Bitcoin is Simplicity

Why try to be the next Warren Buffett when all you have to do is save in the hardest money in the world?

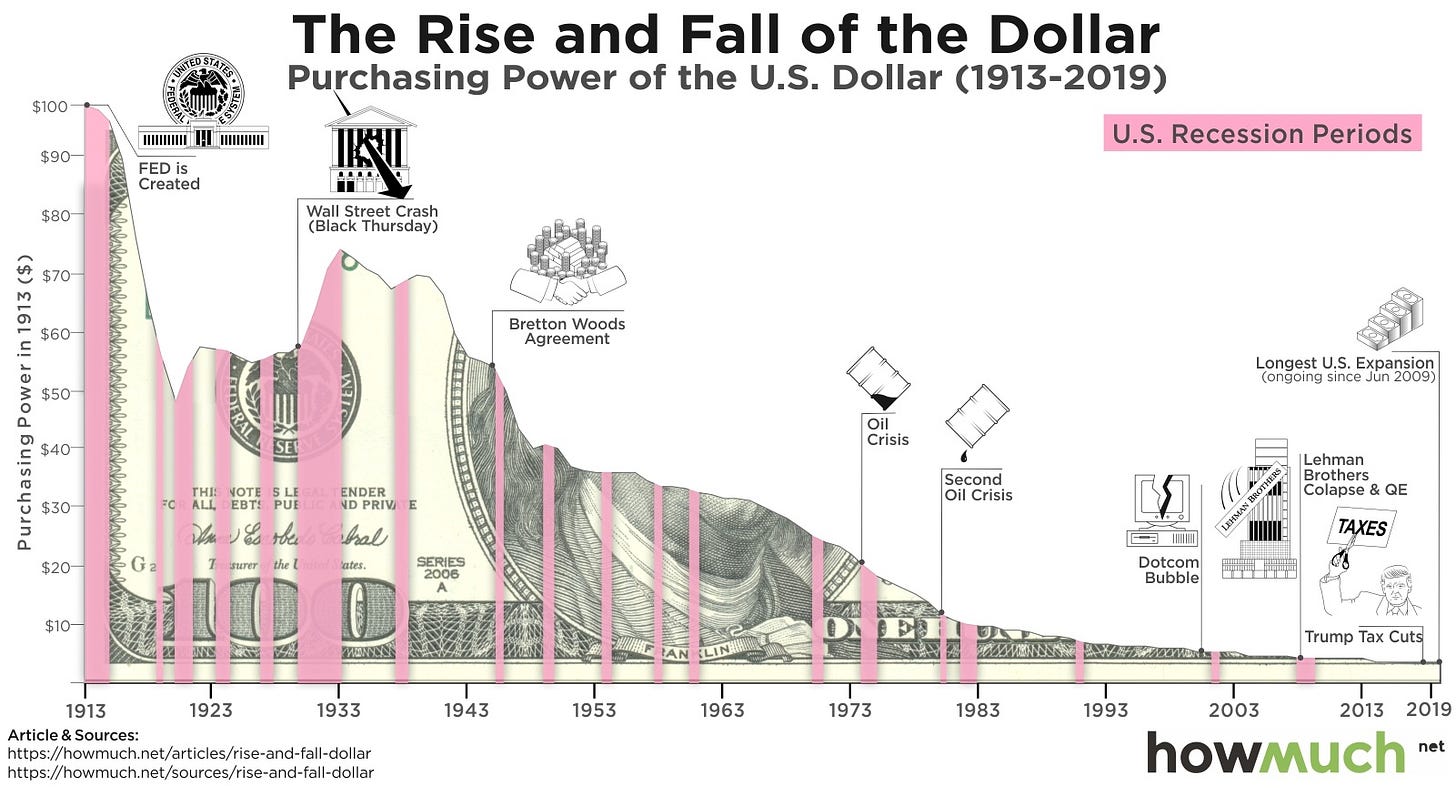

Our financial system is setup to force everyone to be investors, since there’s no other way to keep up with inflation, the effect of which is demonstrated nicely in the chart above. Over time, through every major economic crisis, the answer is the same - print more dollars, expand the money supply and provide more credit to stabilize an unstable system, which ultimately drives the purchasing power of the dollar inexorably lower. This will happen again in the aftermath of the recession that is now brewing for next year (currently the consensus view) - it’s all but inevitable and so obvious to anyone who is paying attention.

Meanwhile, you are told to save for retirement in a 401(k) or IRA and pick from a variety of investments, all of which result in huge fees paid to Wall Street who make money whether you do or not. Whether you are a good or bad investor, the government gets their share when you take out your distributions in retirement. This is really unfair to folks who don’t have all day to learn about markets and investing. You are either forced to spend a lot of time learning about the financial system and still fail to make a good return, or turn your money over to third parties that you have to trust and who earn fees whether your investments perform well or not. Even hedge funds have struggled to perform this year as reported by Institutional Investor here:

The ten largest multi-strategy funds lost 2.1 percent year-to-date, significantly better than the entire group's loss of 3.4 percent. The ten largest fixed-income funds lost an average of 1.5 percent in 2022, beating the entire group by 4 percentage points.

So far this year, the “average buy and hold investor” is getting crushed with the NASDAQ down 30%, the S&P 500 down 17% and the DJIA down 8%. Let’s not forget the supposedly “safe” longer dated US Treasury Bonds (TLT) down 26%. Wouldn’t it be nice if you didn’t have to worry about all that? Wouldn’t it be nice if you could just work hard, save your money and know that it’s going to be there for you to buy the same amount of stuff in retirement as it does today?

Let’s set aside the concept of investing for a moment, since I believe it should be your choice to take some of your savings and invest it for a greater return - it should not be a requirement for financial survival. Let’s focus instead on core long term savings. It’s always good to have some savings set aside. Let’s review what you are up against:

First of all, let’s look at the real rate of inflation (well over 15%) after ignoring methodological changes over time that have resulted in lower reported numbers:

Even if you just look at the government’s own numbers using their methodology (held constant to 1980), inflation is approaching 10%. Next, let’s take a look at the “best savings rates” available in the market (courtesy of Bankrate):

So, for a saver you can get at best 4% and you are dealing with between 10% and 15% inflation, so you are looking at a negative return on your savings cash of -6% to -11%. If you keep your money in a normal bank savings account, you get even less. I just checked and Wells Fargo is paying 0.01% and Chase is paying 0.02% on my accounts. It’s almost like they don’t want your money! Indeed, they don’t because they don’t need any deposits to lend against anymore (zero reserve requirement). No wonder people are feeling like they need to speculate in anything and everything!

Maybe you still want to keep some fiat cash on the side for more immediate needs, but there is a solution for long term savings and it’s Bitcoin, not “crypto.” All you have to do is buy Bitcoin regularly, put it into cold storage and forget about it. With a long enough time horizon, you don’t have to worry about the short term volatility as the fiat value of Bitcoin will naturally adjust for the increase in the quantity of fiat money that is printed by global governments over time. This money printing is the only solution they have to maintain the debt based fiat currency system we have in place today, as history has shown us. This system needs credit to be expanded and ever larger amounts of debt in order to function.

First, a quick reminder about why Bitcoin is such a remarkable financial innovation:

Absolutely scarce (21M maximum coins)

Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

The Bitcoin network operates independently of all legacy financial systems; it is the first digital global payments infrastructure

No counter party risk when self-custodied

Trustless; Bitcoin is not controlled by any person or group

A hedge against fiat currency debasement / collapse in the same way that gold is, but doesn’t have gold’s drawbacks of difficulty to validate, store, transfer and secure - especially in large amounts

Bitcoin’s value grows through 1) fiat currency debasement (highly probable to continue) and 2) network adoption (also highly probable). Network adoption is enhanced by layer two protocols like Lightning Network and the ability for an individual to be financially sovereign - indeed many people living in countries who face hyperinflation have already learned this lesson. Network adoption is also enhanced by the realization that Bitcoin held in self custody is immune to crypto exchange and hedge fund fraud / crashes / bankruptcies and is the primary reserve asset for a new digital monetary system. Here’s a long-term log chart of Bitcoin to put valuation in context:

When you reach retirement, or sooner if you need to tap your funds for some reason, you have a few options. You can use Bitcoin to directly pay for goods and services (in the future there will be many more vendors who will accept Bitcoin for payment especially as the Lightning network expands fast, cheap payments). You can also sell your Bitcoin for fiat currency and use that to make purchases, although that can trigger tax liabilities in many jurisdictions. Or you can take out a loan against your Bitcoin in fiat to make purchases. The advantage of a loan is that it is not taxable and can be paid off as part of your estate settlement process or sooner if desired. The key is to keep your borrowings very low relative to the value of your asset so you don’t have a margin call. In case you missed it, here’s a recent post that gives you a quick primer on some places to buy Bitcoin (hint: not on the shady “crypto” exchanges):

Bitcoin offers you the simplicity of long term savings again, just like people used to be able to do years ago when you earned interest on your savings that was higher than the rate of inflation. The “good old days.” You don’t have to try to be Warren Buffett, unless you want to. Honestly, it’s a bit unfair as the average person has a job, family and other commitments and unless you are able to spend all your free time studying markets, most individual investors are at an extreme disadvantage. Even then, it’s very difficult to generate a good return on your investments. The “average individual investor” is the exit liquidity for the “smart money,” buying at the top and selling at the bottom. It’s time to break that cycle and become financially sovereign and that starts with Bitcoin.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.