In a world of ever-shifting markets, two of the most popular investments—Bitcoin and real estate—have sparked intense debate. With growing inflationary pressures, economic uncertainty, and rapid technological advancements, investors are revisiting this question: is it better to hold Bitcoin or invest in real estate? As someone who has been following both markets closely, I’ve updated my earlier views to reflect the latest developments. Let's dive into the strengths, weaknesses, and outlooks for both.

1. Performance and Appreciation

Bitcoin:

Bitcoin’s price has seen significant volatility since its inception, but if you zoom out, the trend is clear: Bitcoin has outperformed almost all traditional asset classes, including real estate. In the last five years alone, Bitcoin has continued to climb, especially as institutional adoption accelerates through Bitcoin ETFs, Lightning Network improvements, and growing geopolitical interest in Bitcoin as sovereign wealth.

In 2024, Bitcoin’s price has fluctuated around the $50,000 - $70,000 range, a recovery from the 2022 bear market. Long-term HODLers continue to see exponential returns, especially those who have accumulated since before the pandemic. Notably, Bitcoin’s supply remains capped at 21 million, and as halving events reduce the available new supply, this scarcity continues to drive up demand and price.

The chart below illustrates the cost of an average U.S. home in both U.S. dollars and Bitcoin over the past 10 years. While the dollar cost of homes has steadily increased, the cost in Bitcoin has declined significantly over time and continues to fall.

Real Estate:

Real estate markets, on the other hand, have seen a more nuanced development. In 2024, home prices have stabilized somewhat after experiencing rapid inflation-driven price growth during the pandemic. Mortgage rates spiked during the Federal Reserve's rate-hiking cycle but have since come down slightly, hovering around 6-7%, still well above the lows of 2020-2021.

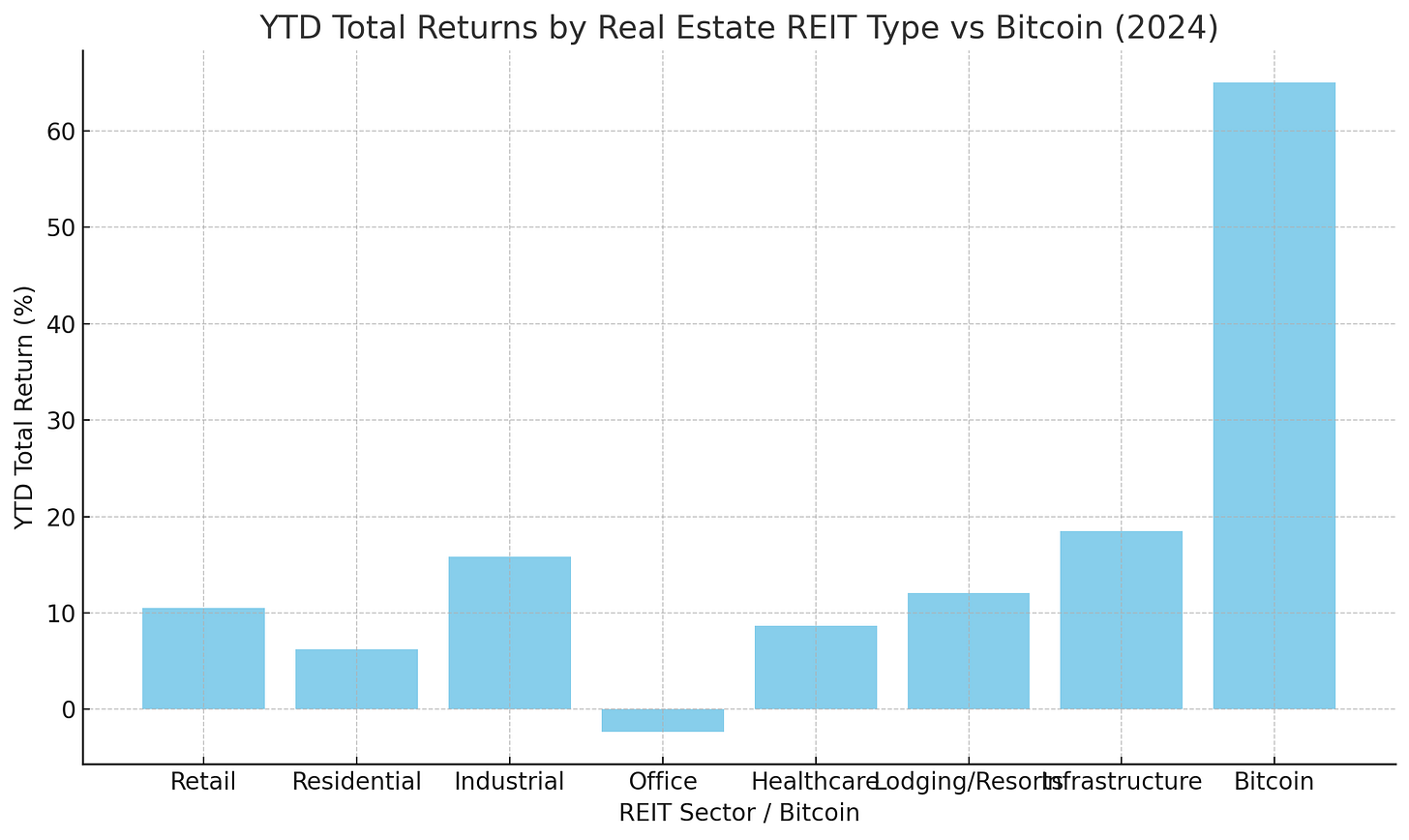

While certain markets have cooled, prime real estate continues to see healthy appreciation. However, real estate values are tied closely to local factors like zoning laws, demand for physical locations, and economic conditions. Inflation has increased maintenance, insurance, and property tax costs, further diminishing net returns for some real estate investors. All segments of commercial real estate have struggled to perform as well as Bitcoin and office continues to see negative returns.

2. Liquidity and Accessibility

Bitcoin:

Bitcoin remains the more liquid asset. You can buy, sell, or trade Bitcoin globally within minutes on a wide variety of exchanges. Moreover, Bitcoin is accessible to virtually anyone with an internet connection, regardless of where they live or how much they can afford to invest. You can buy fractions of Bitcoin (down to 1 satoshi) with no minimums, allowing for more inclusivity. Lightning Network advancements have further increased Bitcoin’s transaction speed and reduced fees, making it even more accessible.

Real Estate:

Real estate is notorious for being illiquid. Property transactions can take weeks or months to close, and the associated costs—closing fees, agent commissions, and legal fees—can significantly cut into any potential profit. Additionally, the large down payments required to buy property mean that real estate is far less accessible to average investors compared to Bitcoin. Many people are also priced out of the housing market entirely in high-demand cities, further restricting accessibility.

3. Control and Ownership

Bitcoin:

Bitcoin offers unmatched control and sovereignty over your wealth. If you hold your Bitcoin in self-custody, using a hardware wallet or a secure wallet app, you can access your funds 24/7 without relying on any third party. No government, bank, or intermediary can confiscate, freeze, or restrict access to your Bitcoin, making it the ultimate asset for those concerned about personal freedom.

Real Estate:

While real estate gives you ownership of a physical asset, this ownership is far from absolute. Property rights can be subject to government intervention (eminent domain), zoning regulations, or increased taxation. Additionally, real estate investments require ongoing management and maintenance, either directly or through hiring a property manager. While owning real estate does provide tangible value, it’s far from the unconfiscatable nature of Bitcoin.

4. Income Generation

Bitcoin:

While Bitcoin itself doesn’t generate income like a rental property might, there are emerging opportunities. Lightning Network node operators, for example, can earn fees from routing payments. However, this requires technical knowledge and is currently a niche practice. Stacking Bitcoin through consistent dollar-cost averaging or getting paid for your work in Bitcoin are common long-term wealth-building strategies. Earning a yield and passive income are fiat system concepts that aren’t necessary in a hard money system which is by its very nature deflationary.

Real Estate:

Real estate shines in the area of income generation. A well-located rental property can provide steady, reliable cash flow. In fact, some investors rely on rental income as their primary source of passive income. However, rental income is not without its headaches—dealing with tenants, maintenance issues, and vacancy periods can reduce the net yield. And in recent years, rent control measures, economic struggles for low wage workers and nonpaying tenants have also added risk for landlords. Being a long-term owner of real estate also requires capital for improvements from time to time for major repairs or renovations, which is much harder for a smaller investor to cover.

5. Volatility and Risk

Bitcoin:

Bitcoin’s volatility remains one of its defining characteristics. Large swings in price can occur in a short period, which can be daunting for risk-averse investors. However, for those with long time horizons and high conviction in Bitcoin’s future, volatility is often viewed as an opportunity to accumulate more. Over the years, volatility has been gradually decreasing as Bitcoin’s market matures.

Real Estate:

Real estate is generally seen as a more stable investment, but it’s not without its risks. Housing bubbles, rising interest rates, and economic downturns can all negatively impact property values. Moreover, unforeseen events like natural disasters, changes in zoning laws, or new taxes can affect real estate investments. While real estate’s slow appreciation makes it less volatile than Bitcoin, it’s not immune to downturns, as the 2008 financial crisis reminded us. You also can’t pick up your real estate and move it like you can with Bitcoin.

6. Inflation Hedge

Bitcoin:

Bitcoin is often called "digital gold" due to its deflationary design. Its fixed supply makes it an ideal hedge against inflation, especially in an environment where central banks are printing money at unprecedented rates. In fact, many investors are turning to Bitcoin as a way to preserve their purchasing power in the face of fiat currency devaluation. As central banks continue to flood the economy with money, Bitcoin's non-inflationary nature becomes even more attractive.

Real Estate:

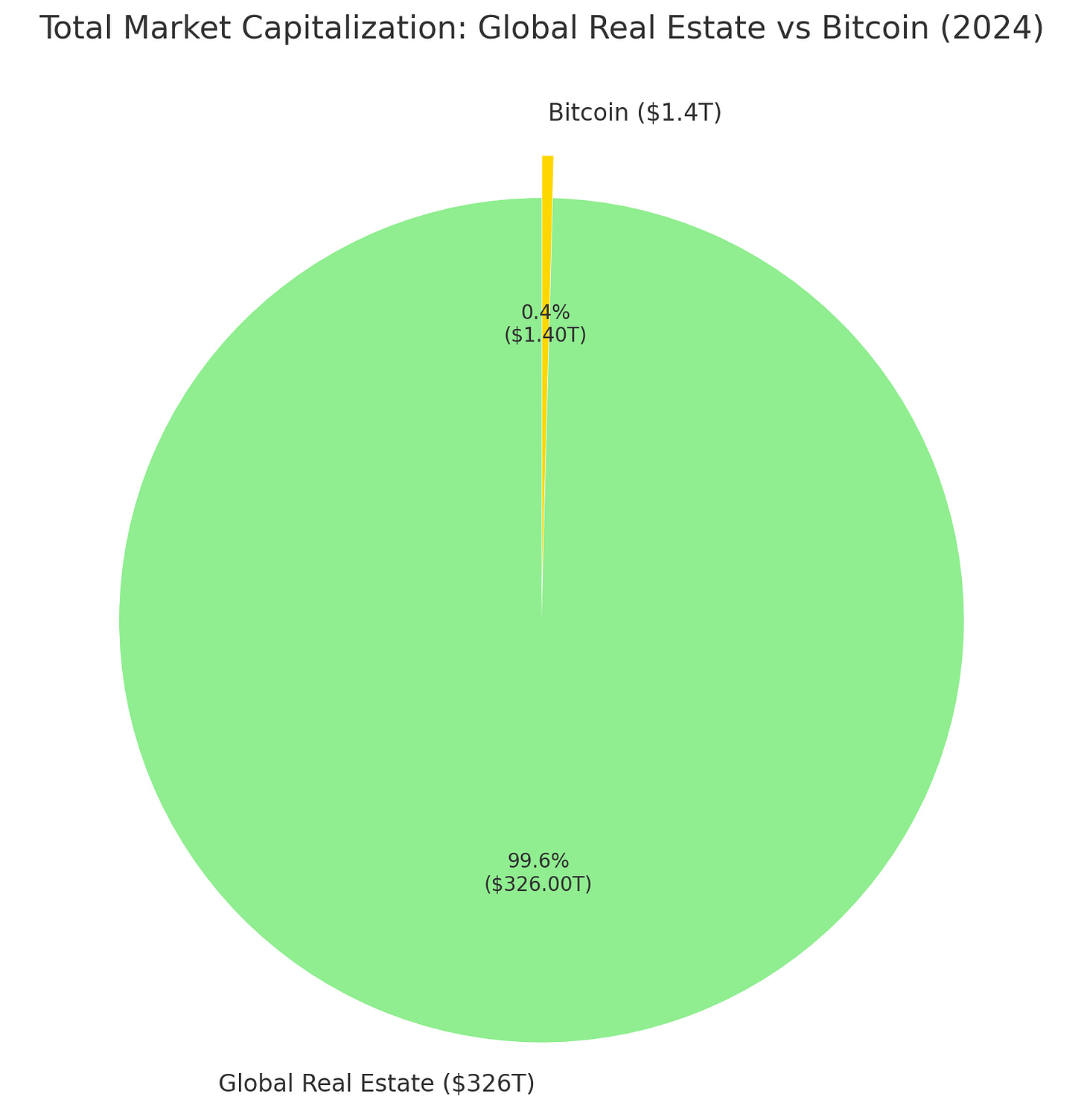

Real estate has traditionally been seen as a hedge against inflation, particularly because home values tend to rise with inflation. However, this doesn’t always translate to proportional gains for the investor, especially when factoring in higher property taxes, insurance costs, and maintenance fees that tend to increase alongside inflation. In order for the math to work, rents have to grow more than expenses. Moreover, rising interest rates can negatively impact real estate prices, making Bitcoin a more direct inflation hedge in today’s economy. If Bitcoin behaves as we expect it to, it will demonetize real estate and remove the monetary premium over time, returning real estate to its functional value. Currently, Bitcoin’s total market cap is a tiny fraction of the global real estate market value:

Conclusion

In my mind, it’s not even a contest. For the long-term investor focused on preserving wealth in an increasingly volatile and inflationary environment, Bitcoin presents a more compelling case. While real estate remains a valuable asset, its risks and diminishing returns (including demonetization) in today’s market may lead investors to rethink traditional asset allocation models, with Bitcoin playing an ever-growing role in future portfolios.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.