In the ever-evolving landscape of finance and technology, Bitcoin has emerged as a transcendent force, embodying the essence of innovation, resilience, and decentralization. Drawing upon the metaphor-rich wisdom of Michael Saylor, a prominent advocate for Bitcoin's significance, this post explores why Bitcoin stands as a remarkable financial innovation. Each metaphor, resonating from Saylor's insights, unveils the unparalleled attributes that set Bitcoin apart from conventional assets.

Bitcoin as Pristine Real Estate in Cyberspace

Comparing Bitcoin to pristine real estate in cyberspace echoes the potential that this digital currency offers. Much like raw land in Manhattan centuries ago, Bitcoin presents an uncharted territory rich with possibilities. Yet, its supremacy lies in its frictionless nature. Unlike real estate, Bitcoin can be instantaneously transferred across the globe at minimal cost, transcending borders and time zones, unlike real estate which is anchored to the physical world. Bitcoin is arguably more pristine collateral for lenders than real estate because of its price transparency, global liquidity and speed at which a loan can be originated (minutes versus weeks/months). Moreover, while real estate faces the burden of taxation and potential confiscation, Bitcoin remains immune to governmental intervention, safeguarding one's wealth with unparalleled resilience.

Bitcoin as a Fire in Cyberspace

Saylor's metaphor of Bitcoin as a fire raging in cyberspace mirrors the uncontainable transformative power of this cryptocurrency on the financial system and ultimately society. Just as fire spreads relentlessly, Bitcoin's influence transcends traditional financial systems since its adoption is purely driven by market forces, recognizing Bitcoin as “better money.” Its decentralized nature ensures that no central authority can extinguish its flame, granting financial sovereignty to its holders. This stark contrast to fiat currencies tethered to central banks underscores Bitcoin's resilience against inflation and arbitrary manipulation.

Bitcoin as a Swarm of Cyber Hornets

Portraying Bitcoin as a swarm of cyber hornets evokes an image of collective strength and resistance. Like hornets defending their hive, Bitcoin enthusiasts form a resilient network, guarding against external threats by holding their coins in self-custody, running a node or even doing some Bitcoin mining at home. All of these individual acts by millions of global users strengthens the network. This metaphor encapsulates Bitcoin's security mechanisms, grounded in its decentralized timechain, encryption and proof of work technology. Unlike traditional banking systems susceptible to breaches by bad actors (and of course theft through creation of money out of thin air - inflation), Bitcoin's hive-like structure ensures data integrity, impervious to malicious attacks.

Bitcoin as Digital Gold

The comparison of Bitcoin to digital gold encapsulates its store-of-value attributes. Much like gold, Bitcoin is finite and immune to manipulation by central authorities. However, Bitcoin outshines gold in terms of divisibility, portability and also in its absolute scarcity. Fractional ownership of Bitcoin enables microtransactions, democratizing financial access. Additionally, Bitcoin's digital nature enables instantaneous global transactions, transcending the logistical challenges associated with physical gold. Bitcoin is easier to store, easier to move, weightless and traded globally 24/7/365. It is truly gold for a digital age.

Bitcoin as a Monetary Network

Saylor's portrayal of Bitcoin as a monetary network underscores its transformative impact on the financial landscape. Bitcoin operates as a decentralized ledger, creating a self-sustaining economy free from intermediaries. This global network effect empowers individuals to directly control their wealth and engage in peer-to-peer transactions without intermediaries 24/7/365 at very low transaction costs. In contrast, traditional banking systems involve cumbersome processes and intermediaries that are also not open for business all the time, ask a lot of questions and rent-seek, thereby diluting the financial autonomy of individuals. Here’s a funny take on what going to a bank in Australia is like today.

Bitcoin as a Digital Energy Network

Comparing Bitcoin to a digital energy network has multiple connotations. The first law of thermodynamics says that energy cannot be created or destroyed, only transformed from one form to another. When you save in fiat currency, you are pouring your life’s energy into something that will be taken from you (transformed) in the form of inflation and given to others who benefit from the inflation - this is the worst form of taxation. When you save in Bitcoin, you are pouring your life’s energy into a scarce digital asset that cannot be transformed without your permission. This asset will be safeguarded across time and space, protecting its value not only for your lifetime, but also your future generations. In this way, Bitcoin can act as a portal to transfer energy across time. The proof of work consensus mechanism of Bitcoin requires large amounts of energy and computing (hash) power to mine and confirm transactions and this energy, along with Bitcoin’s decentralization, works to defend the network. Buckminster Fuller said it best in this clip, which is really stunning to me given how long ago this was filmed - Wealth is Energy. He was way ahead of his time.

Bitcoin as a Swiss Bank in Your Pocket

Saylor's metaphor of Bitcoin as a Swiss bank in your pocket encapsulates its ability to democratize highly private banking. Swiss banks are known historically for their privacy which is enshrined in Switzerland’s banking secrecy law, but like most things in clown world today, even that is changing. Unlike traditional Swiss banks who are selective about their clientele (must be very wealthy as a starting point), Bitcoin offers financial inclusivity to individuals across the globe no matter how much or little they have to convert to Bitcoin. Bitcoin holders become their own custodians, eliminating the need for intermediaries and granting unparalleled control over their assets. Unlike a Swiss Bank, there’s no counterparty risk with Bitcoin and the costs of custody and transfer are very minimal. There are also no rent-seeking bank fees involved in Bitcoin. You just have to pay a market rate of sats to transfer coins on chain, but you also have the Lightning Network now which is a way cheaper, more private and faster way to make payments. Finally and most importantly, Bitcoin’s native privacy is a feature of the system and can be enhanced using tools such as CoinJoins, privacy-enhancing wallets, acquiring non-KYC bitcoin, etc.

Bitcoin as a Digital Monument to Truth

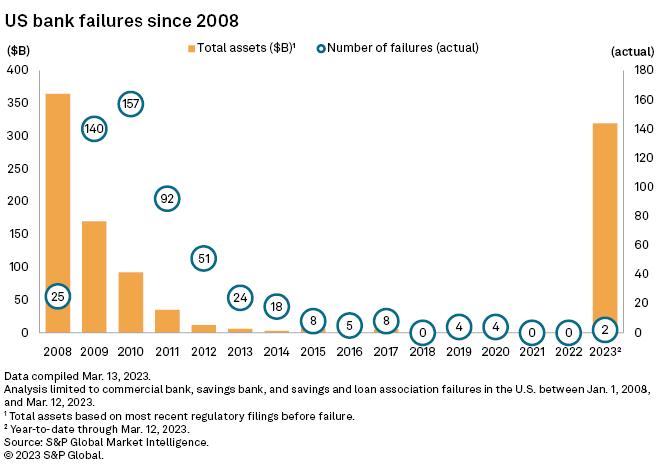

The portrayal of Bitcoin as a digital monument to truth captures its transparency and immutability. Bitcoin's blockchain serves as an incorruptible ledger, chronicling every transaction on a timechain, in a totally transparent public domain. In many ways, Bitcoin embodies absolute truth in digital form. This stands in stark contrast to opaque banking / financial systems, which are vulnerable to manipulation and fraud. Beyond that, these institutions are also susceptible to collapse based on their business model of no reserve (formerly fractional reserve) banking, which allows banks to loan unlimited amounts, unconstrained by the amount of reserves they hold.

“Safe and sound banking” is perhaps the biggest lie ever told. Bitcoin's encoded commitment to truth resonates as a bulwark against systemic corruption.

Bitcoin as a Network of Time

Saylor's metaphor of Bitcoin as a network of time underscores its timelessness and endurance. Bitcoin transcends temporal constraints, operating seamlessly across generations. Unlike fiat currencies prone to devaluation over time, Bitcoin's scarcity ensures its value appreciation, making it a generational asset with enduring significance. In another more important sense, the Bitcoin ledger represents a “time chain,” or an immutable sequential transaction history, as Satoshi originally wrote:

Nodes collect new transactions into a block, hash them into a hash tree, and scan through nonce values to make the block’s hash satisfy proof-of-work

requirements. When they solve the proof-of-work, they broadcast the block

to everyone and the block is added to the timechain. The first transaction

in the block is a special one that creates a new coin owned by the creator of the block. — Satoshi Nakamoto, [bitcoin-nov08-tgz/main.h:719–724]

Bitcoin as a Monetary Black Hole

The portrayal of Bitcoin as a monetary black hole speaks to its deflationary nature and unparalleled value retention. In contrast to fiat currencies subject to inflationary pressures, Bitcoin engenders a sense of urgency to invest, fostering a culture of saving and prudent financial planning. Like a Black Hole devours all matter and even light that comes near it, Bitcoin as the superior monetary asset will absorb the energy / monetary premium of fiat currencies and other assets such as gold, real estate, stocks, art, etc. that have become “monetary substitutes,” due to inflationary fiat currency regimes.

Conclusion: The Imperative of Embracing Bitcoin's Promise

In the tapestry of financial innovation, Bitcoin emerges as a symphony of metaphorical brilliance, redefining the contours of modern finance. As Michael Saylor's metaphors illuminate, Bitcoin's superiority over traditional assets is a testament to its unique attributes – decentralization, resilience, transparency, and efficiency. Embracing Bitcoin is not merely an option but an imperative in an era of transformative change. Learning about Bitcoin and strategically incorporating it into one's financial plan is an act of prudence, granting access to a new paradigm of financial empowerment and autonomy. As the future unfolds, Bitcoin stands poised to rewrite the rules of finance and empower generations to come.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated: