Bitcoin's resilience in the face of recent tariff-induced stock market turmoil is both notable and intriguing. As equities sold off sharply—driven by investor anxieties around new tariffs and their cascading effects on corporate profits—Bitcoin remained surprisingly stable, prompting many investors to reconsider its narrative as a safe haven or at least an uncorrelated asset.

Bitcoin: Tariff-Proof?

The simplest explanation could be the most powerful: Bitcoin is fundamentally unaffected by tariffs or international trade disputes. Unlike multinational corporations whose profits can be significantly eroded by tariffs on imported goods and disruptions to supply chains, Bitcoin operates entirely outside traditional economic systems. Its decentralized, digital nature insulates it from geopolitical trade conflicts, rendering tariffs irrelevant in influencing its fundamental value.

Anticipating the Fed’s Next Move

A deeper rationale might lie in market expectations surrounding monetary policy responses to economic downturns triggered by trade wars. If escalating tariffs lead to a significant economic slowdown, historical precedent suggests the Federal Reserve will likely respond aggressively—cutting interest rates and renewing monetary expansion. Such actions typically weaken the dollar, boost inflation expectations, and lower yields on traditional safe-haven assets like government bonds. Bitcoin, increasingly viewed by investors as digital gold, could greatly benefit in this scenario.

Indeed, Bitcoin's fixed supply and decentralized issuance contrast sharply with fiat currencies, which central banks routinely inflate to mitigate economic crises. During periods of monetary easing, Bitcoin’s scarcity becomes increasingly attractive, positioning it as a compelling store of value and inflation hedge—with the added benefits of digital portability and global accessibility.

Deficits, Debt, and Potential Monetary Reset

Further complicating the economic landscape is the potential blowout of the U.S. government's deficit, driven by falling tax revenues and increased fiscal spending to stimulate a weakening economy. This scenario could rapidly reverse the current rally in bonds, placing enormous pressure on the Federal Reserve to stabilize the treasury market through additional money printing. Such intervention might further erode confidence in fiat currencies, indirectly benefiting Bitcoin as an alternative form of money.

Moreover, this situation raises a crucial question: Are we witnessing the early stages of the monetary reset predicted by many economists, driven by accelerating global sovereign debt to unsustainable levels? Persistent deficits, ballooning debt levels, and aggressive monetary interventions collectively point to systemic fragility, making Bitcoin’s decentralized, limited-supply model even more appealing.

Or Something Completely Different?

Could Bitcoin’s recent resilience indicate something else entirely?

Perhaps we're witnessing the maturation of Bitcoin into a genuinely uncorrelated asset class. Investors and institutions seeking true portfolio diversification might increasingly allocate to Bitcoin precisely because its performance does not reliably move in lockstep with traditional financial markets. If Bitcoin consistently demonstrates resilience during economic and geopolitical turmoil, it will further solidify its place in mainstream asset allocation strategies.

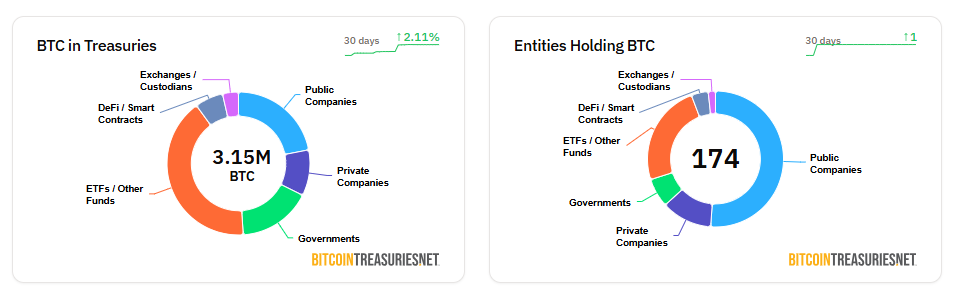

Another intriguing possibility is growing institutional recognition and adoption of Bitcoin beyond retail speculation. With Bitcoin ETFs gaining momentum and corporations quietly adding Bitcoin to their balance sheets as insurance against broader economic instability, Bitcoin’s price stability may signal deeper, sustained demand less prone to speculative volatility.

Final Thoughts

The recent tariff-inspired market volatility presents a moment for reflection: Bitcoin's stability could result from multiple converging factors—its independence from traditional economic pressures, monetary policies, its emerging role as a new asset class, and its institutional adoption.

Whatever the exact cause, Bitcoin’s recent performance amid market turmoil offers investors plenty to think about. It challenges conventional financial wisdom and underscores Bitcoin’s evolving narrative in global finance—a narrative where Bitcoin increasingly appears as a resilient, viable alternative amid uncertainty.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2025.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.