Asset Class Review: Precious Metals Are Looking Attractive Again

coin 50$ us gold (Photo credit: sprottmoney)

Looking at the different types of investments available, stocks seem overvalued at the current market levels, so it's difficult to put new money there unless you have identified a particular company that looks poised for growth. Even then, it probably makes sense to trim your stock market exposure and remain broadly diversified. Bonds are worrisome with the threat of higher interest rates, however it looks like until the economy gets going and unemployment becomes less of an issue, the Fed will continue to keep rates low, which bodes well for borrowers; okay for bond investors who can at least earn a modest yield. Real estate seems to be enjoying a nice run-up in most markets, but is getting pricey. Precious metals had a tough year last year, but they are beginning to look like a buy.

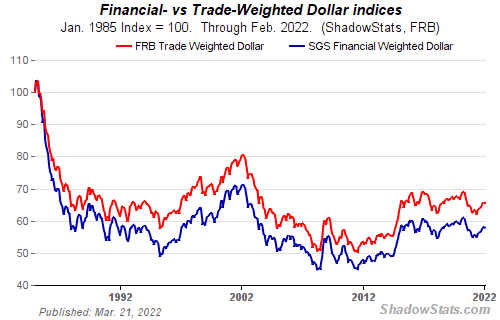

Silver is looking very attractive at current prices of $18.80 per ounce and recently touching a low not seen in a year (see chart below). The investment thesis is still sound: the metal is consumed in industrial applications so as the economy improves so does demand. Also, silver has safe haven appeal and protection against declining value of the dollar, which even at low rates of inflation steadily erodes over time. A dollar now only buys about half of what it did in 1985, for example (see chart below).

Gold is looking good as well (see chart below) and so is investment thesis as timeless store of value, safe haven and inflation hedge.

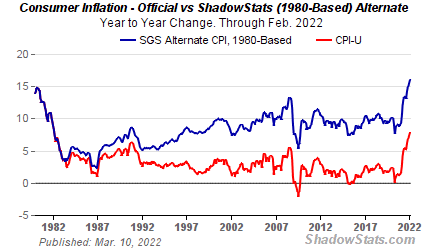

Although government statistics seem to say inflation is low and even "below target" from the Fed's point of view, the real story on inflation unfolds when you go to the gas station or grocery store, buy a car or pay rent.

Other investment alternatives worth considering include early stage investing through a crowdfunding site. These do require you to be an accredited investor (i.e., net worth not including home over $1 million or earning more than $200K/year) and initial investment can be substantial and risk of loss is very high. If you have available funds, investing in one or two well-researched crowdfunding deals could add a nice lift to your portfolio down the road if the company is successful. There are several crowdfunding sites but only a few that allow you to invest for a return (vs. make a donation to a cause). One of the premier sites is Crowdfunder.

Disclosure: I own physical gold and silver as part of a broadly diversified investment portfolio.

Related articles

Precious Metals Manipulation Isn't Hidden, IT'S RIGHT IN FRONT OF YOUR EYES!

Gold And Silver - Debt Is Trouncing Precious Metals, For Now.