After following the news flow for the past week and reading a rather interesting article in the Financial Times on bond market “volatility vortex,” I thought it would be a great time to look at Bitcoin’s volatility recently compared to other assets since it’s often a big complaint from non-Bitcoiners.

First, a few charts:

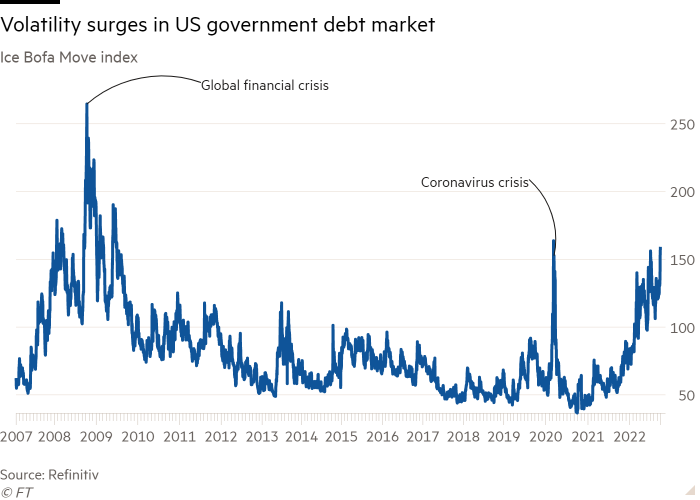

Volatility as measured by the Move index shows recent US government debt market volatility approaching the recent coronavirus crisis highs.

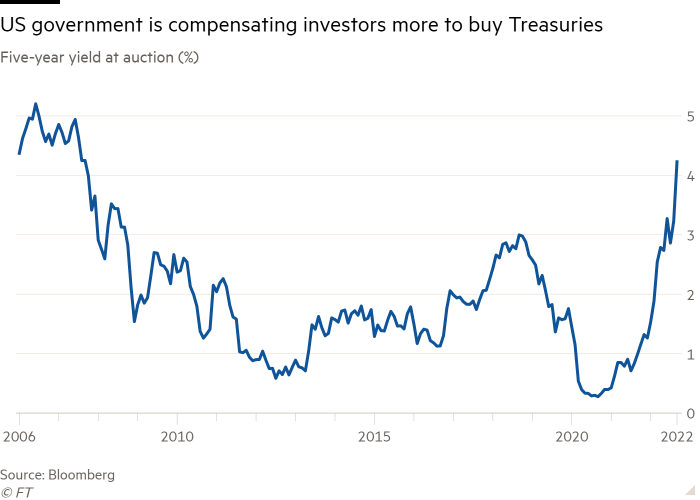

Meanwhile, rates are on a parabolic upward move (which means bond prices are also plummeting - so much for a safe investment) - the chart below shows the five year yield.

Finally, the Treasury liquidity index is showing signs of stress last seen in March 2020 (higher number means liquidity is worse):

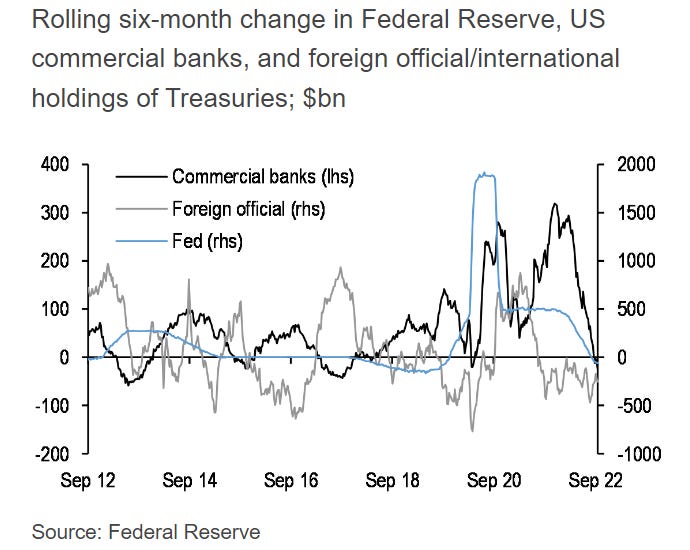

Demand for US government debt is also dropping from all sectors as this chart shows:

So much for the “low risk” asset class. Now how about stocks? Volatility as measured by the VIX index is up almost 100% over the past year and clearly on an uptrend as shown below (thanks to Macrotrends for the chart):

Meanwhile, the volatility of Bitcoin has literally dropped to zero as the price has flatlined in a very narrow range since July:

Could Bitcoin finally be showing it’s promise as a store of value and stability outside of a system that is showing very troubling signs of collapse?

As a refresher, these are the qualities of Bitcoin:

Absolutely scarce (21M maximum coins)

Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

The Bitcoin network operates independently of all legacy financial systems; it is the first digital global payments infrastructure

No counter party risk when self-custodied

Trustless; Bitcoin is not controlled by any person or group

A hedge against fiat currency debasement / collapse in the same way that gold is, but doesn’t have gold’s drawbacks of difficulty to validate, store, transfer and secure - especially in large amounts

I’m fairly sure the Federal Reserve won’t risk crashing the system and they have lots of tools at their disposal to bring order back to the Treasury Market, as James Lavish recently wrote (highly recommend his free weekly newsletter where he does simple explainers for complex financial topics):

Regardless, the most likely outcome as I have written about before and many people agree is that the Federal Reserve and other central banks will eventually have no choice to stabilize the system but by lowering interest rates / buying bonds / printing money given the amount of debt that is outstanding. This will of course be inflationary and will benefit all risk assets and particularly Bitcoin, at least until the next crash (so traders start your engines).

The unending boom and bust cycle (for me that was dot.com, great financial crisis, coronavirus crisis and now whatever this will be called in 2022) will continue and the booms and busts will get bigger and bigger if history is a guide. For the people who think Treasuries look “interesting” I would say maybe as a short-term trade, but I wouldn’t be putting any long term money there and as I reported in my last portfolio update. For me, I’m looking to continue to allocate to Bitcoin, some gold and possibly a few commodity stocks over the next few months. Check out next week’s post for my portfolio update for October.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. Every week I recap the prior week’s market activity, look ahead to the coming week’s market events, go over recent Bitcoin news and provide commentary and also include content related to my weekly substack post (minus the charts, of course).