If you’ve been following the news lately, we are hearing more and more about corporate and institutional Bitcoin adoption now that Bitcoin ETF’s are readily available to investors. This really seems to be taking on some momentum and is likely providing quite a bit of price support to Bitcoin.

Here are the top 10 institutional holders of Bitcoin ETFs based on recent SEC Form 13F filings for Q1 2024:

Millennium Management: Holds approximately $1.9 billion in various Bitcoin ETFs, including $844 million in BlackRock’s iShares Bitcoin Trust (IBIT) and $800 million in Fidelity's Wise Origin Bitcoin Trust (FBTC).

Yong Rong: Owns over 1 million shares of BlackRock’s iShares Bitcoin Trust (IBIT), making it one of the largest holders.

Bracebridge Capital: Holds a total of $434 million in Bitcoin ETFs, including $307.2 million in Ark Invest's ARKB, $26.5 million in Grayscale's Bitcoin Trust (GBTC), and $100.6 million in BlackRock's IBIT.

Boothbay Fund Management: Holds about $376 million in Bitcoin ETFs, including $149.8 million in BlackRock’s IBIT, $105.5 million in Fidelity’s FBTC, $69.5 million in Grayscale’s GBTC, and $52.3 million in Bitwise’s BITB.

Morgan Stanley: Holds over $271 million in Bitcoin ETFs, with the majority in Grayscale's GBTC.

Pine Ridge Advisers: Holds $205 million in Bitcoin ETFs, including $93.4 million in Fidelity’s FBTC and $83.2 million in BlackRock’s IBIT.

Aristeia Capital: Invested $163.5 million in BlackRock’s IBIT in Q1 2024.

State of Wisconsin Investment Board (SWIB): Invested $64 million in Grayscale’s Bitcoin Trust ETF and $99.2 million in BlackRock’s IBIT, totaling over $160 million.

BNY Mellon: Holds shares in Grayscale’s GBTC and BlackRock’s IBIT, though specific amounts were not disclosed. It is notable for being one of the oldest and largest financial institutions to invest in Bitcoin ETFs.

Bank of Montreal (BMO): Holds shares in Fidelity’s FBTC, Franklin Templeton’s EZBC, BlackRock’s IBIT, and Grayscale’s GBTC, demonstrating significant investment in Bitcoin ETFs among Canadian banks.

These holdings highlight the growing institutional interest and investment in Bitcoin ETFs, reflecting increased confidence in the digital asset's potential. Of particular interest is the State of Wisconsin Investment Board, which manages $156 billion in assets for the Wisconsin Retirement System, the State Investment Fund and other trust funds. Getting a Bitcoin allocation approved for investment allocation is a difficult process to get through for government entities. It seems like it’s only a matter of time before more public pension funds across the US start allocating to Bitcoin.

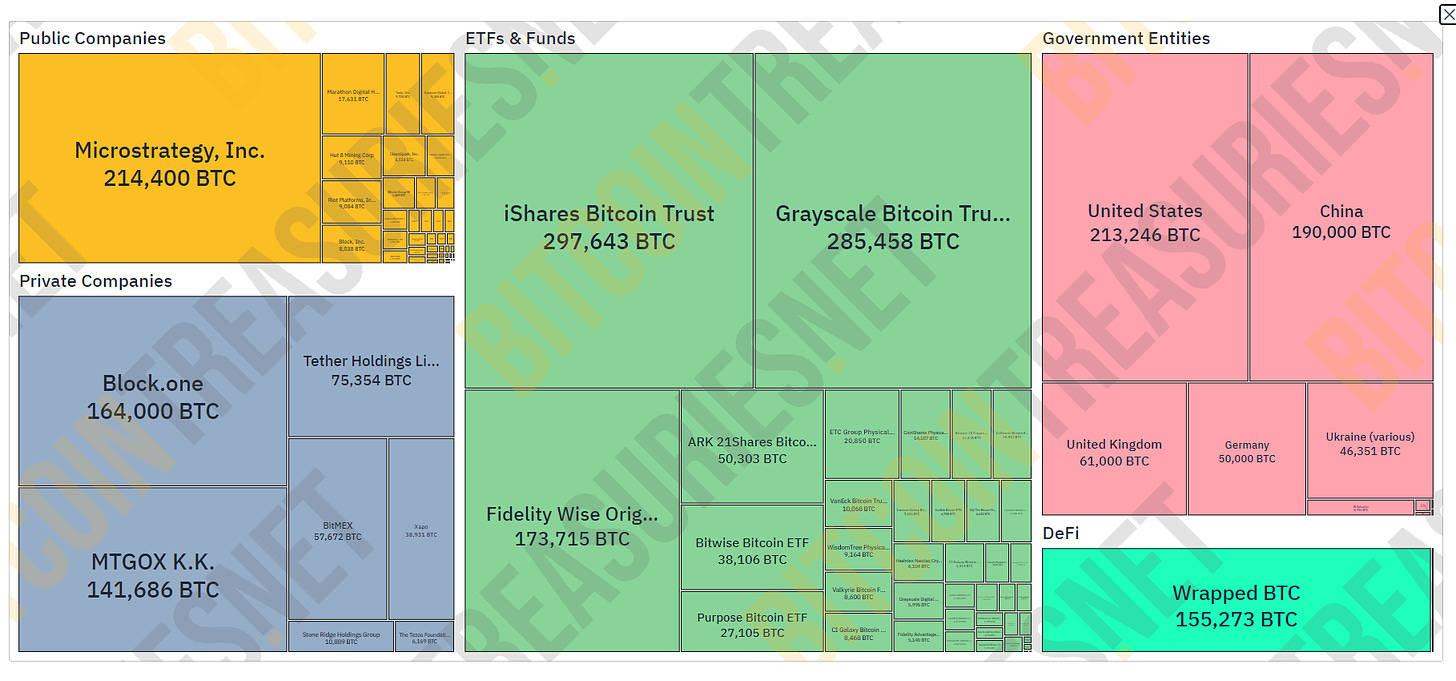

Below is a snapshot of overall Bitcoin holdings from BitcoinTreasuries.net. ETF’s continue to accumulate in size (Blackrock now holds more Bitcoin than Grayscale for the first time). Microstrategy continues to lead the public companies, while Block.one and Mt. Gox lead the private companies. There are also several countries that own Bitcoin now, including a few new ones that haven’t been on here before like the UK and Germany.

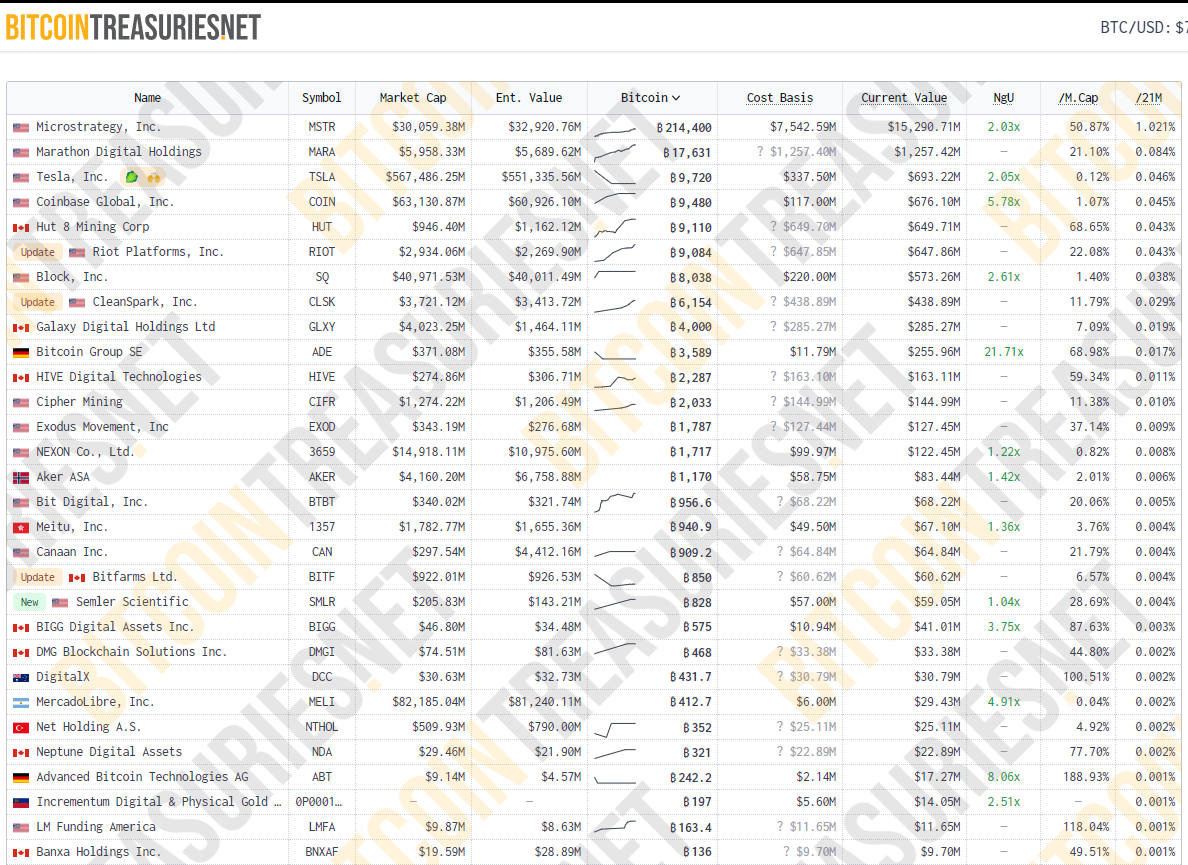

The list of companies holding Bitcoin on their balance sheet now is pretty amazing and continues to grow (below are the “Top 30”):

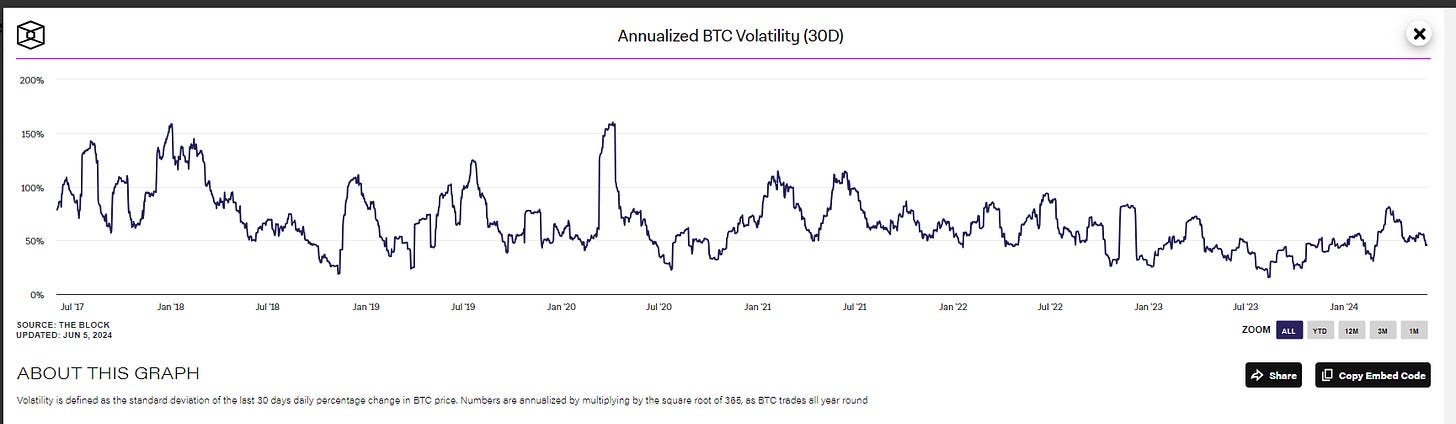

The recent change in accounting guidance in the United States will make it less of a penalty owning Bitcoin, since Companies will be able to reflect all changes in fair market value (up and down) on the balance sheet, where the old rules required write-downs when fair value dropped below cost, without the ability to write up if fair value recovers. As the Bitcoin market matures and volatility declines, it may also prompt more corporate balance sheet adoption. It’s hard to see on the chart below, but over time Bitcoin’s volatility seems to be moderating.

Bitcoin’s price has been trading in a wide range between $60,000 and $70,000 for a few months now, puzzling many people watching the market and giving rise to many theories: miners are selling to “keep the lights on” post-halving, “basis trade” - buying spot Bitcoin and selling futures contracts and pocketing the premium, highly leveraged versions of basis trade, etc. Bitcoin’s price will do what it will do and most analysts generally agree we are still in the bull market. Regardless of short term price action, ongoing adoption of Bitcoin bodes well for the future.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

Retail investors first, institutions second, Central Banks last.