Michael Saylor's recent presentation at the Cantor Fitzgerald conference on Bitcoin, titled "Bitcoin, The Red Wave, and The Crypto Renaissance," offers an intricate roadmap of how Bitcoin is revolutionizing capital markets and reshaping economic dynamics. As the Chairman of MicroStrategy, Saylor delved into his company’s strategic alignment with Bitcoin, the implications of recent political changes in the U.S., and the broader potential of digital assets to disrupt traditional systems. His arguments, reinforced with compelling data and projections, illuminate a "Bright Orange Future" for Bitcoin.

MicroStrategy: Bridging Bitcoin and Capital Markets

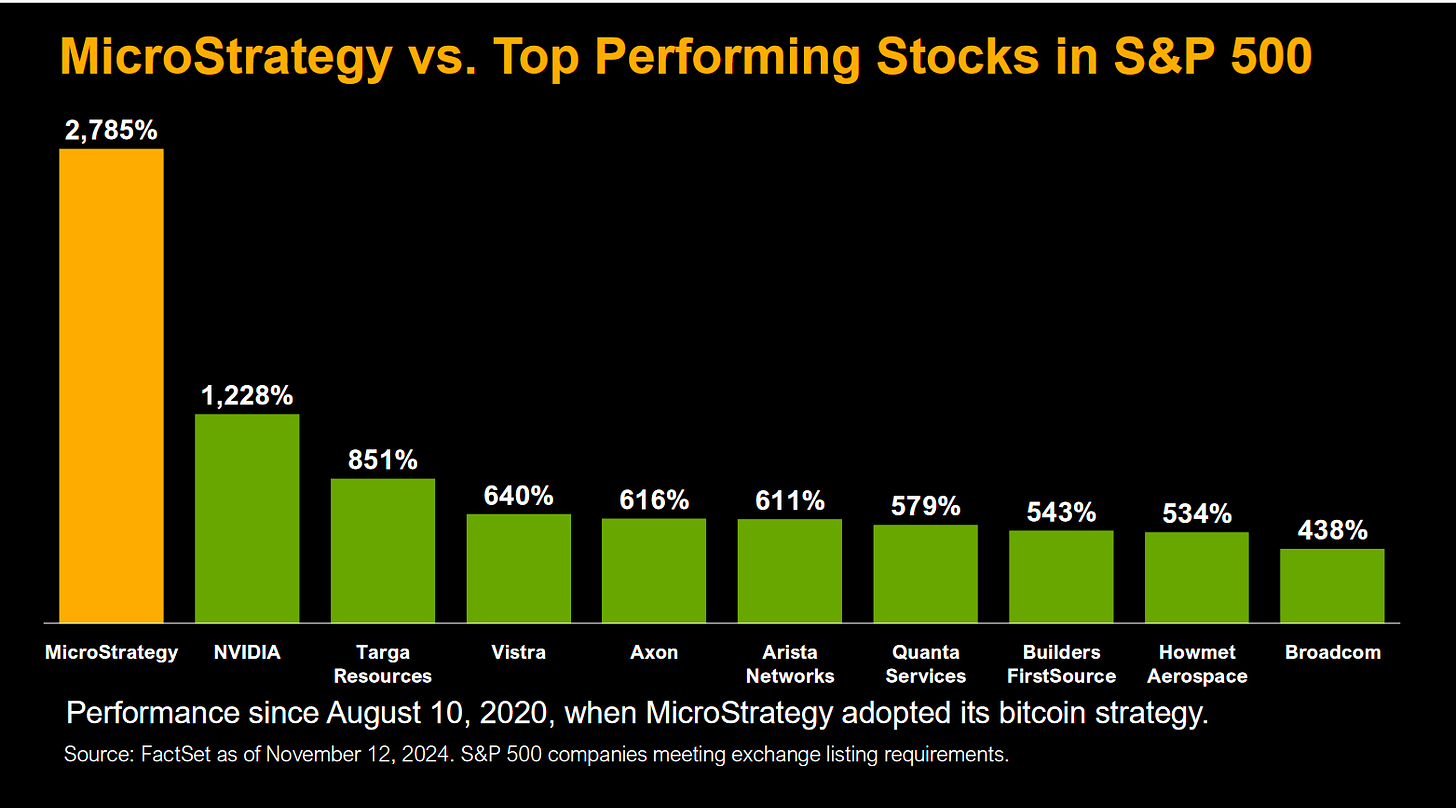

MicroStrategy's transformation into the first publicly traded Bitcoin treasury company demonstrates the practical implementation of Saylor's philosophy. Since adopting a Bitcoin-centric strategy in August 2020, the company has delivered extraordinary returns, outperforming even Bitcoin itself through intelligent leverage. A slide in the presentation highlighted MicroStrategy's 2,785% growth during this period compared to other top performing stocks (the closest competitor was NVIDIA at 1,228%), positioning MicroStrategy as both a technology company and a financial innovator.

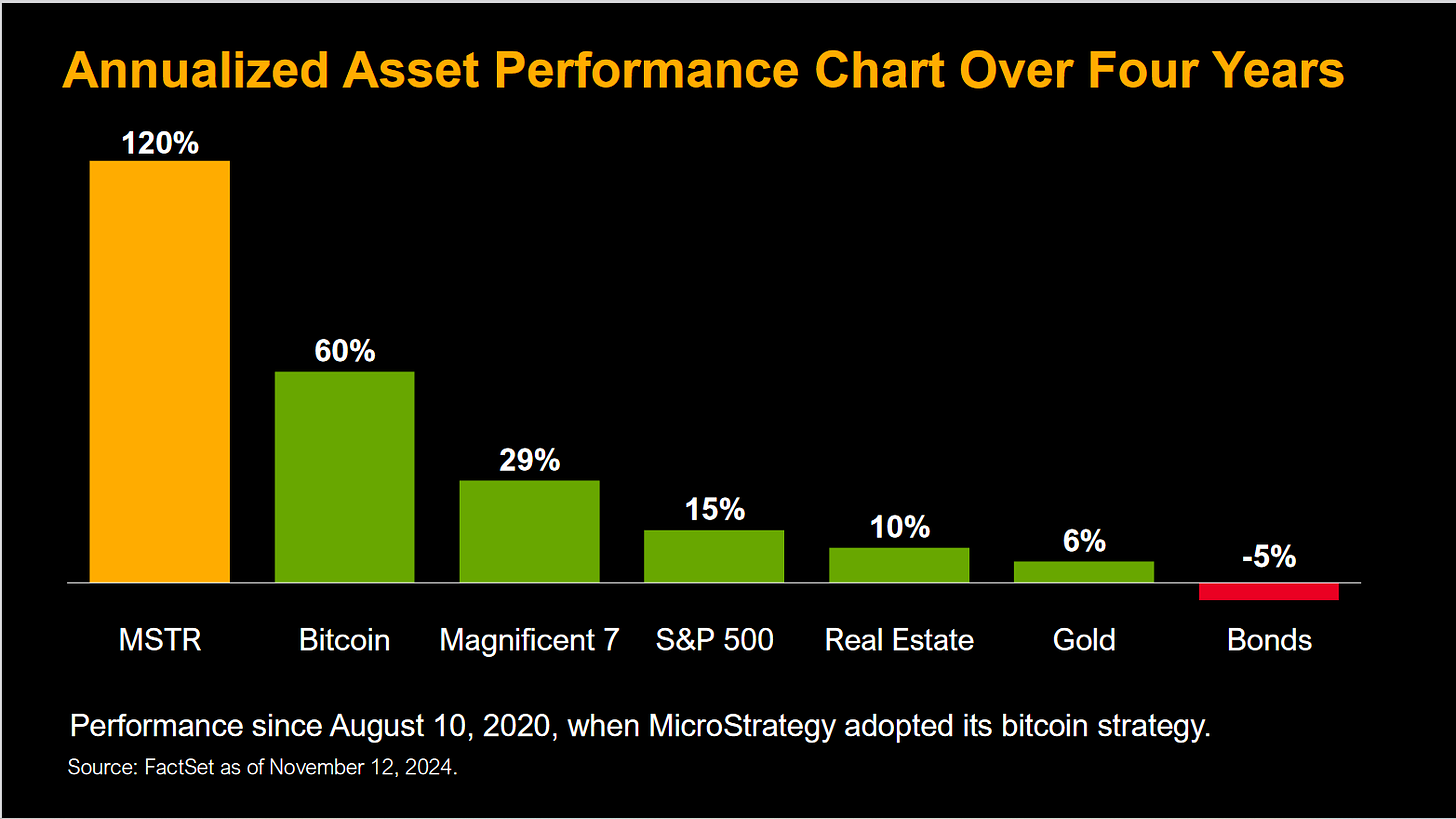

Also MicroStrategy’s annualized return of 120% for this period is higher than all other major asset classes (including Bitcoin's 60% appreciation).

The firm’s BTC principles reflect a bold, transparent approach to integrating Bitcoin with capital markets. Key principles include acquiring Bitcoin continually, maintaining a pristine balance sheet, and issuing innovative fixed-income securities backed by Bitcoin. This dual strategy of holding Bitcoin as a reserve asset while leveraging it for capital raises is a model that could redefine corporate treasury management globally.

The Red Wave: Political Winds Favor Bitcoin

Saylor explored the implications of the "Red Wave," referring to the Republican victories in 2024, including Donald Trump’s return to the presidency. Trump’s administration has signaled a policy pivot with several pro-Bitcoin initiatives, such as:

Repealing regulations like SAB 121, which hinder Bitcoin banking.

Accelerating Bitcoin ETF approvals and adoption.

Introducing favorable tax laws for digital assets.

Advocating for a U.S. Strategic Bitcoin Reserve.

These policies align with Saylor's vision of Bitcoin as a strategic asset that bolsters U.S. economic leadership while addressing deficits and maintaining the dollar’s global supremacy. He emphasized that these measures would catalyze institutional adoption, with pension funds, sovereign wealth funds, and governments increasingly viewing Bitcoin as a necessary diversification tool.

The Crypto Renaissance: Reshaping Capital Markets

Saylor coined the term "Crypto Renaissance" to describe the ongoing disruption of traditional capital markets by digital assets. His presentation outlined the inefficiencies plaguing legacy systems: high costs, regulatory barriers, and lack of innovation. In contrast, Bitcoin and digital tokens offer a streamlined, accessible, and globally interoperable framework for raising and transferring capital.

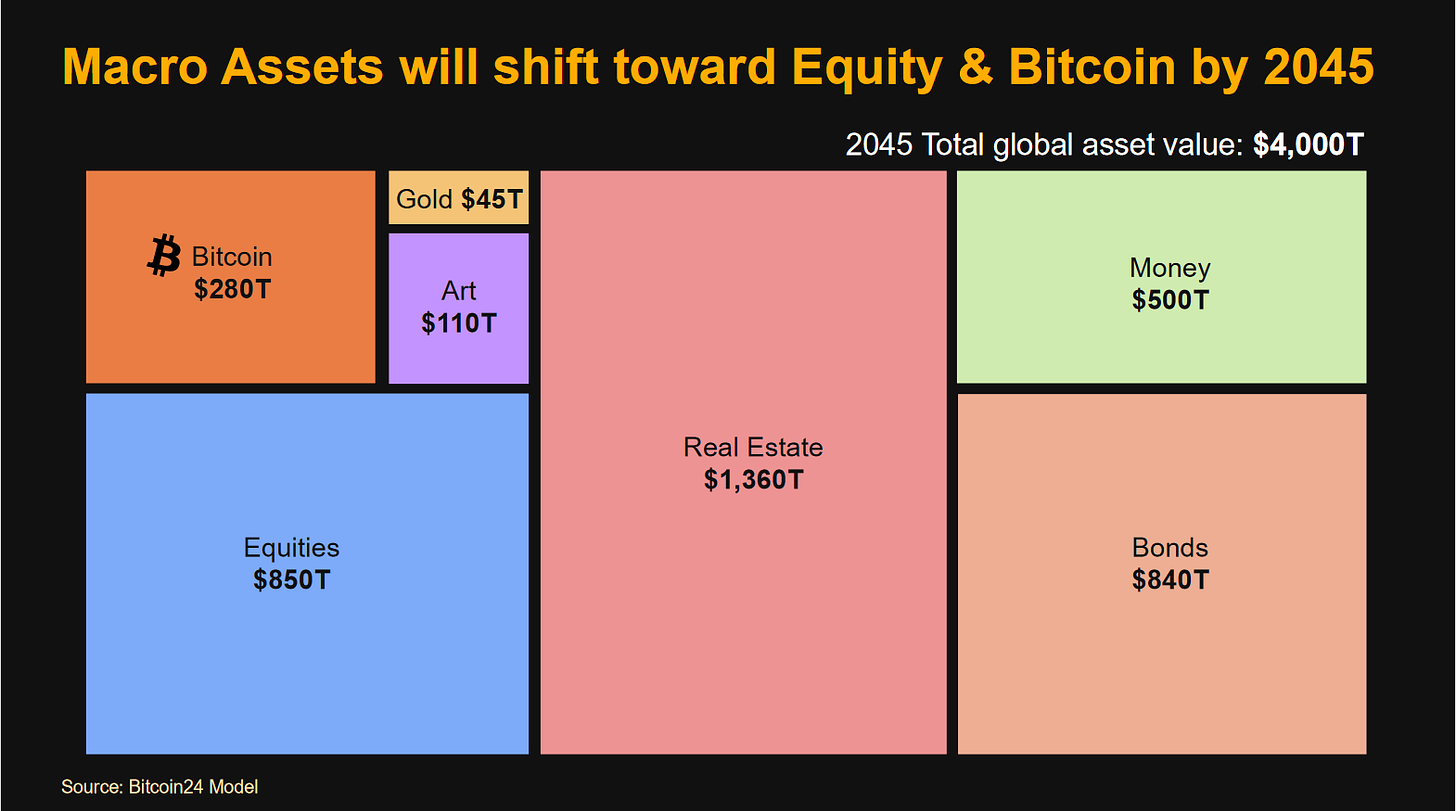

A standout slide forecasted a monumental shift in global assets by 2045, with Bitcoin’s market cap surging from $1.8 trillion today to $280 trillion. This projection underscores the transformative potential of Bitcoin as a superior store of value and global capital asset.

Conclusions and the Road Ahead

Saylor’s analysis presents a compelling case for Bitcoin’s ascension as the cornerstone of a new economic order. MicroStrategy’s success as a Bitcoin treasury company demonstrates the practicality of this vision, while the Red Wave promises a regulatory environment conducive to Bitcoin’s growth. The Crypto Renaissance, meanwhile, heralds the dawn of digital capital markets that prioritize efficiency, accessibility, and innovation.

The "Bright Orange Future" Saylor envisions is not without challenges, but it rests on solid foundations of technological superiority, regulatory momentum, and increasing adoption. Bitcoin’s attributes—scarcity, decentralization, and resilience—make it uniquely suited to thrive in an era of economic and political uncertainty.

A Bright Orange Future

As Saylor aptly noted, Bitcoin represents the "transformation of our capital from financial and physical assets to digital assets." This paradigm shift, bolstered by institutional adoption, regulatory support, and technological innovation, paints a future where Bitcoin serves as both a hedge against entropy and a beacon of prosperity. For companies, individuals, and nations, embracing Bitcoin is no longer an option but a strategic imperative. The crypto renaissance has begun, and with it comes the promise of a more equitable and innovative financial system.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.