Read a gold bug substack post recently that was loaded with FUD here and felt like it might be appropriate to respond.

Here’s a couple of items from the post:

A few thoughts:

1. Built-in Obsolescence and Newer Innovations

Bitcoin’s design is intentionally simple and robust, focusing on security, decentralization, and scarcity. Unlike rapidly evolving technologies, Bitcoin’s core protocol evolves slowly, prioritizing stability over novelty. Newer cryptocurrencies may add features, but Bitcoin’s decentralization, security, and established network effect make it uniquely resilient and trusted as a store of value.

2. Quantum Computing Threat

Quantum computing poses a theoretical risk to all current cryptographic systems, not just Bitcoin. However, quantum-resistant cryptographic techniques are already being developed. If quantum computing advances to the point where it can break Bitcoin’s cryptography, the network can adapt with upgraded cryptographic standards. Bitcoin’s development community is prepared to address such threats, and updates are possible through soft forks.

3. Susceptibility to Hacking and Seizure

Bitcoin’s decentralized nature means it’s highly secure against hacking when following best practices, like self-custody and proper security. Its transparency ensures its immutability, but individuals must practice secure storage. With offline hardware wallets, Bitcoin owners can protect their assets from seizure or compromise, unlike bank accounts, which can be frozen at any time.

4. Dependence on Modern Infrastructure

While Bitcoin transactions require internet access, innovative solutions like Blockstream’s satellite and mesh networks make it possible to access Bitcoin without traditional internet. In power or internet outages, assets like gold would also face accessibility challenges, especially in secure storage. Bitcoin’s flexibility allows for offline storage and transfer, potentially making it more resilient than physical assets in some scenarios.

5. Public Ledger and Privacy Concerns

While Bitcoin’s ledger is public, numerous privacy-enhancing tools like CoinJoin and the Lightning Network improve privacy. Privacy concerns are real but manageable with these tools, which enhance Bitcoin’s use as private money. Bitcoin’s transparent ledger also strengthens its integrity, as the network’s openness makes manipulation or double-spending extremely difficult.

6. NSA Patent and Backdoor Rumors

There is no credible evidence of a Bitcoin backdoor, and Bitcoin’s code is open source, allowing anyone to verify and review it for vulnerabilities. Satoshi Nakamoto’s anonymity has fueled speculation, but the Bitcoin network’s decentralized, open nature assures users of its security independent of its creator’s identity.

7. Comparing Bitcoin’s History to Gold and Silver

Bitcoin’s “young” age doesn’t diminish its significance; rather, it has proven resilient in the face of regulatory pressures, cyber attacks, and economic shifts. Gold and silver have centuries of history, but Bitcoin’s rapid adoption and performance over the past 15 years demonstrate its robustness in a modern, digital context. Bitcoin’s scarcity and durability offer similar characteristics that made gold valuable.

8. Volatility Concerns

Bitcoin’s price volatility reflects its status as an emerging asset and relatively small market cap compared to other global assets. As adoption grows, volatility has decreased, and many investors accept this as part of Bitcoin’s price discovery process. Bitcoin’s volatility is also increasingly viewed as a short-term phenomenon, with its long-term value growing as adoption and awareness increase.

9. Reliance on Complex Technology

Bitcoin’s core protocol is intentionally simple, with the complexity being mainly in hardware wallets or layer-two technologies that are optional. Like any currency, Bitcoin requires infrastructure, but its open-source, community-driven nature fosters resilience and adaptability, even in scenarios of technological disruption.

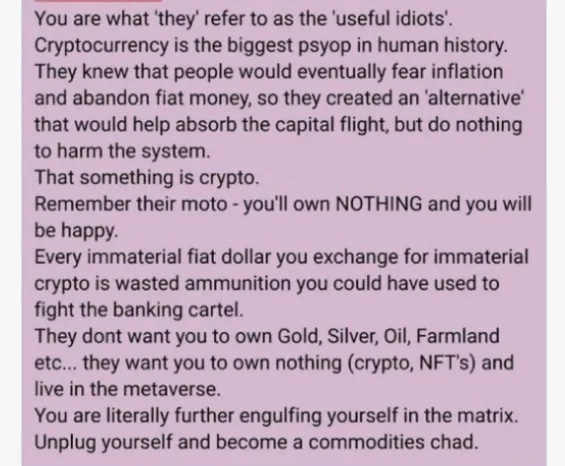

10. Bitcoin as a “Psychological Operation”

Bitcoin was created as a response to centralized financial power, and its decentralized design resists manipulation by any single entity, including government agencies. Bitcoin’s open network empowers individuals by enabling personal financial sovereignty, and its adoption spans individuals and institutions seeking a hedge against centralized economic systems.

11. Promoting Digital Over Physical Assets

Bitcoin offers individuals a modern alternative to physical assets, complementing rather than replacing commodities like gold and silver. Bitcoin enables self-custody without the need for physical storage and transportation, offering advantages like divisibility and portability that physical assets lack. Bitcoin’s promise of financial autonomy aligns with the values of many seeking decentralized alternatives to centralized financial systems.

Conclusion

While the post raises several common FUD points, it overlooks Bitcoin’s unique features: decentralized governance, censorship resistance, and growing acceptance worldwide. Bitcoin has proven resilient over 15 years and has a robust, adaptable community that addresses potential challenges, from technological advances to privacy enhancements. As a store of value, it complements rather than replaces physical assets, offering a digital solution to financial autonomy in today’s increasingly digital world.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

Peter Schiff?

He has ALWAYS been wrong and cannot figure out why he still has so many followers and likes. He's the living example, the perfect incarnation of the "unuseful idiot".

Whoever doesn't get the meaning of debasement and debunking is another unuseful idiot. Just look at the monster national debts of the US, Japan and Italy. They are unsubstainable.

The debunking continue to hide the rampant currency debasement