Introduction

Central Bank Digital Currencies (CBDCs) have become a focal point in the evolving landscape of global finance. As countries worldwide explore the potential of digital currencies issued by central banks, the implications for monetary policy, financial stability, and individual freedoms are profound. This post delves into the definition and mechanics of CBDCs, distinguishes between retail and wholesale CBDCs, examines global adoption trends, and critically assesses the human rights concerns associated with CBDCs. We will also explore the contrast between CBDCs and Bitcoin, often referred to as "freedom money."

Defining Central Bank Digital Currencies

A Central Bank Digital Currency (CBDC) is a digital form of a country's national currency, issued and regulated by the central bank. Unlike cryptocurrencies such as Bitcoin, which operate on decentralized networks, CBDCs are centralized and under the direct control of the issuing authority. They are designed to function as legal tender and aim to combine the “convenience” of digital payments with the “security and stability” of a central bank's backing. Safe and sound, right?

How CBDCs Work

CBDCs operate using a digital ledger system, which can be either centralized or distributed. The central bank maintains a record of all transactions, ensuring transparency (to the bank and other interested parties like the government!) and traceability. This digital ledger can be based on blockchain technology or other distributed ledger technologies (DLT), depending on the country's infrastructure and policy goals.

There are two primary models for CBDCs: account-based and token-based. In an account-based model, the central bank maintains accounts for all users, and transactions are executed by transferring balances between these accounts. In a token-based model, CBDCs function more like digital cash, where ownership of the currency is transferred via the exchange of digital tokens.

Retail vs. Wholesale CBDCs

CBDCs can be categorized into two main types: retail and wholesale, each serving distinct purposes within the financial system.

Retail CBDCs: Retail CBDCs are designed for use by the general public, including individuals and businesses. They establish a direct relationship between the central bank and end-users, bypassing traditional commercial banks. This model can potentially disintermediate commercial banks, as users could hold accounts directly with the central bank. This direct access could lead to greater “financial inclusion,” especially for unbanked populations, and provide the central bank with real-time data on economic activities (i.e., total control).

Wholesale CBDCs: Wholesale CBDCs are intended for use by financial institutions, primarily to facilitate large-scale interbank transactions. This type of CBDC does not disintermediate commercial banks; instead, it aims to streamline and secure the settlement process between banks and the central bank. Wholesale CBDCs can improve the efficiency and security of financial markets by reducing settlement risks and operational costs.

Global Adoption of CBDCs

The exploration and adoption of CBDCs vary widely across the globe. According to the Atlantic Council's CBDC Tracker, 134 countries are currently exploring or piloting CBDCs. Some countries, like China, the Bahamas, and Nigeria, have already launched their digital currencies, while others are still in the research or development phase.

China has been at the forefront of CBDC development with its Digital Currency Electronic Payment (DCEP) or digital yuan. The digital yuan aims to enhance the efficiency of the payment system and reduce the reliance on cash. China has conducted extensive pilots across various cities, testing the digital currency in real-world scenarios. China also has a social credit scoring system, which when coupled with CBDC gives the government extraordinary control over it’s citizens.

The Bahamas launched the Sand Dollar in 2020, becoming one of the first countries to issue a CBDC. The Sand Dollar aims to improve financial inclusion in the archipelago, where many residents do not have access to traditional banking services.

Nigeria introduced the eNaira in 2021, with the goal of enhancing financial inclusion and enabling a more efficient payment system. However, the implementation of the eNaira faced several challenges, including low public awareness and concerns over data privacy and security. This is discussed in more detail below.

Human Rights Concerns and the Loss of Financial Freedom

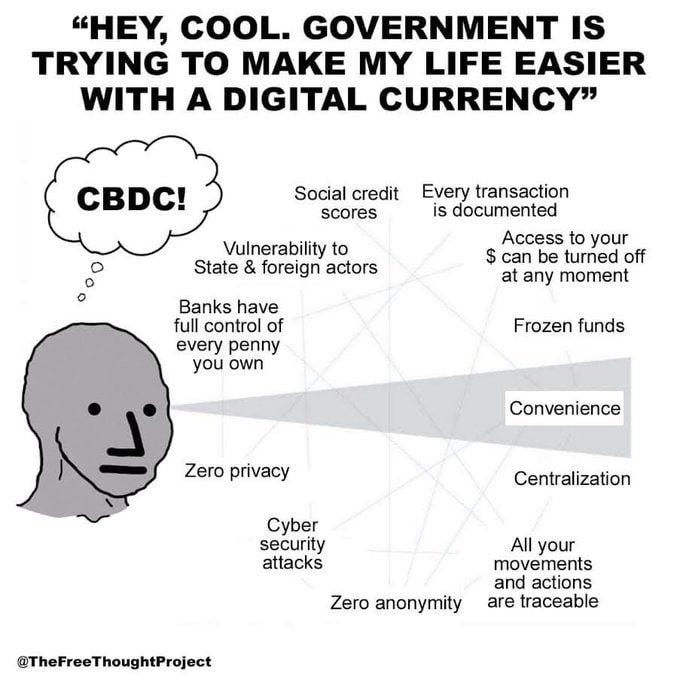

While CBDCs are touted as offering potential benefits such as increased financial inclusion and improved payment systems, they raise significant concerns, particularly regarding individual freedoms and human rights.

CBDCs provide central banks with unprecedented visibility into individual financial transactions. This transparency, while beneficial for preventing illegal activities like money laundering, also poses a threat to privacy. With CBDCs, every transaction can be traced, recorded, and potentially monitored by authorities. This capability raises concerns about the erosion of financial privacy and the potential for government overreach.

Moreover, CBDCs could enable censorship of transactions and facilitate the implementation of social credit systems. Governments could potentially restrict or control how individuals spend their money, based on certain criteria or behaviors, infringing on personal freedoms. This concern is particularly acute in authoritarian regimes, where financial data could be used to suppress dissent or target specific groups.

The Human Rights Foundation (HRF) has highlighted these issues, warning that CBDCs could become tools for surveillance and control, undermining the fundamental right to privacy and freedom of expression. The HRF's concerns are not theoretical; they are grounded in real-world scenarios where financial systems have been weaponized against citizens.

Governments have often turned to freezing someone’s financial resources to lock that individual out of society. For example, the Chinese government froze the funds of protestors in response to the Hong Kong freedom protests and the Canadian government froze the bank accounts of protestors in response to the Ottawa trucker protest. This weaponization of the financial system is already such a common problem that many people have turned to cryptocurrencies as a solution to overzealous governments. However, due to the direct access it would provide governments, a CBDC could greatly exacerbate these events.

Case Study: Nigeria's eNaira

The implementation of the eNaira in Nigeria serves as a case study for the challenges and risks associated with CBDCs. The eNaira's rollout has been marred by technical difficulties, a lack of public trust, and concerns over data security. According to a Cornell University report, the eNaira faced a tepid reception from the public, with many Nigerians skeptical of the government's motives and worried about the implications for their financial privacy.

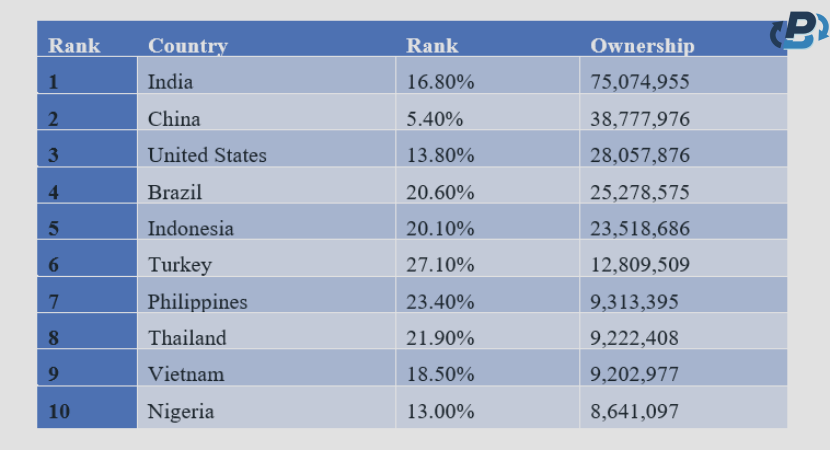

Furthermore, the eNaira's implementation highlighted the broader issues of digital literacy and infrastructure in developing economies. The success of a CBDC relies heavily on public awareness, trust, and access to digital technologies, all of which were lacking in the Nigerian case, according to the report. I’m not buying “digital literacy.” The Nigerian people have a high degree of digital literacy and have one of the highest rates of cryptocurrency use in the world (#10 globally). They simply get it and (correctly) don’t trust a CBDC.

Contrasting CBDCs with Bitcoin: Freedom vs. Control

In stark contrast to CBDCs, Bitcoin represents a form of "freedom money." Bitcoin is decentralized, permissionless, and censorship-resistant, operating on a peer-to-peer network without central authority. This decentralization ensures that no single entity can control or manipulate the Bitcoin network, making it an attractive option for those concerned about financial freedom and privacy.

Bitcoin transactions are pseudonymous, providing a level of privacy not available with CBDCs. While Bitcoin's public ledger does record all transactions, it does not inherently link them to individuals, offering a degree of anonymity. Moreover, Bitcoin's fixed supply of 21 million coins contrasts with the potentially inflationary nature of fiat currencies, including CBDCs, which can be issued at the discretion of central banks.

Conclusion

Central Bank Digital Currencies represent a significant shift in the way we perceive and use money. They pose substantial risks to individual freedoms and privacy. The direct control and oversight by central banks can lead to potential abuses, including surveillance and censorship.

In contrast, Bitcoin offers an alternative that prioritizes decentralization, privacy, and financial sovereignty. As the world moves toward digital currencies, it is crucial to consider the implications for human rights and individual freedoms. The debate between CBDCs and Bitcoin is not just about technology; it is about the kind of society we want to build—one where financial systems empower individuals rather than control them.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

![EN | PT ] CBDCs are a problem - CBDCs ... EN | PT ] CBDCs are a problem - CBDCs ...](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F3917b844-5afe-4de7-88ad-01ccfa80491f_300x168.jpeg)

Just to reiterate and reinforce Bitcoin Fortress piece (my two cents)

RETAIL CBDCs + SOCIAL CONTROL + SOCIAL CREDIT SYSTEM = TYRANNY (END OF FREEDOM)

For example:

if you get too many tickets, if you talk/write against the govt, if you spend your money in a way that’s not in line with govt policies… scoring points will be subtracted from your total initial score and as you go down with your score you will be limited in certain activities as flying business class or flying at all, renting a nice apartment, buy red meat, stay at luxury hotels, buy gasoline, buy nice dresses and appliances …

Furthermore your low score will show up in certain apps and people/friends around you will avoid interacting with you.

NOSEDIVE a 2016 Netflix episode of the famous Black Mirror series tells it all. Here’s an extract: https://www.youtube.com/watch?v=d_AQQZ7j4zE&t=362s

A true nightmare, a life not worth leaving that we must FIGHT now with all our forces before it’s too late.

BITCOIN is of course a mean of self defense against tyranny but also:

MERCHANTS DO NOT ACCEPT THEM

CONSUMERS DO NOT ADOPT THEM

Adoption rates of retail CBDCs like China e-yuan, Nigeria e-naira, Bahamas sand dollar, Jamaica jam-dex are there to prove it. Adoption is close to zero!!

PEOPLE AIN’T STUPID WHEN TALKING ABOUT THEIR MONEY.

Retail CBDCs will NOT take our freedom away from us.

NEVER!

Amen!