Bitcoin is savings technology, plain and simple. The technology behind it is complex, involving cryptography, miners that secure the network, nodes that store exact copies of the validated blockchain and all are part of a massive, resilient decentralized global computer network. Sounds a lot like the internet, doesn’t it? But the concept of having a scarce digital asset to deposit your savings into, that will protect it from currency debasement and allow you to send it to anyone you choose without the need for a “trusted” third party is extremely powerful. Bitcoin is truly a major breakthrough in computer science. With the recent development of the Bitcoin Lightning network and the many apps that can run on it (Strike and Muun Wallet are just a couple of examples) it’s possible to spend small amounts of Bitcoin anonymously with a very simple user interface that only requires you to scan a QR code. The continued development of these so-called “layer two” technologies will continue to increase Bitcoin’s utility as a decentralized global payment infrastructure.

These are the key attributes of Bitcoin:

Absolutely scarce (21M maximum coins)

Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

The Bitcoin network operates independently of all legacy financial systems; it is the first digital global payments infrastructure

No counter party risk when self-custodied

Trustless; Bitcoin is not controlled by any person or group

A hedge against fiat currency debasement / collapse in the same way that gold is, but doesn’t have gold’s drawbacks of difficulty to validate, store, transfer and secure - especially in large amounts

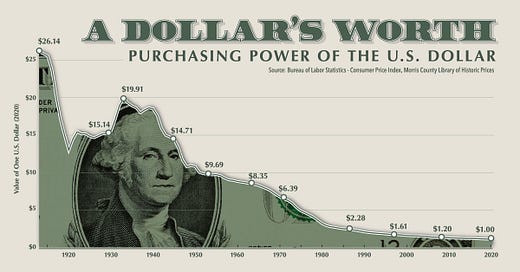

This is what happens to the purchasing power of the dollar, arguably the world’s strongest currency, over time:

The reason for the decline in the purchasing power of the dollar over time is simple: inflation. What causes inflation?

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output... A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society. Milton Friedman

What if there were a way to save that allowed you to preserve the value of your hard work so that you can buy the same amount of goods in five, ten, twenty years from now as you can today? That’s Bitcoin’s fundamental design.

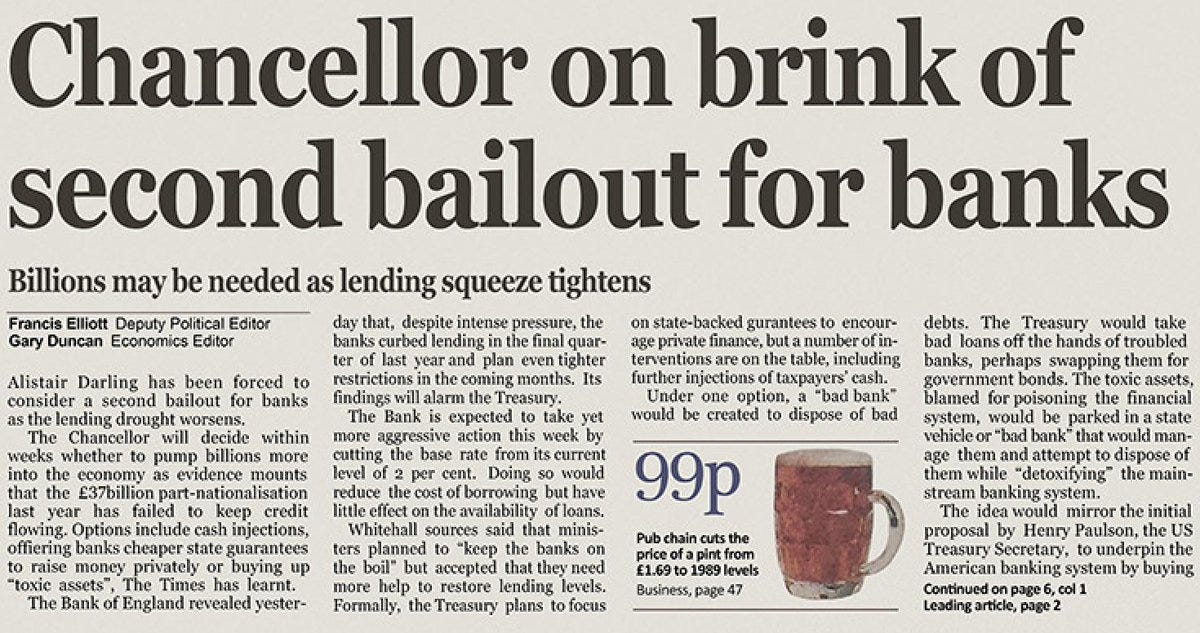

The first block of the Bitcoin blockchain, also called the Genesis Block, contains the following quote (I copied the related article below from the The Times from January 3, 2009 when the first Bitcoin block was mined):

Chancellor on Brink of Second Bailout for Banks

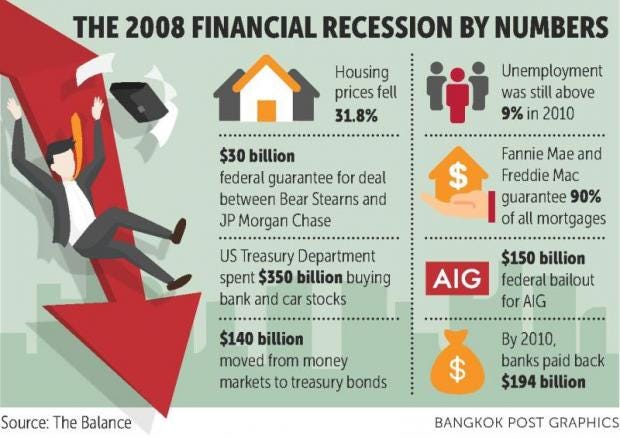

Bitcoin was born in the aftermath of the Global Financial Crisis, during which time the entire global financial system was on the verge of total collapse. The solution then, as it was before (Dot.Com crash - March 2000) and has it has been since (Covid Crisis - March 2020) was to flood the financial system with freshly printed dollars (and other currencies including the Euro). During the GFC, while some banks failed, the largest ones were shored-up with government borrowing and zero or near zero Federal Funds rates. Homeowners who were underwater and lost their jobs also lost their homes and a large chunk of their net worth, including stock portfolios which were all wrecked.

The Global Financial Crisis had a major impact on me personally and was the main reason why I started my personal finance blog in 2011. I wanted to find ways to protect my family from our obviously frail financial system and the constant series of ever greater booms and busts and also help others on this journey. That’s basically how I came up with the concept of the Financial Fortress - a way to setup your financial affairs so you can weather these storms with broad diversification and a decided tilt toward “real” assets, while maintaining a decent amount of liquidity. I didn’t know it then, but the problem isn’t finding a better investment, it’s the system itself and the ultimate hedge I was looking for was Bitcoin.

Here’s one way of looking at it in a chart created by Nik Bhatia and Joe Consorti (authors of The Bitcoin Layer):

Here is their accompanying commentary:

How does bitcoin perform against the expansion and contraction of broad money and credit? Exceptionally well. Here you can see bitcoin tracking with global money stock, indicating that purchasing bitcoin and holding it allows your wealth to expand and contract in tandem with the debasement of central bank-issued currencies. We will continue to monitor this relationship, especially as the Fed’s balance sheet declines over the next many months during QT2.

I started out in Bitcoin as an alternative investment idea in late 2017 and other than buying small amounts until early 2021, I didn’t do much research into Bitcoin and what it was all about. But in early 2021, I put in the time to understand the technology and its implications. I tapped into the Bitcoin community on Twitter and watched a lot of Michael Saylor videos. I was really influenced by Michael Saylor because he is an accomplished technology executive, extremely smart and used to be a Bitcoin skeptic. When he saw the unprecedented fiscal and monetary response to the Covid economic crisis in 2020 and the implications for returns on capital for all businesses (including his company Microstrategy), he realized the only way to stay ahead of the money printer was to pivot toward Bitcoin. He started by converting excess cash to Bitcoin. Of course, he didn’t stop there and has added to his Bitcoin stack through issuing various forms of debt, equity and continuing to use free cash flow to buy more Bitcoin. Some say he is crazy, others say he is a visionary. Most people can agree that he’s aggressive. The more I understood Bitcoin, the higher my conviction was to add to my position and continue to learn more. By May of 2021, I was looking to buy larger amounts on pullbacks and continued dollar cost averaging.

Something else happened as I got deeper into Bitcoin. I used to be very worried about financial independence, retirement and being able to support my family in the meantime, especially during economic downturns. Oddly enough, the more I learned about Bitcoin and the more I stacked, the less I worried about these things. Today, I know that I’m not going to have to worry about retirement or providing for my family, the recent sell-off of Bitcoin notwithstanding. That has been a tremendously liberating feeling.

Perhaps as I felt more confident in my financial situation, I was better able to sift through the “noise” of daily life. As I continued my Bitcoin education through reading books and listening to podcasts, something else happened. I became laser-focused on what matters the most to me - my family and closest friends, health and fitness, critical thinking and education. I also started thinking about deeper topics, like purpose and meaning and what sort of an impact I am to make in this life - my higher purpose. I asked questions that I have never asked myself before like “Why am I here?” “What is my purpose?” “What is God’s plan for me?” I have always been interested in education and mentoring throughout my career, but never in a formal teaching position. For me, providing financial education is critical and sorely lacking in our society. I started out with my blog and a few self-published books. About six months ago I launched a new podcast. Teaching people about Bitcoin has become even more important and has taken the financial education to another level. I have learned that while it’s important to understand how the legacy financial system works and also the macro investing environment, actually saving in Bitcoin is pretty simple.

Long story short, getting involved in Bitcoin has been transformational in my outlook on life. I have learned to enjoy every day, but also to plan ahead with a patient, low time preference view towards the future. Perhaps it is because I can strongly identify with the ethos of Bitcoin, which is sort of a digital embodiment of truth and transparency and that is something that I always aspire to whether in professional or personal situations. Maybe it’s because Bitcoin is independent of legacy systems and it’s tremendously resilient and I can relate to those aspects as well. Maybe it’s because Bitcoin provides hope to people all over the world as a place to store the fruits of their labor without fear of censorship, manipulation or debasement. Again, that’s something that is not hard to support.

Wherever you are on your Bitcoin journey, I hope this has been helpful to you. Bitcoin education is never ending and always takes you on different paths (some call this the “Bitcoin rabbit hole”) and you begin learning about Austrian Economics, Cryptography, the benefits of eating meat and Game Theory, among many other topics. Bitcoin is savings technology, so keep it simple and just save.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.