environmental Protection agency:

Here’s one example of how the energy FUD argument is made:

It’s currently estimated that Bitcoin consumes about 0.6% of global energy consumption. Most Bitcoiners believe that is a small price to pay for sound money. Also, while Bitcoin does consume energy to support network security (Proof of Stake), it’s quite a bit less than the legacy banking system and even gold as this chart shows:

Also, Bitcoin can help clean up the environment by taking waste gas from oil and gas fields that was previously “flared” and convert it to energy using generators to mine bitcoin and reduce the amount of carbon released to the atmosphere. In addition, bitcoin mining in remote locations can help make alternative energy (large solar or wind farms) economically feasible where they would not otherwise be since they can be located closer to the energy source even if that is far away from where the energy is consumed.

Finally, the Bitcoin Mining Council an industry group at the end of 2021 reported that more than half (58.5%) of global mining operations were sustainable.

The most recent escalation in the FUD is what I believe are personal attacks against Bitcoiners including the following:

Bitcoin fans are psychopaths who don’t care about anyone, study shows

Bitcoin investors tend to have low financial literacy, according to BoC research

My experience with the Bitcoin community has been the exact opposite of these allegations. Bitcoiners are productive, hard working people who just want to save their money in something that can’t be debased by the government. They are for the most part incredibly financially literate and have a deep understanding of banking, the legacy financial system and its flaws, capital markets, economic theory (Keynes, Austrian, Modern Monetary Theory, etc.), technology and the differences between Bitcoin and “altcoins,” not to mention philosophy and politics. Indeed, some of the smartest people I have encountered both generally and in financial matters has been in the Bitcoin community.

In conclusion, while there is plenty of FUD out there, when you look at the facts there's not much reason to be concerned if you have a long-term buy and hold approach to Bitcoin. Your percentage allocation should be in accordance with your comfort level and I certainly am not recommending going "all in," as some have done. It still makes sense to have a diversified portfolio consistent with a strong Financial Fortress, since not all assets are always "working" at the same time. The outlook for cash and bonds with ongoing monetary and fiscal stimulus not just in the US but globally, suggests that a higher allocation to alternatives such as Bitcoin make sense in the current environment.

Not financial advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.