The concept of Bitcoin as "energy money" ties into a broader vision of monetary systems directly linked to tangible, universally valued resources—particularly energy. This idea isn't new and finds its roots in the thoughts and inventions of some of the 20th century's most innovative minds, such as Buckminster Fuller and Henry Ford, who envisioned a world where currency was backed by the intrinsic value of energy, thereby promoting greater abundance and reducing the likelihood of conflict. Eventually, these visionary ideas found resonance in the digital age through the creation of Bitcoin by the pseudonymous Satoshi Nakamoto.

Buckminster Fuller, a renowned 20th-century inventor, designer, and futurist, frequently discussed the potential of energy to serve as the basis for a new and equitable economic system. In his work, Fuller often emphasized the importance of utilizing technology and resources efficiently to support humanity's long-term survival and prosperity. Although direct quotations from Fuller specifically addressing "energy money" are not readily accessible, his principles can be inferred from his broader philosophy. Fuller believed in the law of conservation of energy applied to societal systems, suggesting that the efficient and equitable distribution of resources, including energy, could lead to a state of "energy abundance." This abundance, underpinned by renewable resources and innovative technologies, could theoretically eliminate scarcity, reduce conflict, and promote peace and prosperity on a global scale. There’s also this great YouTube video:

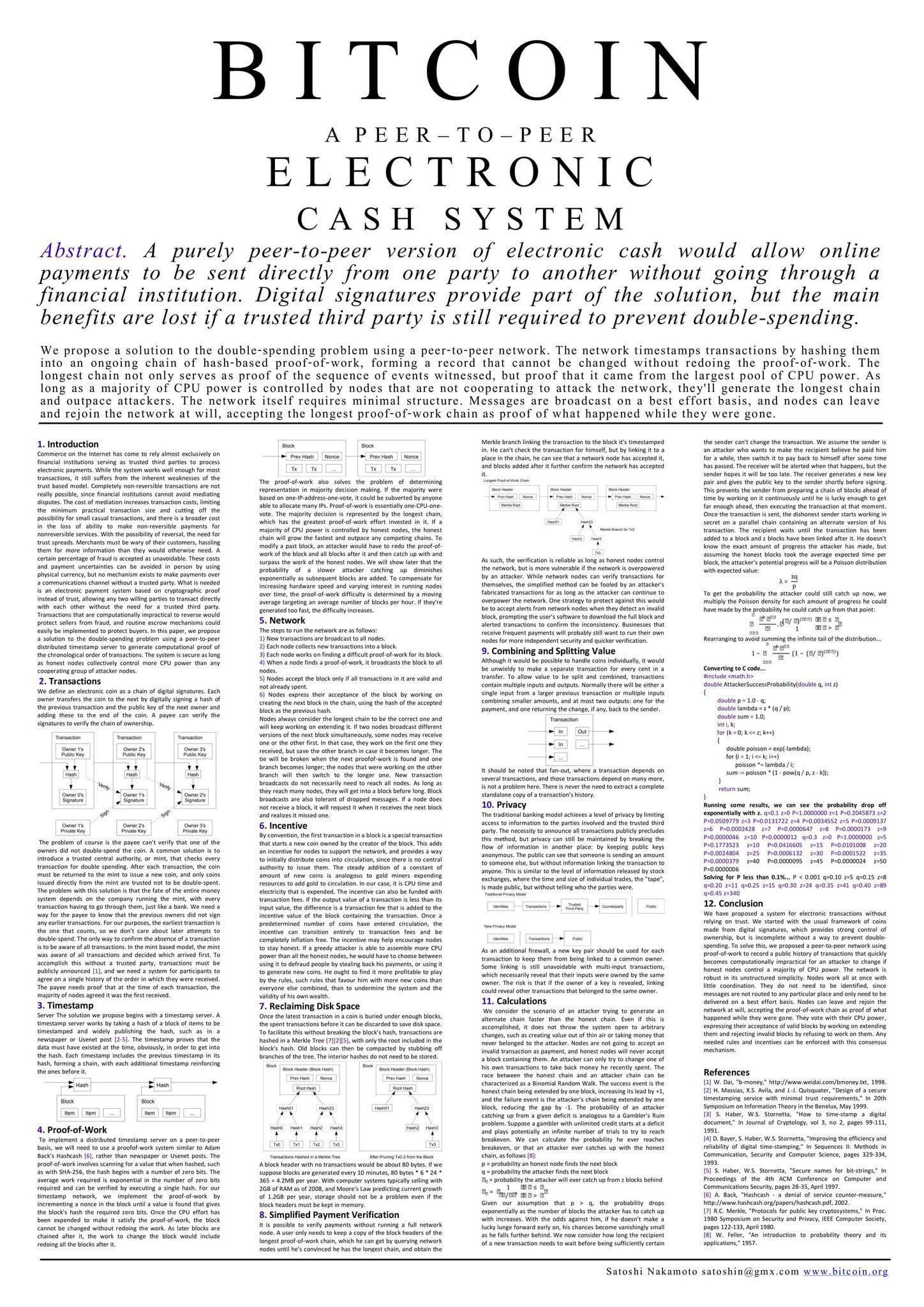

Similarly, industrialist Henry Ford had a vision for an "energy currency" that would be based on units of energy, which he believed could make wars obsolete by eliminating the gold standard and creating an economy based on real, tangible value. In 1921, Ford told The New York Tribune, "The essence of my idea is that the nation's currency shall be issued against the nation's wealth — the spent energy of the nation," suggesting a revolutionary shift from traditional monetary systems towards one grounded in the intrinsic value of energy produced and consumed. Ford's proposal aimed at stabilizing economic systems by tying the value of currency directly to the productivity and energy consumption of a nation, potentially leading to a more equitable and sustainable global economy.

These early 20th-century concepts were revolutionary, suggesting a radical shift from established economic paradigms towards systems that inherently value sustainability, efficiency, and equity. However, it wasn't until the advent of Bitcoin in 2009 that these ideas found a practical implementation in the modern world. Bitcoin, as conceptualized by Satoshi Nakamoto, is often described as "energy money" because its creation (mining) and transaction verification processes are energy-intensive, directly linking its existence and value to the expenditure of electrical power. One way this is expressed is the amount of “hash rate” or computing power securing the network, which has shown tremendous growth since inception:

This process anchors a digital asset to a significant real world cost. Bitcoin’s inherent scarcity, ability to be used peer to peer in a sovereign way and ability to be easily stored and transported at a low cost, combined with Bitcoin’s strong anchor to real world energy all create tremendous inherent value, contrary to what many critics argue (I’m talking to you Peter Schiff). Moreover, Bitcoin's decentralized nature and finite supply echo Fuller's and Ford's visions for an economic system that is more equitable, less prone to manipulation, and grounded in real, tangible assets.

Bitcoin represents a form of "energy money" not merely in its energy-intensive creation process but also in its potential to fulfill Fuller's and Ford's visions of an economy based on real value, which could lead to greater abundance and reduce the likelihood of conflicts. By creating a decentralized, secure, and finite currency that is directly tied to the expenditure of energy, Satoshi Nakamoto has brought us closer to an economic system that values real-world resources, efficiency, and equity, much like the systems envisioned by Fuller and Ford.

In summary, the ideas of Buckminster Fuller and Henry Ford, concerning energy as a basis for currency and economic prosperity, were indeed ahead of their time. However, through the advent of Bitcoin, Satoshi Nakamoto has provided a modern embodiment of these ideas, presenting a form of "energy money" that could potentially transform our global economic systems in line with these visionary concepts. Bitcoin represents a significant step towards realizing a more equitable and abundance-oriented world.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

![r/Bitcoin - Henry Ford’s [bitcoin] energy currency full article r/Bitcoin - Henry Ford’s [bitcoin] energy currency full article](https://substackcdn.com/image/fetch/$s_!SFn-!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ffae570-bbea-486f-b8ca-0919c62823f0_640x896.jpeg)

Taking this one take further I call it proof of time. The energy used to create a bitcoin will forever be stored in that bitcoin. In the United States, many places have negative prices for natural gas, miners are always looking for cheap energy, so miners will move in to close this energy arbitrage-a fight against entropy. We have historical accounts for this-gold and silver-which is way the where so highly prize-because of the energy or work needed to obtain the resources for use. We now have a situation where we-the United States-can take the most important energy molecules-natural gas-and forever lock in negative prices. Proof of time.