As Bitcoin mining continues to evolve, the industry has seen significant changes in terms of technological advancement, regulatory developments, and global distribution. This post will provide an updated overview of Bitcoin mining in 2024, examining where hashpower is distributed, the rise of public mining companies, the role of state-sponsored mining, the importance of mining pools, the use of stranded energy sources, and the latest in ASIC chip development. We will conclude with a summary of the overall state of the industry.

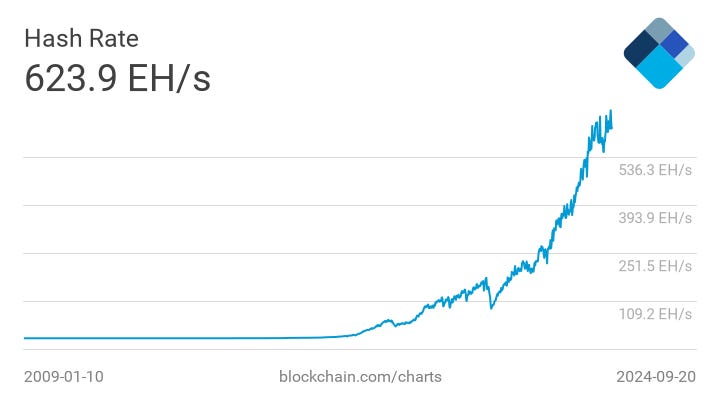

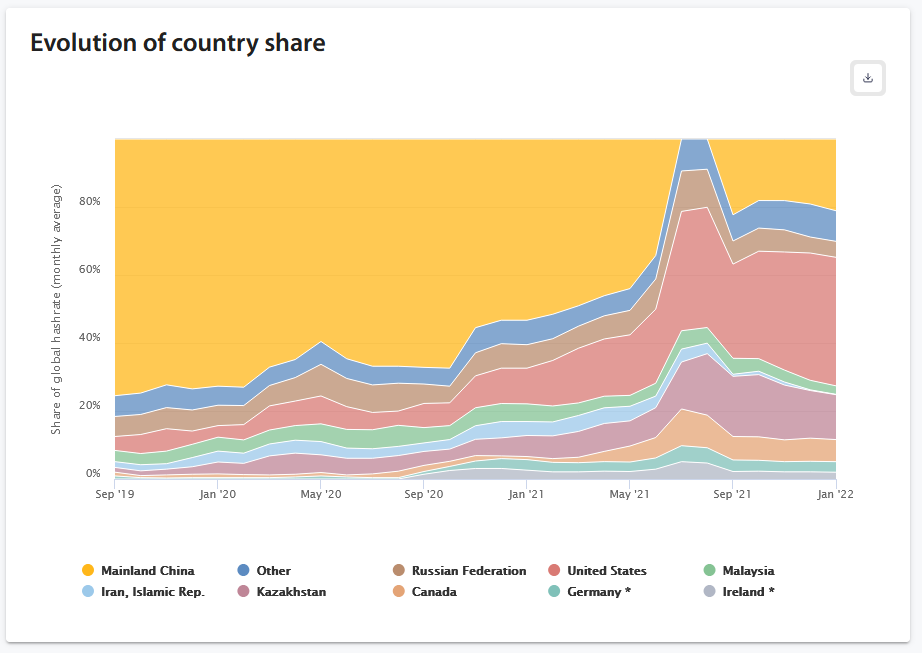

Global Distribution of Hashpower in 2024

The distribution of Bitcoin’s computational power, or hashpower, has continued to shift, becoming increasingly decentralized. In 2024, the major players in Bitcoin mining are:

United States: The U.S. remains the global leader, hosting around 30% of Bitcoin’s total hashpower. States like Texas and Wyoming continue to offer favorable regulatory environments and abundant renewable energy sources such as wind and solar power.

Russia: Russia has increased its share of global hashpower to approximately 13%, thanks to its energy-rich regions and supportive government policies, despite international sanctions in certain areas.

Kazakhstan: Accounting for about 12% of the global hashpower, Kazakhstan remains a major hub, though it continues to face energy supply challenges and evolving government regulations.

Canada: Canada’s hashpower share has grown to 10%, primarily due to its vast hydroelectric resources, particularly in Quebec and British Columbia, which offer low-cost, renewable energy.

Germany and Paraguay: Other countries like Germany, leveraging its renewable energy sector, and Paraguay, with abundant hydroelectric power, have also increased their participation.

These changes reflect the ongoing geographical dispersion of mining operations, enhancing Bitcoin’s decentralization and overall security.

Public Bitcoin Mining Companies

Publicly traded Bitcoin mining companies play an increasingly significant role in the industry. As of 2024, there are more than 25 public companies engaged in mining, with growing investments in energy efficiency and sustainability. Some prominent examples include:

Marathon Digital Holdings (NASDAQ: MARA): Expanding its operations in Texas, Marathon focuses on integrating more renewable energy sources.

Riot Platforms (NASDAQ: RIOT): Riot continues to grow its Texas operations and has launched new mining farms powered by renewable energy.

CleanSpark (NASDAQ: CLSK): A leading company focused on sustainable mining, CleanSpark uses flared gas and renewable energy to power its facilities.

Bitfarms Ltd. (NASDAQ: BITF): Bitfarms has expanded its operations to South America, capitalizing on low-cost, renewable energy in Paraguay.

The transparency and accessibility of these public companies attract institutional investors and increase public awareness of Bitcoin mining’s role in the broader financial ecosystem.

State-Sponsored Mining Initiatives

In 2024, several nations have embraced Bitcoin mining as part of their economic strategy, using their natural energy resources to gain a foothold in the industry. Some notable state-sponsored initiatives include:

Bhutan: The Kingdom of Bhutan continues to quietly expand its Bitcoin mining operations using its abundant hydroelectric power. Bhutan’s government sees Bitcoin mining as a way to diversify its revenue streams and strengthen its economy. The best part is they are building their Bitcoin stack by mining and not simply seizing from criminals like Germany or the US.

El Salvador: After its initial foray into Bitcoin mining in 2021, El Salvador has ramped up its efforts by building out larger facilities powered by geothermal energy from its volcanoes. The country has also begun using solar energy to supplement its mining operations.

These countries view Bitcoin mining not only as a way to generate additional revenue but also as a means of fostering technological innovation and boosting economic development.

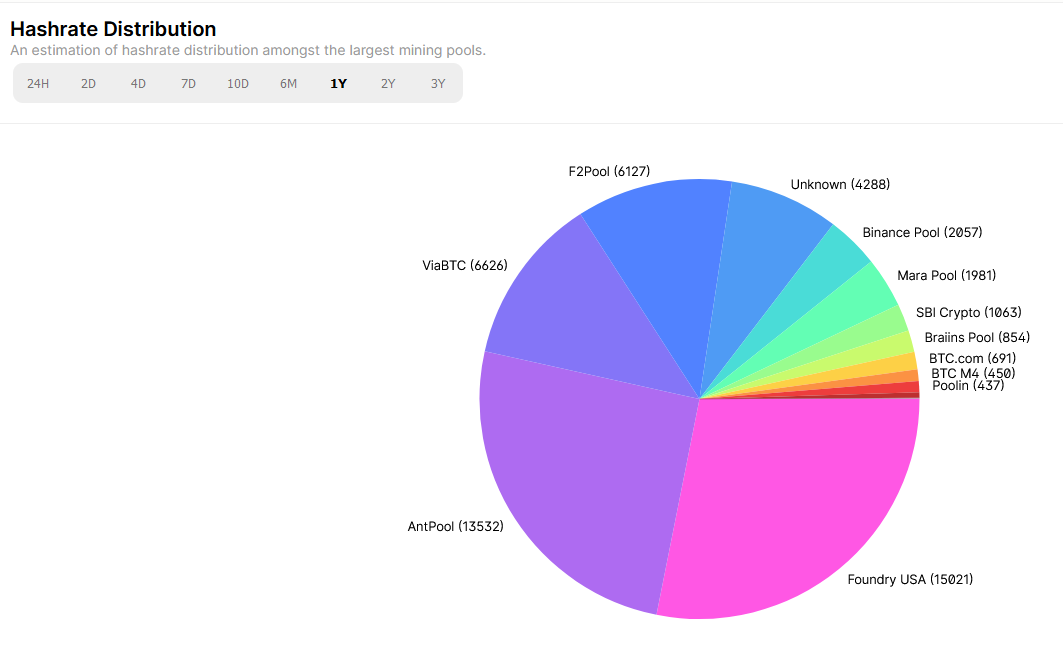

The Role of Mining Pools in 2024

Mining pools remain an essential part of the Bitcoin mining ecosystem. These groups allow miners to combine their computational power to increase their chances of earning Bitcoin rewards. As of 2024, there are over 20 active mining pools, with the largest ones controlling significant portions of the network’s hashpower. Notable mining pools include:

AntPool: Operated by Bitmain, AntPool remains a leading player, consistently contributing a large percentage of the total network hashpower.

F2Pool: One of the most established pools, based in China, which offers services for multiple cryptocurrencies, including Bitcoin.

ViaBTC: Continues to grow as a leading multi-cryptocurrency mining pool with a focus on user-friendly platforms.

Foundry USA Pool: A North American-based pool that has gained significant traction due to the U.S. dominance in Bitcoin mining.

Mining pools provide stability to the Bitcoin network, ensuring consistent rewards for miners and playing a key role in maintaining the blockchain’s security.

Stranded Energy Resources: Mining with Sustainability

In 2024, the use of stranded or wasted energy to power Bitcoin mining operations has become more widespread, aligning with environmental sustainability goals. Miners have increasingly turned to alternative energy sources, including:

Flared Gas: Companies like Crusoe Energy Systems and Upstream Data have expanded their operations to capture more flared natural gas from oil fields, reducing carbon emissions while generating energy to power mobile Bitcoin mining rigs.

Hydroelectric Power: Countries with an abundance of hydroelectric energy, such as Canada and Paraguay, are major players in using renewable energy for Bitcoin mining, which helps offset the industry’s environmental impact.

Solar and Wind Energy: In regions like Texas, solar and wind energy continue to be used to power mining farms, with many large-scale operations setting up in remote areas where electricity would otherwise go unused.

The utilization of stranded energy has improved Bitcoin’s environmental profile while reducing operating costs for miners.

Advances in ASIC Chip Technology

ASIC (Application-Specific Integrated Circuit) miners, which are specialized chips designed for Bitcoin mining, continue to see rapid technological advancement in 2024. The latest developments focus on maximizing efficiency while minimizing energy consumption:

Bitmain’s Antminer S23: This latest generation of miners offers up to 22 joules per terahash (J/TH), making it one of the most energy-efficient miners on the market.

WhatsMiner M90 by MicroBT: MicroBT’s latest offering provides higher performance with lower energy consumption, catering to miners looking to maximize their returns while lowering operational costs.

Intel's Bonanza Mine Chips: Intel’s entry into the ASIC market has brought competition and innovation, focusing on more efficient energy use and heat dissipation technologies.

These advancements in ASIC technology are crucial as mining difficulty continues to increase, driving the need for faster, more efficient hardware to maintain profitability.

Open-Source Solo Mining

The Bitaxe open-source solo miner embodies a significant advancement in Bitcoin mining by making it more accessible and decentralized, taking advantage of advancements in new ASIC chip technology. It allows individuals to build and operate their own cost-effective Bitcoin miners using readily available components and open-source hardware and software. Alternatively, you can buy one from a number of companies that manufacture these miners that are essentially “plug and play.”

By providing comprehensive guides and encouraging community collaboration, Bitaxe reduces barriers to entry, fosters innovation, and promotes transparency. A Bitaxe miner can provide a significant amount of hashrate at a low electricity cost with the latest ASIC chips. While the chances of finding a block are low, it’s another way (similar to running a node) to support the Bitcoin network. This movement aligns with Bitcoin's core values by empowering enthusiasts to participate directly in securing the network, enhancing decentralization, and contributing to a more resilient and distributed Bitcoin ecosystem.

Conclusion

In 2024, the Bitcoin mining industry has reached a new stage of maturity, marked by increased decentralization, technological innovation, and a focus on sustainability. The distribution of hashpower has spread across more regions, with countries like the U.S., Russia, and Kazakhstan playing major roles. The rise of public mining companies has made the industry more transparent and accessible to mainstream investors. State-sponsored mining projects in countries like Bhutan and El Salvador highlight the global economic potential of Bitcoin mining. The use of stranded energy, such as flared gas and renewable sources, has significantly reduced the industry’s environmental impact, while advancements in ASIC chip technology have improved mining efficiency.

As Bitcoin continues to evolve, its mining industry remains a key component of the network’s strength, security, and future growth.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.