Before You Sell Commodities, Take a Deep Breath

I have been reading a lot lately about all the "dumb money" that bought silver, gold and oil in the weeks preceding last week's cratering of the commodities markets. Apparently, the "smart money" was selling when everyone else (i.e., retail investors) were buying. I find the whole "smart money/dumb money" thing offensive. Either you are an educated investor or not. The only difference in my mind is whether you can gamble with other people's money (or in the case of large institutions, using money borrowed from the Fed for virtually zero interest).

After last week, you may be thinking about selling gold, silver, oil and other commodity holdings and getting back into the stock market or bond market (or even holding cash). Take a deep breath. The strategy of investing in commodities for the long term is fundamentally sound. The chart below shows the consumer price index and annual rate of inflation since 1985. The dollar has lost approximately half of its purchasing power in that time frame as a result of inflation:

Gold, on the other hand, has increased in value 400% in that period (from $300/oz to $1,500/oz).

Silver increased approximately 300% from $9/oz to $36/oz (400% when silver was at $45/oz).

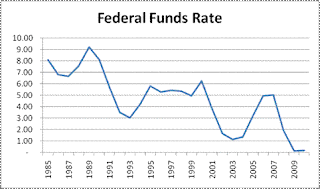

The Federal Reserve is on a mission to devalue the dollar, which means more inflation and less purchasing power for your dollars. By keeping interest rates virtually zero and buying bonds on the open market, the Fed is accomplishing its goal. The Fed is also helping their pals in the investment/banking community by providing plenty of cheap money to borrow (in fact, the money has become progressively cheaper since 1985, as shown in the chart below):

As for investing in stocks, be careful. The Dow Jones Industrial Average is up over 30% in the past year and has almost doubled since hitting an all time low during the financial crisis in 2009. The same is true of the NASDAQ and the S&P 500. Many people believe the stock market could experience another "flash crash" again, or worse. Let's also not forget the "lost decade" for the S&P 500, where there has been virtually no return to investors who are broadly invested in stocks:

Stay the course. A well diversified portfolio includes commodities, as well as real estate and other assets.