A Brief History of Central Banks in the United States

Their Rise, Fall, and the Case for Bitcoin

Introduction

The history of central banks in the United States is a complex narrative marked by the formation and dissolution of various institutions, each with its own set of political, economic, and societal circumstances. I will briefly explore this history while highlighting the role of central banks as government-sanctioned banking cartels (i.e., the “banksters”) and their connection to economic cycles and wars. Additionally, I will discuss the potential for Bitcoin to replace central banks and usher in a new era of decentralized sound money.

The First and Second Banks of the United States

The first central bank in the United States, the First Bank of the United States, was chartered in 1791 under President George Washington. It was primarily established to address the financial challenges following the American Revolution. However, it faced staunch opposition from Thomas Jefferson and James Madison, who believed it was unconstitutional and favored state-chartered banks. The First Bank's charter expired in 1811 and was not renewed, marking its dissolution.

The Second Bank of the United States was chartered in 1816 to restore economic stability following the War of 1812. Similar to its predecessor, it was controversial and faced opposition from President Andrew Jackson, who famously vetoed its recharter in 1832. The Second Bank ceased operations in 1836.

It’s interesting to note the connection between Central Banks, money printing and war. More on that later.

The Creature from Jekyll Island and the Federal Reserve

The Federal Reserve System, established in 1913, marked a significant chapter in the history of central banking in the United States. The circumstances surrounding its formation were indeed shrouded in secrecy, as described in "The Creature from Jekyll Island" by G. Edward Griffin. A group of powerful bankers and government officials met on Jekyll Island, Georgia, in 1910 to draft the Federal Reserve Act.

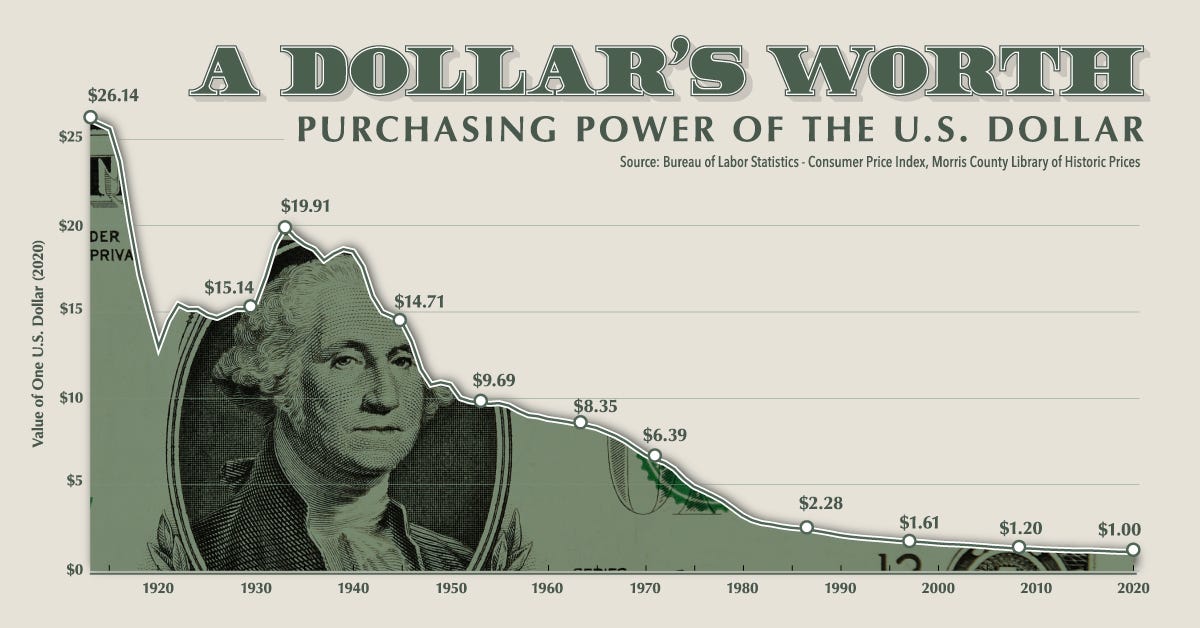

The Federal Reserve Act aimed to create a more stable and flexible banking system. However, it can be argued that this central bank was, like its predecessors, a government-sanctioned cartel designed to serve the interests of a select few. Critics argue that it grants private banks undue influence over the nation's money supply and exacerbates economic cycles through its ability to create money from nothing. Indeed, since the Federal Reserve’s founding financial crises have not only been the norm, they have been getting more frequent and more severe as the chart below shows:

Central Banks and Communism

It's important to note that central banks, as outlined in "The Communist Manifesto" by Karl Marx, are often seen as a pillar of communism. Marx emphasized the importance of centralizing control over money and credit as a means of advancing the goals of communism. Central banks play a similar role in controlling the money supply and influencing economic policy.

Central Banks and War

The money printing enabled by the Central Bank results in a debasement of the value of the currency over time, which is essentially a tax on the average person holding dollars as savings. This “free money” can be used by politicians to make good on campaign promises as well as funding all sorts of military escapades.

Here is a list of all wars involving the United States since the Revolutionary War. Central Banks and the ability to print endless amounts of fiat money have made endless wars possible and as mentioned earlier were indeed the main reason for their creation.

American Revolutionary War

Dates: April 19, 1775 – September 3, 1783

Outcome: The Thirteen Colonies gained independence from British rule and formed the United States.

Quasi-War

Dates: 1798 – 1800

Outcome: A naval conflict with France ended with the signing of the Convention of 1800, restoring peace.

Barbary Wars

First Barbary War:

Dates: 1801 – 1805

Outcome: The United States secured the release of American hostages and ended tribute payments to the Barbary states.

Second Barbary War:

Dates: 1815

Outcome: American forces defeated the Barbary pirates, further securing American interests in the Mediterranean.

War of 1812

Dates: June 18, 1812 – February 18, 1815

Outcome: The war ended in a stalemate, with no territorial changes, but it solidified American sovereignty and inspired national pride.

Mexican-American War

Dates: April 25, 1846 – February 2, 1848

Outcome: The Treaty of Guadalupe Hidalgo ceded territory to the United States, including California, New Mexico, and parts of Arizona, Utah, Nevada, and Colorado.

Civil War (American Civil War)

Dates: April 12, 1861 – April 9, 1865

Outcome: The Union defeated the Confederacy, preserving the United States as a single nation and leading to the abolition of slavery.

Spanish-American War

Dates: April 21, 1898 – August 13, 1898

Outcome: The United States gained control of several territories, including Puerto Rico, Guam, and the Philippines, while Cuba became independent.

World War I

Dates: April 6, 1917 – November 11, 1918

Outcome: The Allies, including the United States, defeated the Central Powers, leading to significant geopolitical changes.

World War II

Dates: December 7, 1941 – September 2, 1945

Outcome: The Allies, including the United States, defeated the Axis Powers, resulting in the end of the war and significant global changes.

Korean War

Dates: June 25, 1950 – July 27, 1953

Outcome: The Korean Peninsula remained divided along the 38th parallel, with South Korea supported by the United Nations and North Korea by China and the Soviet Union.

Vietnam War

Dates: November 1, 1955 – April 30, 1975

Outcome: The war ended with the fall of Saigon, leading to the reunification of North and South Vietnam under communist control.

Gulf War (Operation Desert Storm)

Dates: January 17, 1991 – February 28, 1991

Outcome: The coalition, led by the United States, liberated Kuwait from Iraqi occupation but did not overthrow Saddam Hussein.

Iraq War (Operation Iraqi Freedom)

Dates: March 20, 2003 – December 18, 2011

Outcome: The toppling of Saddam Hussein's regime and an extended period of instability in Iraq.

War in Afghanistan (Operation Enduring Freedom) - this and the Patriot Act were direct results of the 9/11/2001 terrorist attacks

Dates: October 7, 2001 – August 30, 2021

Outcome: A protracted conflict aimed at countering terrorism and removing the Taliban from power. The U.S. withdrew its troops in August 2021. Total estimated cost of $2.3 Trillion, 243,000 estimated deaths.

Russia-Ukraine Conflict

February 4, 2022 - Present

US providing military aid (security assistance, weapons and equipment, and grants/loans for weapons and equipment) of $47 Billion to date (through May 2023)

The U.S. Constitution and Sound Money

The U.S. Constitution, in Article I, Section 8, Clause 5, explicitly grants Congress the power to "coin Money, regulate the Value thereof." Furthermore, the Constitution specifies that "No State shall... make any Thing but gold and silver Coin a Tender in Payment of Debts." These constitutional provisions reflect the Founding Fathers' intent to establish a system based on commodity money, such as gold and silver, to safeguard the stability of the nation's currency. With today’s fiat money completely unbacked by anything but a promise from the government, we have completely departed from the principles that the Country’s founders had in mind. As fiat money continues to be printed endlessly by incurring ever more debt, it’s only a matter of time before the system collapses upon itself.

Bitcoin: A Solution for Central Banking?

I believe that Bitcoin offers a compelling solution to the issues associated with central banking. Bitcoin is a decentralized, digital form of sound money that operates on a peer-to-peer network. It is not subject to the whims of central banks or governments, and its supply is limited, making it resistant to inflationary pressures.

Bitcoin's potential to eliminate the need for central banks lies in its ability to enable direct, trustless transactions between individuals. It offers financial sovereignty, transparency, and security, making it a viable alternative to traditional fiat currencies. By embracing Bitcoin and decentralization, we can move away from the centralized control of central banks and toward a more equitable and resilient financial system.

Conclusion

The history of central banks in the United States is a story of not one but three attempts to control the money and we are currently in the third iteration (Federal Reserve). Central banks make economic cycles worse, serve as government-sanctioned private banking cartels, align with communist ideologies and also enable the funding of endless wars. The U.S. Constitution's original intent was to establish a system based on commodity money, but this vision has been largely abandoned.

Bitcoin, as a decentralized and digital form of sound money, offers a potential solution to the issues associated with central banking. It enables peer-to-peer transactions and financial sovereignty, making it a promising path forward. Regardless of the type of commodity money that ultimately replaces the fiat system, Central Banks need to be shut down as they have been in the past.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here:

Thanks for sharing this. I wrote a piece today on how the Fed went broke. Would love for you to check it out.

https://amritaroy.substack.com/p/part-1-the-fed-is-broke-how-is-that