Bitcoin Infinite Banking

When Nelson Nash Meets Sound Money

For years, I’ve written about Bitcoin as savings, insurance, and estate planning infrastructure. Recently, a conversation made something click even more clearly.

If you understand Infinite Banking and you understand Bitcoin, a new structure emerges — one that feels almost too elegant to be real.

It isn’t magic.

It’s just sound money finally meeting a sound system.

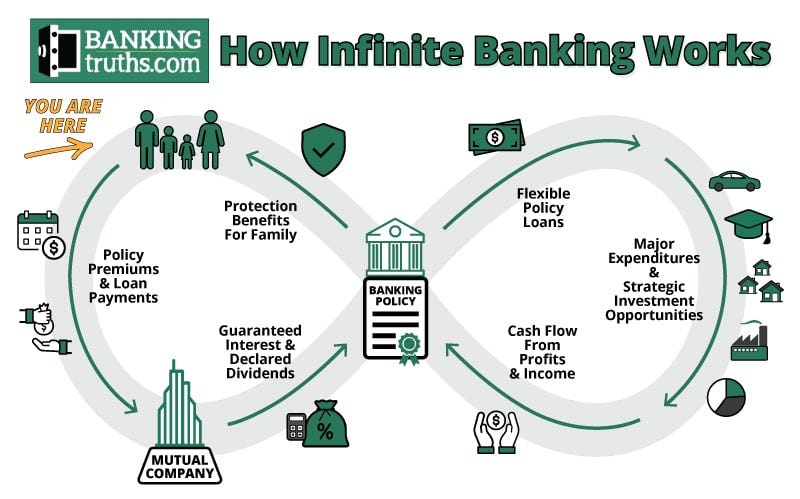

A Quick Refresher: Infinite Banking (IBC)

The Infinite Banking Concept, developed by Nelson Nash, was never about chasing returns.

It was about control.

At its core, IBC teaches that individuals should:

Own the banking function in their lives

Store capital in a stable, liquid base

Borrow against their capital instead of selling it

Optimize for long-term certainty, not short-term yield

Traditionally, this was implemented using whole life insurance as the capital base.

And for decades, it worked — within the constraints of fiat money.

The Problem Nelson Nash Couldn’t Solve

Nelson Nash identified the problem with banks.

He did not have access to sound money.

Whole life insurance solved volatility and liquidity — but not monetary debasement.

Cash value grows, but it grows in units designed to lose purchasing power.

So Infinite Banking worked structurally, but not monetarily.

Bitcoin changes that.

Bitcoin Completes the Infinite Banking Equation

Bitcoin fixes the one thing traditional IBC could never fix:

The unit of account itself.

Instead of building a personal banking system on top of inflating fiat, Bitcoin allows Infinite Banking to operate on:

A fixed-supply monetary base

A bearer asset with no counterparty risk

A savings vehicle that rewards patience instead of punishing it

This is where things get truly interesting.

4

Bitcoin-Denominated Infinite Banking (Conceptually)

Think of this not as a product, but as a framework:

Traditional Infinite Banking

Capital base: fiat

Growth: slow, capped, predictable

Inflation risk: unavoidable

Loans: fiat against fiat

Upside: limited

Bitcoin Infinite Banking

Capital base: Bitcoin

Growth: asymmetric

Inflation risk: removed

Loans: Bitcoin-backed

Upside: preserved for heirs

You still get:

Liquidity without liquidation

Access to capital without selling

Long-term planning clarity

Estate efficiency

But now the system is built on sound money.

Why This Feels Like a “Magic Solution”

Because it quietly solves four hard problems at once.

1. Long-Term Capital Storage

Bitcoin replaces fiat as the base layer of savings.

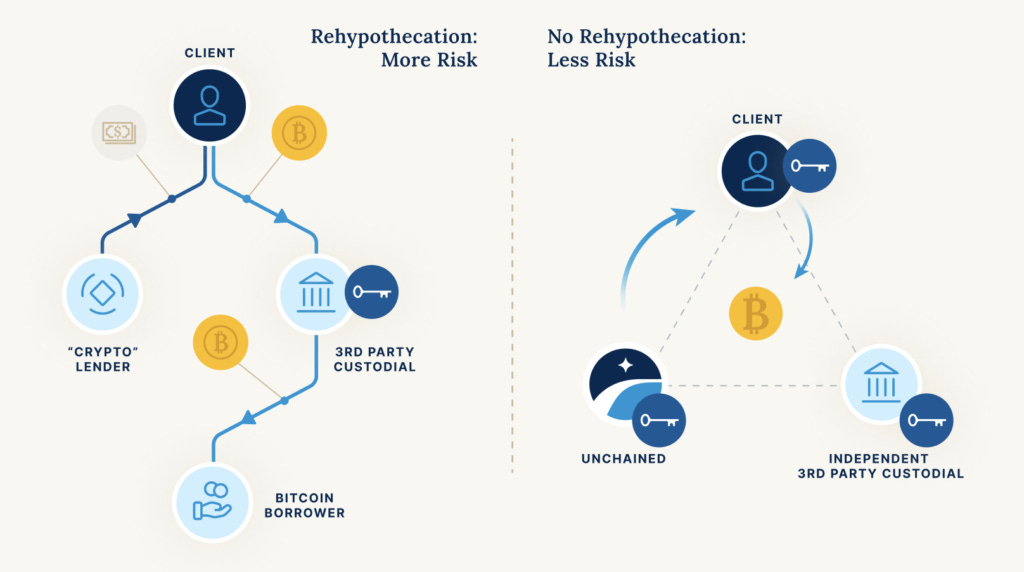

2. Liquidity Without Taxable Sales

Loans — whether policy-based or Bitcoin-collateralized — allow spending without triggering capital gains.

3. Intergenerational Transfer

Insurance wrappers and trust structures allow Bitcoin (or Bitcoin value) to pass cleanly to heirs.

4. Time Preference Alignment

This system discourages speculation and encourages patience — exactly how Bitcoiners already think.

How This Complements Bitcoin-Denominated Life Insurance

In the previous essay, we explored Bitcoin-denominated life insurance as:

A tax-efficient wrapper

A way to remove Bitcoin from the taxable estate

A powerful inheritance tool

Bitcoin Infinite Banking builds on top of that:

Life insurance becomes the banking rail

Bitcoin becomes the capital base

Loans become voluntary, controlled leverage

Heirs receive structure, not chaos

Instead of just passing wealth forward, you pass forward a system.

Important: This Is Not Yield Hunting

This is not:

A yield product

A trading strategy

A shortcut

It is:

Capital formation

Risk management

Intergenerational thinking

It’s slow by design.

And that’s the point.

Why This Resonates So Strongly With Bitcoiners

Bitcoin already teaches us to:

Save before spending

Delay gratification

Avoid unnecessary risk

Think in decades, not quarters

Infinite Banking teaches the same lessons.

Bitcoin just makes them honest.

Final Thoughts

Nelson Nash showed us how to own the banking function.

Bitcoin gives us a monetary foundation worthy of that responsibility.

Put together, they form something powerful:

A personal banking system built on sound money, designed to outlive you.

This isn’t about chasing returns.

It’s about building something that lasts.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2025.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Also, check out my books:

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

BTC + IBC = natural fit.

Worth the work to understand and implement both. Infinite benefits.