Introduction:

Welcome to the roaring, cash-fueled circus of “Peak Fiat Culture”! This post dives into the comical, bewildering, and downright absurd symptoms of a world running on hyperinflated dollars, euros, and yen. We Bitcoiner rebels watch from the sidelines with a mix of amusement and horror, and here are the top ten signs that the fiat system has truly jumped the shark.

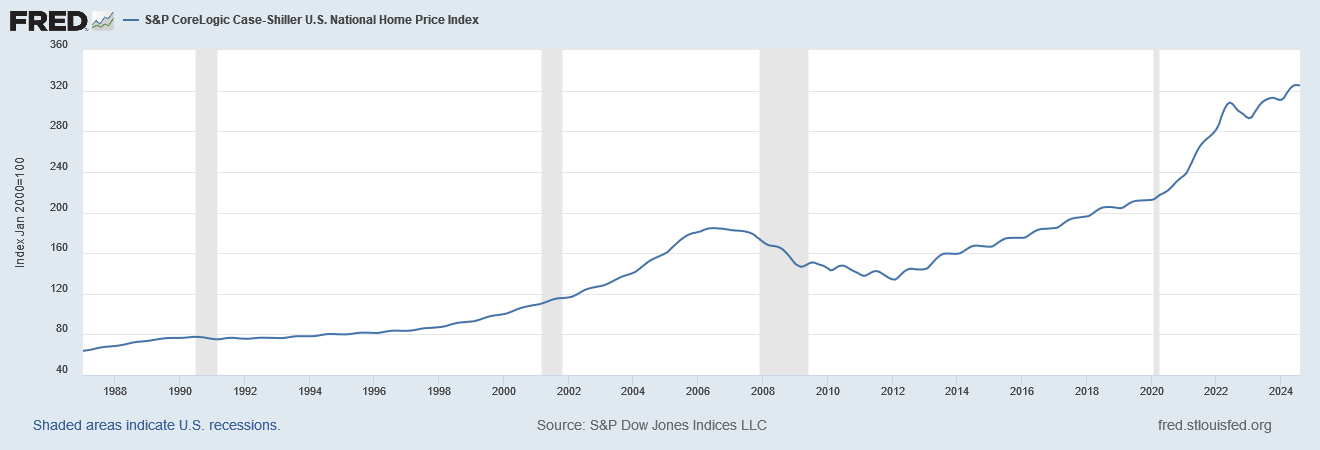

1. Real Estate Prices Are Out of This Galaxy

When even the smallest studio apartment in a big city could cost you your first-born child, you know we’re at peak fiat. Property has become a global game of musical chairs where only those in the top 1% end up with a seat.

Enter Bitcoin: a fixed-supply asset that doesn’t need granite countertops or waterfront views to preserve value.

2. Negative Interest Rates – Yes, You Pay to Save

It’s absurd, but banks are charging you for the privilege of holding your money. Imagine a world where your ice cream melts faster than your bank balance!

This, to any Bitcoiner, is a laughable reminder of the sad state of fiat – where even a mattress feels like a better investment than the bank.

3. Endless Bailouts for the Rich and Famous

When fiat culture peaks, bailouts are just part of the wallpaper. Banks, airlines, and megacorps all get handouts when they’re in a pinch, but good luck if you’re a small business. None of these guys went to jail for 2008 and that guy there second from the left still has his job:

Bitcoin doesn’t do bailouts – it’s hard, fair, and transparent. No need to hit the “print” button in times of crisis. In fact, you can’t!

4. A Rising Sea of Gucci and Glitzy Fast Fashion

Peak fiat is splattered across billboards with branded logos and “limited edition” sneakers going for the cost of a small house. When keeping up with the Kardashians becomes an actual lifestyle, you know the fiat culture is in overdrive.

Bitcoin encourages a lower time preference – sustainability, quality, and long-term thinking. You buy once and buy smart, without needing five different shades of avocado green in your closet.

5. The Celebrity NFT Craze

When pictures of apes and pixelated punks sell for millions, the fiat culture is in fever mode. Celebrity-driven NFT projects crash and burn daily, but not before the “fiat faithful” sink their savings into these…uh, investments?

Bitcoiners love innovation, but we’re also fans of utility and actual value. With Bitcoin, there’s substance behind the hype.

6. Government Debt Has Reached Cartoonsville

It’s like watching Wile E. Coyote run off a cliff – the debt figures keep climbing, leaving every future taxpayer on the hook. We’re piling on debt with abandon, as if it’ll all just disappear someday.

Bitcoin has no debt. With a cap at 21 million, it plays by the rules and keeps things simple. Maybe that’s why fiat doesn’t want it around.

7. The “Everything Bubble” Keeps Inflating

Houses, stocks, collectibles, pet rocks – everything’s a bubble waiting to burst. People are buying up assets not for their utility but for the guaranteed bump in resale value next week.

With Bitcoin, value is straightforward: you buy, you hold, and scarcity takes care of the rest. There’s no bubble when supply is capped and demand keeps growing.

8. The Normalization of Surveillance – Big Brother Goes Mainstream

Peak fiat needs constant surveillance to stay alive, leading to ever-increasing control of our private data. Privacy has become an endangered concept, sacrificed on the altar of “security.”

Bitcoin, by contrast, is privacy-friendly, decentralized, and borderless, resisting the urge to peek over your shoulder with every transaction.

9. The Gig Economy Becomes the New 9-to-5

Every corner of the workforce has become gig-based, with people juggling three apps just to make ends meet. The dream of a stable paycheck seems more distant than ever.

Bitcoiners see this as an opportunity for sovereignty, allowing more people to save and invest rather than scramble for a temporary gig paycheck.

10. The Global Obsession with Central Bank Digital Currencies (CBDCs)

Nothing says “peak fiat” like central banks rushing to launch their own digital currencies – a last-ditch effort to cling to control. These CBDCs are the fiat world’s attempt to make money programmable and…surprisingly Orwellian.

With Bitcoin, we already have a digital, programmable currency that isn’t designed for control. It’s freedom in code form, one block at a time.

Conclusion:

As we watch these signs of peak fiat culture unfold, Bitcoin stands as the antidote to the madness. It offers an escape from the circus of inflated debt, inflated egos, and inflated currencies. So let’s laugh at the absurdities, but also prepare for a world where hard money, sound principles, and individual sovereignty once again become the norm. Bitcoin is here, and it’s time to move past peak fiat – to a place where value is real, and freedom is just a private key away.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.