Back to School - Now Where Can Kids Get a Financial Education?

One thing is for sure, school doesn't teach kids the basics of financial education, which include saving, controlling spending with a budget, the difference between "good debt" and "bad debt," investing, making your money work for you instead of you working for your money, etc.

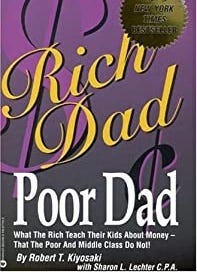

For a basic book about financial education that's also very motivational, I like Rich Dad, Poor Dad, a book by Robert Kiyosaki (I grew up in Hawaii, so I can relate to a lot of what he talks about in the book). It's a pretty easy read and has some great basic concepts in it.

Since my son is going into 6th grade next year and is pretty good with numbers (main interest is sports statistics - all sports), I wanted to make sure I started his financial education. I made a deal with him at the beginning of the summer that I would pay him one Silver Eagle bullion coin (current estimated value about $40) if he reads the book this summer. Summer's almost over and he's only half way through. I'm not disappointed because I know he will finish it. Also, he must be learning something, because he knows the value of silver went up over the summer, so the longer he waits to finish the book, the more the coin will be worth. He has also been asking me about investments and has taken more of an interest in our household budget. Unfortunately, he still wants $100+ basketball shoes. Oh, well.

It's a good start, anyway.

Related articles