Are Bonds Risky?

I was recently listening to a podcast "Chaos in the Bond Market" on What Bitcoin Did with Peter McCormack. His guests were two guys I follow on Twitter, Lawrence Lepard and Greg Foss. Lawrence is a precious metals fund manager who also has a strong and balanced appreciation for the benefits of investing in Bitcoin, which is very much in line with my way of thinking. Greg is a former bond trader and investor who has a significant allocation to Bitcoin but also advocates for some portfolio diversification, which again is very much in line with my way of thinking. After the podcast, Greg posted the below tweet which summarized one of his key comments about how bonds have traditionally been considered low risk investments, but that may no longer be the case. Here's the tweet:

This really got me to thinking about how the current macro environment has flipped everything on its head and how a "traditional" portfolio (i.e., 60% equity / 40% bonds) is not only likely to perform poorly, but could actually expose the investor to more risk as rates rise from all time lows (see chart below). Even if rates continue their steady march toward zero or even go negative at some point, which some have postulated given the massive amount of sovereign debt outstanding and the inability of the government to afford to service the debt if interest rates move significantly higher, the upside to bonds is diminishing rapidly. Real rates of return would also most likely continue to be negative in that scenario. Until and if interest rates rise to a level where there is a "real" or positive rate of return after considering inflation, bonds are a money-losing proposition and as rates rise, this exposes bond investors to potentially huge losses as Greg points out in his tweet. For example, assuming inflation is 7% now as reported by the BLS, rates would have to be 8% on the 30-year bond in order to provide investors with only a 1% real rate of return. That's an increase of 6% (a 400% increase), from 2% where the 30-year bond sits today! I sincerely doubt this would be allowed to happen.

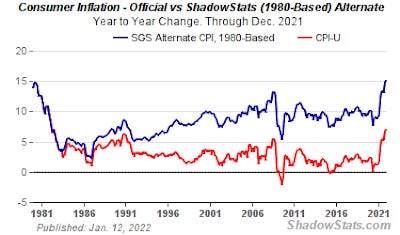

As I have written about before, however, the actual rate of inflation is likely much higher due to changes in the method of calculating the CPI that have been deployed by the BLS over time that have served to reduce the reported rate of inflation. If the methodology from 1980 was followed consistently, the actual rate of inflation is around 15%, very similar to what it was in 1981! See chart below from ShadowStats:

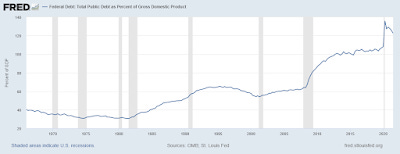

So if you're wondering why in my recent portfolio allocation update (check it out here), I reduced my allocation to bonds to zero, this is it in a nutshell. Bonds (and to a lesser extent cash) are probably the riskiest assets out there currently, certainly more risky in my mind than holding hard assets such as real estate, Bitcoin, gold, silver, commodities, etc. in the face of the kind of inflation we are seeing. Also, even though the Federal Reserve is talking a good game about pivoting to fighting inflation, if the economy slips into a recession (which seems possible in the next couple of years due to lower fiscal stimulus and tighter credit conditions) or even if economic growth simply slows meaningfully with high inflation (stagflation) and the stock market suffers a big enough correction, they will be forced to back off and resume the low rate, quantitative easing environment. As Lawrence said in the podcast, "you can't taper a Ponzi." The days of Paul Volcker raising interest rates to double digits to squash inflation are over, with debt to GDP ratio at levels we have not seen in recent history (see chart below).

One thing is for sure, the battle between market forces driving interest rates higher in response to inflation and central bank forces trying to keep rates lower will be epic and we are already seeing a tremendous amount of volatility in the bond market as rates make big moves, rising some days and plummeting other days. It's certainly not something that makes you "sleep well at night" as a holder of the safest asset. This is why it's critical for you to take an active role in your investments, stay broadly diversified, educate yourself and make appropriate decisions about risk in your portfolio based on the facts and the macro environment. This includes putting aside conventional thinking and what your financial advisor might be telling you and doing your own homework.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.